Citibank 2010 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

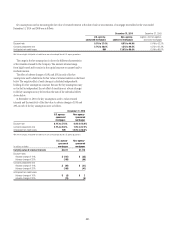

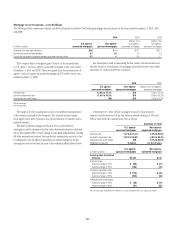

232

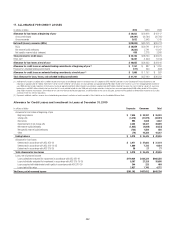

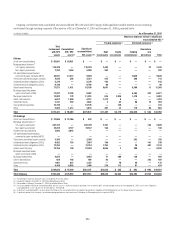

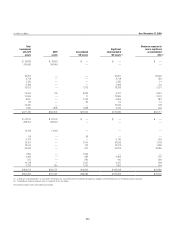

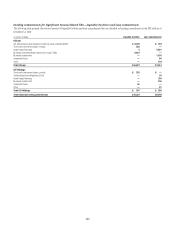

Citigroup’s involvement with consolidated and unconsolidated VIEs with which the Company holds significant variable interests or has continuing

involvement through servicing a majority of the assets in a VIE as of December 31, 2010 and December 31, 2009 is presented below:

In millions of dollars As of December 31, 2010

Maximum exposure to loss in significant

unconsolidated VIEs (1)

Funded exposures (2) Unfunded exposures (3)

Total

involvement

with SPE

assets

Consolidated

VIE / SPE

assets

(4)

Significant

unconsolidated

VIE assets (4)(5)

Debt

investments

Equity

investments

Funding

commitments

Guarantees

and

derivatives Total

Citicorp

Credit card securitizations $ 62,061 $ 62,061 $ — $ — $ — $ — $ — $ — $ 78,833 $ 78,833 $ — $ — $ —

Mortgage securitizations (6) 264,949 264,949 — — —

U.S. agency-sponsored 175,229 — 175,229 2,402 — — 27 2,429

Non-agency-sponsored 7,352 1,454 5,898 302 — — — 302

Citi-administered asset-backed

commercial paper conduits (ABCP) 30,941 21,312 9,629 — — 9,629 — 9,629 36,327 — — 36,327 36,326

Third-party commercial paper conduits 4,845 308 4,537 415 — 298 — 713 3,718 — — 3,718 353

Collateralized debt obligations (CDOs) 5,379 — 5,379 103 — — — 103 2,785 — — 2,785 21

Collateralized loan obligations (CLOs) 6,740 — 6,740 68 — — — 68 5,409 — — 5,409 120

Asset-based financing 17,571 1,421 16,150 5,641 — 5,596 11 11,248 19,612 — 1,279 18,333 5,221

Municipal securities tender

option bond trusts (TOBs) 17,047 8,105 8,942 — — 6,454 423 6,877 19,455 705 9,623 9,127 6,841

Municipal investments 12,002 178 11,824 675 2,929 1,478 — 5,082 10,906 — 11 10,895 2,370

Client intermediation 6,612 1,899 4,713 1,312 8 — — 1,320 8,607 — 2,749 5,858 881

Investment funds 3,741 259 3,482 2 82 66 19 169 93 — 39 54 10

Trust preferred securities 19,776 — 19,776 — 128 — — 128 19,345 — — 19,345 128

Other 5,085 1,412 3,673 467 32 119 80 698 7,380 1,808 1,838 3,734 446

Total $374,381 $ 98,409 $275,972 $11,387 $3,179 $23,640 $ 560 $38,766 $477,419 $346,295 $15,539 $ 115,585 $ 52,717

Citi Holdings

Credit card securitizations $ 33,606 $ 33,196 $ 410 $ — $ — $ — $ — $ — $ 42,274 $ 42,274 $ — $ — $ —

Mortgage securitizations (6) 308,504 308,504 — — —

U.S. agency-sponsored 207,729 — 207,729 2,701 — — 108 2,809

Non-agency-sponsored 22,274 2,727 19,547 160 — — — 160

Student loan securitizations 2,893 2,893 — — — — — — 14,343 14,343 — — —

Citi-administered asset-backed

commercial paper conduits (ABCP) — — — — — — — — 98 — 98 — —

Third-party commercial paper conduits 3,365 — 3,365 — — 252 — 252 5,776 — — 5,776 439

Collateralized debt obligations (CDOs) 8,452 755 7,697 189 — — 141 330 24,157 — 7,614 16,543 1,158

Collateralized loan obligations (CLOs) 12,234 — 12,234 1,754 — 29 401 2,184 13,515 — 142 13,373 1,658

Asset-based financing 22,756 136 22,620 8,626 3 300 — 8,929 52,598 — 370 52,228 18,385

Municipal securities tender

option bond trusts (TOBs) — — — — — — — — 1,999 — 1,999 — —

Municipal investments 4,652 — 4,652 71 200 136 — 407 5,364 — 882 4,482 375

Client intermediation 659 195 464 62 — — 345 407 675 — 230 445 396

Investment funds 1,961 627 1,334 — 70 45 — 115 10,178 — 1,037 9,141 268

Other 8,444 6,955 1,489 276 112 91 — 479 3,732 610 1,472 1,650 604

Total $329,025 $ 47,484 $281,541 $13,839 $ 385 $ 853 $ 995 $16,072 $483,213 $ 365,731 $ 13,844 $ 103,638 $ 23,283

Total Citigroup $703,406 $145,893 $557,513 $25,226 $ 3,564 $24,493 $1,555 $54,838 $960,632 $712,026 $29,383 $ 219,223 $ 76,000

(1) The definition of maximum exposure to loss is included in the text that follows.

(2) Included in Citigroup’s December 31, 2010 Consolidated Balance Sheet.

(3) Not included in Citigroup’s December 31, 2010 Consolidated Balance Sheet.

(4) Due to the adoption of ASC 810, Consolidation (SFAS 167) on January 1, 2010, the previously disclosed assets of former QSPEs are now included in either the “Consolidated VIE / SPE assets” or the “Significant

unconsolidated VIE assets” columns for the December 31, 2010 period.

(5) A significant unconsolidated VIE is an entity where the Company has any variable interest considered to be significant, regardless of the likelihood of loss or the notional amount of exposure.

(6) A significant portion of the Company’s securitized mortgage portfolio was transferred from Citi Holdings to Citicorp during the first quarter of 2010.