Citibank 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.111

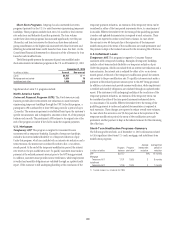

Repurchase Reserve

Citi has recorded a reserve for its exposure to losses from the obligation to

repurchase previously sold loans (referred to as the repurchase reserve)

that is included in Other liabilities in the Consolidated Balance Sheet. In

estimating the repurchase reserve, Citi considers reimbursements estimated

to be received from third-party correspondent lenders and indemnification

agreements relating to previous acquisitions of mortgage servicing rights. Citi

aggressively pursues collection from any correspondent lender that it believes

has the financial ability to pay. The estimated reimbursements are based on

Citi’s analysis of its most recent collection trends and the financial solvency

of the correspondents.

In the case of a repurchase of a credit-impaired SOP 03-3 loan, the

difference between the loan’s fair value and unpaid principal balance at the

time of the repurchase is recorded as a utilization of the repurchase reserve.

Make-whole payments to the investor are also treated as utilizations and

charged directly against the reserve. The repurchase reserve is estimated

when Citi sells loans (recorded as an adjustment to the gain on sale, which is

included in Other revenue in the Consolidated Statement of Income) and is

updated quarterly. Any change in estimate is recorded in Other revenue.

The repurchase reserve is calculated by individual sales vintage (i.e.,

the year the loans were sold) and is based on various assumptions. While

substantially all of Citi’s current loan sales are with GSEs, with which Citi

has considerable historical experience, these assumptions contain a level

of uncertainty and risk that, if different from actual results, could have a

material impact on the reserve amounts. The most significant assumptions

used to calculate the reserve levels are as follows:

Loan documentation requests:• Assumptions regarding future expected

loan documentation requests exist as a means to predict future repurchase

claim trends. These assumptions are based on recent historical trends

as well as anecdotal evidence and general industry knowledge about the

current repurchase environment (e.g., the level of staffing and focus

by the GSEs to “put” more loans back to servicers). These factors are

considered in the forecast of expected future repurchase claims and

changes in these trends could have a positive or negative impact on Citi’s

repurchase reserve. During 2009 and 2010, loan documentation requests

trended higher than in the prior periods, which led to an increase in the

repurchase reserve.

Repurchase claims as a percentage of loan documentation •

requests: Given that loan documentation requests are an indicator

of future repurchase claims, an assumption is made regarding the

conversion rate from loan documentation requests to repurchase claims.

This assumption is also based on historical performance and, if actual

rates differ in the future, could also impact repurchase reserve levels.

While this percentage was generally stable during 2009, during 2010, Citi

observed a slight increase in this conversion rate, meaning Citi observed a

slight increase in the number of loan documentation requests converting

to repurchase claims. However, in the fourth quarter of 2010, Citi

observed an improvement in the conversion rate, meaning that as loan

documentation requests increased, the claims as a percentage of such

requests have been trending lower.

Claims appeal success rate: • This assumption represents Citi’s expected

success at rescinding a claim by satisfying the demand for more

information, disputing the claim validity, etc. This assumption is also based

on recent historical successful appeals rates. These rates could fluctuate

and, in Citi’s experience, have historically fluctuated significantly based on

changes in the validity or composition of claims. Generally, during 2009

and 2010, Citi’s appeal success rate improved from levels in prior periods,

which had a favorable impact on the repurchase reserve.

Estimated loss given repurchase or make-whole: • The assumption of

the estimated loss amount per repurchase or make-whole payment, or

loss severity, is applied separately for each sales vintage to capture volatile

housing price highs and lows. The assumption is based on actual and

expected losses of recent repurchases/make-whole payments calculated

for each sales vintage year, which are impacted by factors such as

macroeconomic indicators, including overall housing values. During 2009

and 2010, including the fourth quarter of 2010, Citi’s loss severity increased.

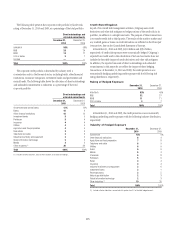

In sum, and as set forth in the table below, during 2009, loan

documentation package requests and the level of outstanding claims increased.

In addition, Citi’s loss severity estimates increased during 2009 due to the

impact of macroeconomic factors and its experience with actual losses at such

time. These factors contributed to a change in estimate for the repurchase

reserve amounting to $492 million for the year ended December 31, 2009.

During 2010, loan documentation package requests, the level of outstanding

claims and loss severity estimates increased, contributing to a change in

estimate for the repurchase reserve amounting to $917 million for the year

ended December 31, 2010. In addition, included in Citi’s current reserve

estimate is an assumption that repurchase claims will remain at elevated levels