Citibank 2010 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

184

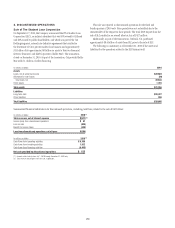

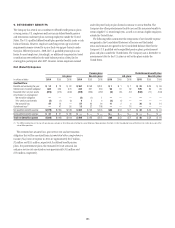

7. PRINCIPAL TRANSACTIONS

Principal transactions revenue consists of realized and unrealized gains

and losses from trading activities. Trading activities include revenues from

fixed income, equities, credit and commodities products, as well as foreign

exchange transactions. Not included in the table below is the impact of

net interest revenue related to trading activities, which is an integral part

of trading activities’ profitability. The following table presents principal

transactions revenue for the years ended December 31:

In millions of dollars 2010 2009 2008

Regional Consumer Banking $ 533 $ 1,569 $ (146)

Institutional Clients Group 5,567 5,626 6,102

Subtotal Citicorp $6,100 $ 7,195 $ 5,956

Local Consumer Lending (217) 896 504

Brokerage and Asset Management (37) 30 (4,958)

Special Asset Pool 2,078 (2,606) (26,270)

Subtotal Citi Holdings $1,824 $(1,680) $(30,724)

Corporate/Other (407) 553 879

Total Citigroup $7,517 $ 6,068 $(23,889)

In millions of dollars 2010 2009 2008

Interest rate contracts (1) $3,231 $ 6,211 $(10,369)

Foreign exchange contracts (2) 1,852 2,762 3,921

Equity contracts (3) 995 (334) (958)

Commodity and other contracts (4) 126 924 970

Credit derivatives (5) 1,313 (3,495) (17,453)

Total Citigroup $7,517 $ 6,068 $(23,889)

(1) Includes revenues from government securities and corporate debt, municipal securities, preferred

stock, mortgage securities, and other debt instruments. Also includes spot and forward trading of

currencies and exchange-traded and over-the-counter (OTC) currency options, options on fixed

income securities, interest rate swaps, currency swaps, swap options, caps and floors, financial

futures, OTC options, and forward contracts on fixed income securities.

(2) Includes revenues from foreign exchange spot, forward, option and swap contracts, as well as

translation gains and losses.

(3) Includes revenues from common, preferred and convertible preferred stock, convertible corporate

debt, equity-linked notes, and exchange-traded and OTC equity options and warrants.

(4) Primarily includes revenues from crude oil, refined oil products, natural gas, and other commodities

trades.

(5) Includes revenues from structured credit products.

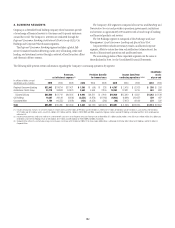

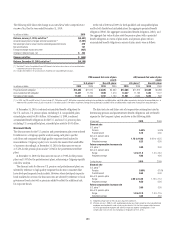

8. INCENTIVE PLANS

The Company has adopted a number of equity compensation plans under

which it currently administers award programs involving grants of stock

options, restricted or deferred stock awards, and stock payments. The award

programs are used to attract, retain and motivate officers, employees and

non-employee directors, to provide incentives for their contributions to the

long-term performance and growth of the Company, and to align their

interests with those of stockholders. Certain of these equity issuances also

increase the Company’s stockholders’ equity. The plans and award programs

are administered by the Personnel and Compensation Committee of the

Citigroup Board of Directors (the Committee), which is composed entirely of

independent non-employee directors. Since April 19, 2005, all equity awards

have been pursuant to stockholder-approved plans.

At December 31, 2010, approximately 806.22 million shares were

authorized and available for grant under Citigroup’s 2009 Stock Incentive

Plan. Citigroup’s general practice has been to deliver shares from treasury

stock upon the exercise or vesting of equity awards. However, newly issued

shares were issued as stock payments in April 2010 to settle common stock

equivalent awards granted in January 2010. Newly issued shares were also

issued as stock payments in January 2011. Citigroup will be reviewing its

general practice in 2011 and might begin using newly issued shares more

regularly in 2011 or 2012 as an alternative to treasury shares. There is no

income statement difference between treasury stock issuances and newly

issued share issuances.

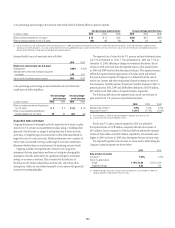

The following table shows components of compensation expense relating

to the Company’s stock-based compensation programs as recorded during

2010, 2009 and 2008:

In millions of dollars 2010 2009 2008

Charges for estimated awards to

retirement -eligible employees $ 366 $ 207 $ 110

Option expense 197 55 29

Amortization of deferred cash awards and

deferred cash stock units 280 113 —

Amortization of MC LTIP awards (1) —19 18

Amortization of salary stock awards 173 162 —

Amortization of restricted and deferred

stock awards (2) 747 1,543 3,133

Total $1,763 $2,099 $3,290

(1) Management Committee Long-Term Incentive Plan (MC LTIP) awards were granted in 2007. The

awards expired in December 2009 without the issuance of shares.

(2) The 2008 period includes amortization of expense over the remaining life of all unvested, restricted

and deferred stock awards granted to all employees prior to 2006. All periods include amortization

expense for all unvested awards to non-retirement-eligible employees on or after January 1, 2006.

Amortization is recognized net of estimated forfeitures of awards.