Citibank 2010 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

228

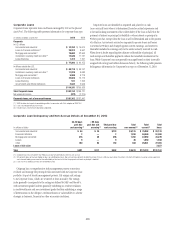

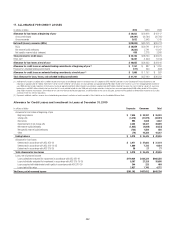

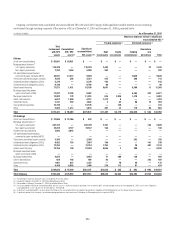

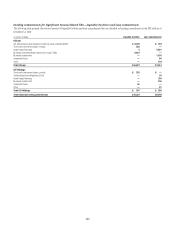

The following table summarizes the financial structure of each of the Company’s subsidiary trusts at December 31, 2010:

Trust securities

with distributions

guaranteed by

Citigroup

Issuance

date

Securities

issued

Liquidation

value (1)

Coupon

rate

Common

shares

issued

to parent

Junior subordinated debentures owned by trust

Amount Maturity

Redeemable

by issuer

beginning

In millions of dollars, except share amounts

Citigroup Capital III Dec. 1996 194,053 $ 194 7.625% 6,003 $ 200 Dec. 1, 2036 Not redeemable

Citigroup Capital VII July 2001 35,885,898 897 7.125% 1,109,874 925 July 31, 2031 July 31, 2006

Citigroup Capital VIII Sept. 2001 43,651,597 1,091 6.950% 1,350,050 1,125 Sept. 15, 2031 Sept. 17, 2006

Citigroup Capital IX Feb. 2003 33,874,813 847 6.000% 1,047,675 873 Feb. 14, 2033 Feb. 13, 2008

Citigroup Capital X Sept. 2003 14,757,823 369 6.100% 456,428 380 Sept. 30, 2033 Sept. 30, 2008

Citigroup Capital XI Sept. 2004 18,387,128 460 6.000% 568,675 474 Sept. 27, 2034 Sept. 27, 2009

Citigroup Capital XII Mar. 2010 92,000,000 2,300 8.500% 25 2,300 Mar. 30, 2040 Mar. 30, 2015

Citigroup Capital XIII Sept. 2010 89,840,000 2,246 7.875% 25 2,246 Oct. 30, 2040 Oct. 30, 2015

Citigroup Capital XIV June 2006 12,227,281 306 6.875% 40,000 307 June 30, 2066 June 30, 2011

Citigroup Capital XV Sept. 2006 25,210,733 630 6.500% 40,000 631 Sept. 15, 2066 Sept. 15, 2011

Citigroup Capital XVI Nov. 2006 38,148,947 954 6.450% 20,000 954 Dec. 31, 2066 Dec. 31, 2011

Citigroup Capital XVII Mar. 2007 28,047,927 701 6.350% 20,000 702 Mar. 15, 2067 Mar. 15, 2012

Citigroup Capital XVIII June 2007 99,901 155 6.829% 50 156 June 28, 2067 June 28, 2017

Citigroup Capital XIX Aug. 2007 22,771,968 569 7.250% 20,000 570 Aug. 15, 2067 Aug. 15, 2012

Citigroup Capital XX Nov. 2007 17,709,814 443 7.875% 20,000 443 Dec. 15, 2067 Dec. 15, 2012

Citigroup Capital XXI Dec. 2007 2,345,801 2,346 8.300% 500 2,346 Dec. 21, 2077 Dec. 21, 2037

Citigroup Capital XXXII Nov. 2007 1,875,000 1,875 6.935% 10 1,875 Sept. 15, 2042 Sept. 15, 2014

Citigroup Capital XXXIII July 2009 3,025,000 3,025 8.000% 100 3,025 July 30, 2039 July 30, 2014

Adam Capital Trust III Dec. 2002 17,500 18

3 mo. LIB

+335 bp. 542 18 Jan. 7, 2033 Jan. 7, 2008

Adam Statutory Trust III Dec. 2002 25,000 25

3 mo. LIB

+325 bp. 774 26 Dec. 26, 2032 Dec. 26, 2007

Adam Statutory Trust IV Sept. 2003 40,000 40

3 mo. LIB

+295 bp. 1,238 41 Sept. 17, 2033 Sept. 17, 2008

Adam Statutory Trust V Mar. 2004 35,000 35

3 mo. LIB

+279 bp. 1,083 36 Mar. 17, 2034 Mar. 17, 2009

Total obligated $19,526 $19,653

(1) Represents the notional value received by investors from the trusts at the time of issuance.

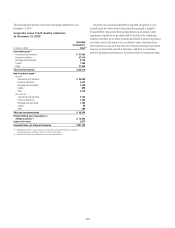

In each case, the coupon rate on the debentures is the same as that on

the trust securities. Distributions on the trust securities and interest on the

debentures are payable quarterly, except for Citigroup Capital III, Citigroup

Capital XVIII and Citigroup Capital XXI on which distributions are payable

semi-annually.

During the second quarter of 2010 Citigroup exchanged Citigroup

Capital Trust XXX for $1.875 billion of senior notes with a coupon of 6%

payable semi-annually. The senior notes mature on December 13, 2013.

On September 29, 2010, Citigroup modified Citigroup Capital Trust XXXIII

by redeeming $2.234 billion of those securities that were owned by the U.S.

Treasury Department. Citigroup Inc. replaced those securities with Citigroup

Capital Trust XIII in the amount of $2.246 billion with a coupon of 7.875%,

payable quarterly. The U.S. Treasury Department then sold all of such

securities of Citigroup Capital Trust XIII to the public.

During the fourth quarter of 2010 Citigroup exchanged Citigroup Capital

Trust XXXI for $1.875 billion of senior notes with a coupon of 4.587%,

payable semi-annually. The senior notes mature on December 15, 2015.