Citibank 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

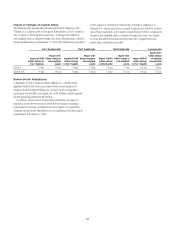

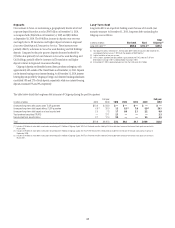

Secured financing is primarily conducted through Citi’s broker-dealer

subsidiaries to facilitate customer matched-book activity and to efficiently

fund a portion of the trading inventory. Secured financing appears as a

liability on Citi’s Consolidated Balance Sheet (“Securities Loaned or Sold

Under Agreements to Repurchase”). As of December 31, 2010, secured

financing was $189.6 billion and averaged approximately $207 billion

during the quarter ended December 31, 2010. Secured financing at

December 31, 2010 increased by $35 billion from $154.3 billion at

December 31, 2009. During the same period, reverse repos and securities

borrowing increased by $25 billion.

The majority of secured financing is collateralized by highly liquid

government, government-backed and government agency securities. This

collateral comes primarily from Citi’s trading assets and its secured lending,

and is part of Citi’s client matched-book activity given that Citi both borrows

and lends similar asset types on a secured basis.

The minority of secured financing is collateralized by less liquid

collateral, and supports both Citi’s trading assets as well as the business of

secured lending to customers, which is also part of Citi’s client matched-book

activity. The less liquid secured borrowing is carefully calibrated by asset

quality, tenor and counterparty exposure, including those that might be

sensitive to ratings stresses, in order to increase the reliability of the funding.

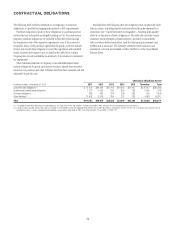

Citi believes there are several potential mitigants available to it in the

event of stress on the secured financing markets for less liquid collateral.

Citi’s significant liquidity resources in its non-bank entities as of December

31, 2010, supplemented by collateralized liquidity transfers between entities,

provide a cushion. Within the matched-book activity, the secured lending

positions, which are carefully managed in terms of collateral and tenor,

could be unwound to provide additional liquidity under stress. Citi also has

excess funding capacity for less liquid collateral with existing counterparties

that can be accessed during potential dislocation. In addition, Citi has the

ability to adjust the size of select trading books to provide further mitigation.

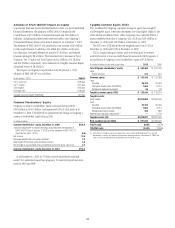

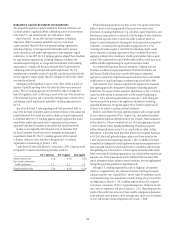

At December 31, 2010, commercial paper outstanding for Citigroup’s non-

bank entities and bank subsidiaries, respectively, was as follows:

In billions of dollars Non-bank Bank (1)

Total

Citigroup

Commercial paper $9.7 $15.0 $24.7

(1) Includes $15 billion of commercial paper related to VIEs consolidated effective January 1, 2010 with

the adoption of SFAS 166/167.

Other short-term borrowings of approximately $54 billion (as set forth

in the Secured Financing and Short-Term Borrowings table above) include

$42.4 billion of borrowings from banks and other market participants, which

includes borrowings from the Federal Home Loan Banks. This represented

a decrease of approximately $11 billion as compared to year-end 2009. The

average balance of borrowings from banks and other market participants

for the quarter ended December 31, 2010 was approximately $43 billion.

Other short-term borrowings also include $11.7 billion of broker borrowings

at December 31, 2010, which averaged approximately $13 billion for the

quarter ended December 31, 2010.

See Notes 12 and 19 to the Consolidated Financial Statements for further

information on Citigroup’s and its affiliates’ outstanding long-term debt and

short-term borrowings.

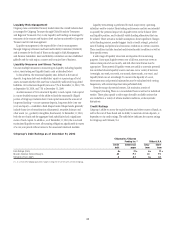

Liquidity Transfer Between Entities

Liquidity is generally transferable within the non-bank, subject to regulatory

restrictions (if any) and standard legal terms. Similarly, the non-bank

can generally transfer excess liquidity into Citi’s bank subsidiaries, such as

Citibank, N.A. In addition, Citigroup’s bank subsidiaries, including Citibank,

N.A., can lend to the Citigroup parent and broker-dealer in accordance with

Section 23A of the Federal Reserve Act. As of December 31, 2010, the amount

available for lending under Section 23A was approximately $26.6 billion,

provided the funds are collateralized appropriately.