Citibank 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

Short-Term Programs. Citigroup has also instituted short-term

programs (primarily in the U.S.) to assist borrowers experiencing temporary

hardships. These programs include short-term (12 months or less) interest

rate reductions and deferrals of past due payments. The loan volume

under these short-term programs has increased significantly over the past

18 months, and loan loss reserves for these loans have been enhanced,

giving consideration to the higher risk associated with those borrowers and

reflecting the estimated future credit losses for those loans. See Note 1 to the

Consolidated Financial Statements for a discussion of the allowance for loan

losses for such modified loans.

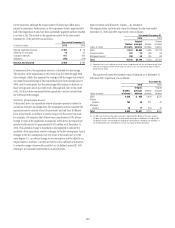

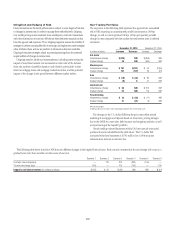

The following table presents the amounts of gross loans modified under

short-term interest rate reduction programs in the U.S. as of December 31, 2010:

December 31, 2010

In millions of dollars Accrual Non-accrual

Cards $2,757 $ —

Mortgage and real estate 1,634 70

Installment and other 1,086 110

Significant short-term U.S. programs include:

North America Cards

Universal Payment Program (UPP). The North America cards

business provides short-term interest rate reductions to assist borrowers

experiencing temporary hardships through the UPP. Under this program, a

participant’s APR is reduced by at least 500 basis points for a period of up to

12 months. The minimum payment is established based upon the customer’s

specific circumstances and is designed to amortize at least 1% of the principal

balance each month. The participant’s APR returns to its original rate at the

end of the program or earlier if they fail to make the required payments.

U.S. Mortgages

Temporary AOT. This program is targeted to Consumer Finance

customers with a temporary hardship. Examples of temporary hardships

include a short-term medical disability or a temporary reduction of pay.

Under this program, which can include both an interest rate reduction and a

term extension, the interest rate is reduced for either a five- or an eleven-

month period. At the end of the temporary modification period, the interest

rate reverts to the pre-modification rate. To qualify, customers must make a

payment at the reduced payment amount prior to the AOT being processed.

In addition, customers must provide income verification, while employment

is verified and monthly obligations are validated through an updated credit

report. If the customer is still undergoing hardship at the conclusion of the

temporary payment reduction, an extension of the temporary terms can be

considered in either of the time period increments above, to a maximum of

24 months. Effective December 2010, the timing of the qualifying payment

is earlier and updated documentation is required at each extension. These

changes are expected to reduce overall entry volumes. In cases where

the account is over 60 days past due at the expiration of the temporary

modification period, the terms of the modification are made permanent and

the payment is kept at the reduced amount for the remaining life of the loan.

U.S Installment Loans

Temporary AOT. This program is targeted to Consumer Finance

customers with a temporary hardship. Examples of temporary hardships

include a short-term medical disability or a temporary reduction of pay.

Under this program, which can include both an interest rate reduction and a

term extension, the interest rate is reduced for either a five- or an eleven-

month period. At the end of the temporary modification period, the interest

rate reverts to the pre-modification rate. To qualify, customers must make a

payment at the reduced payment amount prior to the AOT being processed.

In addition, customers must provide income verification, while employment

is verified and monthly obligations are validated through an updated credit

report. If the customer is still undergoing hardship at the conclusion of the

temporary payment reduction, an extension of the temporary terms can

be considered in either of the time period increments referenced above,

to a maximum of 24 months. Effective December 2010, the timing of the

qualifying payment is earlier and updated documentation is required at

each extension. These changes are expected to reduce overall entry volumes.

In cases where the account is over 90 days past due at the expiration of the

temporary modification period, the terms of the modification are made

permanent and the payment is kept at the reduced amount for the remaining

life of the loan.

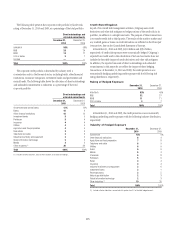

Short-Term Modification Programs—Summary

The following table sets forth, as of December 31, 2010, information related

to Citi’s significant short-term U.S. cards, mortgage, and installment loan

modification programs:

In millions of dollars

Program

balance

Program

start date (1)

Average

interest rate

reduction

Average time

period for

reduction

UPP $2,757 22% 12 months

Mortgage

Temporary AOT 1,701 1Q09 3 8 months

Installment

Temporary AOT 1,196 1Q09 4 7 months

(1) Provided if program was introduced after 2008.