Citibank 2010 Annual Report Download - page 260

Download and view the complete annual report

Please find page 260 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

258

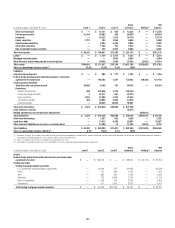

Citigroup evaluates the payment/performance risk of the credit derivatives for

which it stands as a protection seller based on the credit rating assigned to the

underlying referenced credit. Where external ratings by nationally recognized

statistical rating organizations (such as Moody’s and S&P) are used, investment

grade ratings are considered to be Baa/BBB or above, while anything below

is considered non-investment grade. The Citigroup internal ratings are in

line with the related external credit rating system. On certain underlying

reference credits, mainly related to over-the-counter credit derivatives,

ratings are not available, and these are included in the not-rated category.

Credit derivatives written on an underlying non-investment grade reference

credit represent greater payment risk to the Company. The non-investment

grade category in the table above primarily includes credit derivatives where

the underlying referenced entity has been downgraded subsequent to the

inception of the derivative.

The maximum potential amount of future payments under credit

derivative contracts presented in the table above is based on the notional

value of the derivatives. The Company believes that the maximum potential

amount of future payments for credit protection sold is not representative

of the actual loss exposure based on historical experience. This amount

has not been reduced by the Company’s rights to the underlying assets and

the related cash flows. In accordance with most credit derivative contracts,

should a credit event (or settlement trigger) occur, the Company is usually

liable for the difference between the protection sold and the recourse it holds

in the value of the underlying assets. Thus, if the reference entity defaults,

Citi will generally have a right to collect on the underlying reference credit

and any related cash flows, while being liable for the full notional amount

of credit protection sold to the buyer. Furthermore, this maximum potential

amount of future payments for credit protection sold has not been reduced

for any cash collateral paid to a given counterparty as such payments would

be calculated after netting all derivative exposures, including any credit

derivatives with that counterparty in accordance with a related master

netting agreement. Due to such netting processes, determining the amount of

collateral that corresponds to credit derivative exposures only is not possible.

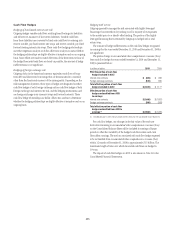

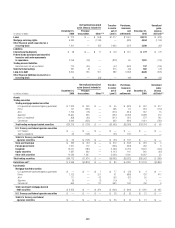

The Company actively monitors open credit risk exposures, and manages

this exposure by using a variety of strategies including purchased credit

derivatives, cash collateral or direct holdings of the referenced assets. This

risk mitigation activity is not captured in the table above.

Credit-Risk-Related Contingent Features in Derivatives

Certain derivative instruments contain provisions that require the Company

to either post additional collateral or immediately settle any outstanding

liability balances upon the occurrence of a specified credit-risk-related

event. These events, which are defined by the existing derivative contracts,

are primarily downgrades in the credit ratings of the Company and its

affiliates. The fair value of all derivative instruments with credit-risk-related

contingent features that are in a liability position at December 31, 2010 and

December 31, 2009 is $25 billion and $17 billion, respectively. The Company

has posted $18 billion and $11 billion as collateral for this exposure in

the normal course of business as of December 31, 2010 and December 31,

2009, respectively. Each downgrade would trigger additional collateral

requirements for the Company and its affiliates. In the event that each legal

entity was downgraded a single notch as of December 31, 2010, the Company

would be required to post additional collateral of $2.1 billion.