Citibank 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

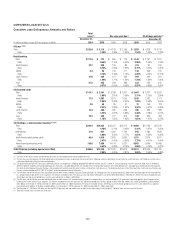

Consumer Loan Modification Programs

Citigroup has instituted a variety of long-term and short-term modification

programs to assist borrowers with financial difficulties. These programs, as

described below, include modifying the original loan terms, reducing interest

rates, extending the remaining loan duration and/or waiving a portion of

the remaining principal balance. At December 31, 2010, Citi’s significant

modification programs consisted of the U.S. Treasury’s Home Affordable

Modification Program (HAMP), as well as short-term and long-term

modification programs in the U.S., each as summarized below.

The policy for re-aging modified U.S. consumer loans to current status

varies by product. Generally, one of the conditions to qualify for these

modifications is that a minimum number of payments (typically ranging

from one to three) be made. Upon modification, the loan is re-aged to

current status. However, re-aging practices for certain open-ended consumer

loans, such as credit cards, are governed by Federal Financial Institutions

Examination Council (FFIEC) guidelines. For open-ended consumer loans

subject to FFIEC guidelines, one of the conditions for the loan to be re-aged

to current status is that at least three consecutive minimum monthly

payments, or the equivalent amount, must be received. In addition, under

FFIEC guidelines, the number of times that such a loan can be re-aged is

subject to limitations (generally once in 12 months and twice in five years).

Furthermore, Federal Housing Administration (FHA) and Department of

Veterans Affairs (VA) loans are modified under those respective agencies’

guidelines, and payments are not always required in order to re-age a

modified loan to current.

HAMP and Other Long-Term Programs. Long-term

modification programs or TDRs occur when the terms of a loan have

been modified due to the borrower’s financial difficulties and a long-term

concession has been granted to the borrower. Substantially all long-term

programs in place provide interest rate reductions. See Note 1 to the

Consolidated Financial Statements for a discussion of the allowance for

loan losses for such modified loans.

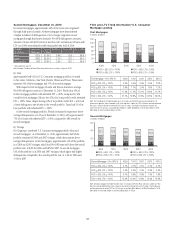

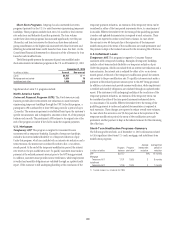

The following table presents Citigroup’s Consumer loan TDRs as of

December 31, 2010 and 2009. As discussed below under “HAMP,” HAMP loans

whose terms are contractually modified after successful completion of the trial

period are included in the balances below:

Accrual Non-accrual

In millions of dollars

Dec. 31,

2010

Dec. 31,

2009

Dec. 31,

2010

Dec. 31,

2009

Mortgage and real estate $15,140 $8,654 $2,290 $1,413

Cards (1) 5,869 2,303 38 150

Installment and other 3,015 3,128 271 250

(1) 2010 balances reflect the adoption of SFAS 166/167.

These TDRs are predominately concentrated in the U.S. Citi’s significant long-

term U.S. modification programs include:

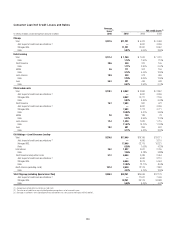

U.S. Mortgages

HAMP. The HAMP is designed to reduce monthly first mortgage payments to

a 31% housing debt ratio (monthly mortgage payment, including property

taxes, insurance and homeowner dues, divided by monthly gross income)

by lowering the interest rate, extending the term of the loan and deferring or

forgiving principal of certain eligible borrowers who have defaulted on their

mortgages or who are at risk of imminent default due to economic hardship.

The interest rate reduction for first mortgages under HAMP is in effect for five

years and the rate then increases up to 1% per year until the interest rate cap

(the lower of the original rate or the Freddie Mac Weekly Primary Mortgage

Market Survey rate for a 30-year fixed rate conforming loan as of the date of

the modification) is reached.

In order to be entitled to a HAMP loan modification, borrowers must complete

a three-month trial period, make the agreed payments and provide the required

documentation. Beginning March 1, 2010, documentation was required to be

provided prior to the beginning of the trial period, whereas prior to that date,

documentation was required before the end of the trial period. This change

generally means that Citi is able to verify income for potential HAMP participants

before they begin making lower monthly payments. Because customers entering

the trial period are qualified prior to trial entry, more are successfully completing

the trial period.

During the trial period, Citi requires that the original terms of the loans

remain in effect pending completion of the modification. From inception

through December 31, 2010, approximately $9.5 billion of first mortgages were

enrolled in the HAMP trial period, while $3.8 billion have successfully completed

the trial period. Upon completion of the trial period, the terms of the loan are

contractually modified, and it is accounted for as a TDR.

Citi also began participating in the U.S. Treasury’s HAMP second mortgage

program (2MP) in the fourth quarter of 2010. 2MP requires Citi to either:

(1) modify the borrower’s second mortgage according to a defined protocol; or

(2) accept a lump sum payment from the U.S. Treasury in exchange for full

extinguishment of the second mortgage. For a borrower to qualify, the borrower

must have successfully modified his/her first mortgage under the HAMP and

met other criteria. Under the 2MP program, if the first mortgage is modified

under HAMP through principal forgiveness, the same percentage of principal

forgiveness is required on the second mortgage.