Citibank 2010 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

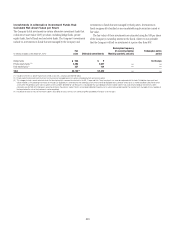

215

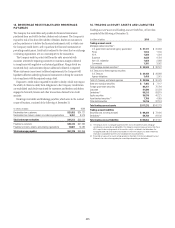

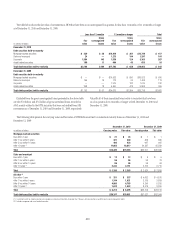

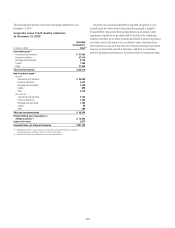

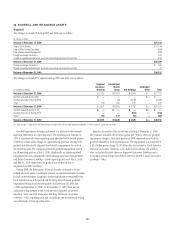

16. LOANS

Citigroup loans are reported in two categories—Consumer and Corporate.

These categories are classified according to the segment and sub-segment

that manages the loans.

Consumer Loans

Consumer loans represent loans and leases managed primarily by the

Regional Consumer Banking and Local Consumer Lending businesses.

The following table provides information by loan type:

In millions of dollars at year end 2010 2009

Consumer loans

In U.S. offices

Mortgage and real estate (1) $151,469 $183,842

Installment, revolving credit, and other 28,291 58,099

Cards (2) 122,384 28,951

Commercial and industrial 5,021 5,640

Lease financing 211

$307,167 $276,543

In offices outside the U.S.

Mortgage and real estate (1) $ 52,175 $ 47,297

Installment, revolving credit, and other 38,024 42,805

Cards 40,948 41,493

Commercial and industrial 18,584 14,780

Lease financing 665 331

$150,396 $146,706

Total Consumer loans $457,563 $423,249

Net unearned income 69 808

Consumer loans, net of unearned income $457,632 $424,057

(1) Loans secured primarily by real estate.

(2) 2010 includes the impact of consolidating entities in connection with Citi’s adoption of SFAS 167.

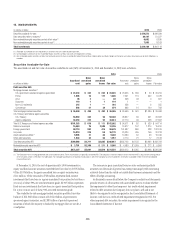

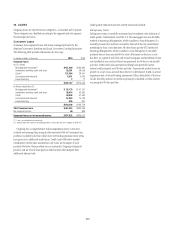

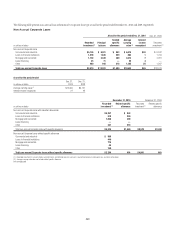

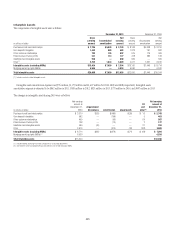

Citigroup has a comprehensive risk management process to monitor,

evaluate and manage the principal risks associated with its Consumer loan

portfolio. Included in the loan table above are lending products whose terms

may give rise to additional credit issues. Credit cards with below-market

introductory interest rates and interest-only loans are examples of such

products. However, these products are not material to Citigroup’s financial

position and are closely managed via credit controls that mitigate their

additional inherent risk.

Credit quality indicators that are actively monitored include:

Delinquency Status

Delinquency status is carefully monitored and considered a key indicator of

credit quality. Substantially all of the U.S. first mortgage loans use the MBA

method of reporting delinquencies, which considers a loan delinquent if a

monthly payment has not been received by the end of the day immediately

preceding the loan’s next due date. All other loans use the OTS method of

reporting delinquencies, which considers a loan delinquent if a monthly

payment has not been received by the close of business on the loan’s next

due date. As a general rule, first and second mortgages and installment loans

are classified as non-accrual when loan payments are 90 days contractually

past due. Credit cards and unsecured revolving loans generally accrue

interest until payments are 180 days past due. Commercial market loans are

placed on a cash (non-accrual) basis when it is determined, based on actual

experience and a forward-looking assessment of the collectability of the loan

in full, that the payment of interest or principal is doubtful or when interest

or principal is 90 days past due.