Citibank 2010 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

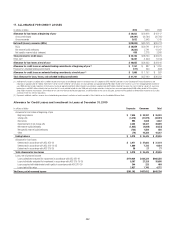

218

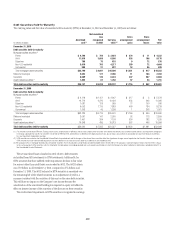

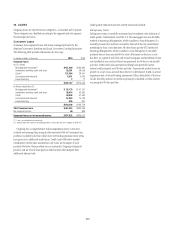

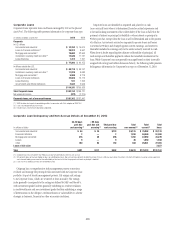

Corporate Loans

Corporate loans represent loans and leases managed by ICG or the Special

Asset Pool. The following table presents information by corporate loan type:

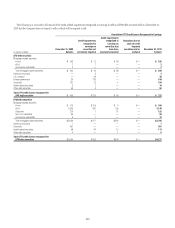

In millions of dollars at year end 2010 2009

Corporate

In U.S. offices

Commercial and industrial $ 14,334 $ 15,614

Loans to financial institutions (1) 29,813 6,947

Mortgage and real estate (2) 19,693 22,560

Installment, revolving credit and other (3) 12,640 17,737

Lease financing 1,413 1,297

$ 77,893 $ 64,155

In offices outside the U.S.

Commercial and industrial $ 69,718 $ 66,747

Installment, revolving credit and other (3) 11,829 9,683

Mortgage and real estate (2) 5,899 9,779

Loans to financial institutions 22,620 15,113

Lease financing 531 1,295

Governments and official institutions 3,644 2,949

$114,241 $105,566

Total Corporate loans $192,134 $169,721

Net unearned income (972) (2,274)

Corporate loans, net of unearned income $191,162 $167,447

(1) 2010 includes the impact of consolidating entities in connection with Citi’s adoption of SFAS 167.

(2) Loans secured primarily by real estate.

(3) Includes loans not otherwise separately categorized.

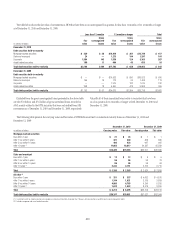

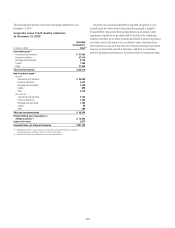

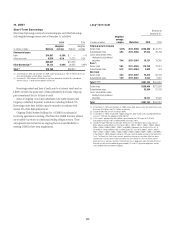

Corporate loans are identified as impaired and placed on a cash

(non-accrual) basis when it is determined, based on actual experience and

a forward-looking assessment of the collectability of the loan in full, that the

payment of interest or principal is doubtful or when interest or principal is

90 days past due, except when the loan is well collateralized and in the process

of collection. Any interest accrued on impaired corporate loans and leases

is reversed at 90 days and charged against current earnings, and interest is

thereafter included in earnings only to the extent actually received in cash.

When there is doubt regarding the ultimate collectability of principal, all

cash receipts are thereafter applied to reduce the recorded investment in the

loan. While Corporate loans are generally managed based on their internally

assigned risk rating (see further discussion below), the following table presents

delinquency information by Corporate loan type as of December 31, 2010:

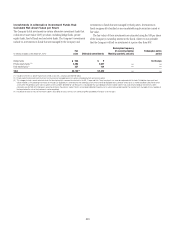

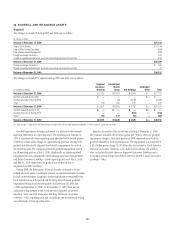

Corporate Loan Delinquency and Non-Accrual Details at December 31, 2010

In millions of dollars

30–89 days

past due

and accruing (1)

≥ 90 days

past due and

accruing (1)

Total past due

and accruing

Total

non-accrual (2)

Total

current (3)

Total

loans

Commercial and industrial $ 94 $ 39 $133 $5,125 $ 76,862 $ 82,120

Financial institutions 2 — 2 1,258 50,648 51,908

Mortgage and real estate 376 20 396 1,782 22,892 25,070

Leases 9 — 9 45 1,890 1,944

Other 100 52 152 400 26,941 27,493

Loans at fair value 2,627

Total $ 581 $111 $692 $8,610 $179,233 $191,162

(1) Corporate loans that are greater than 90 days past due are generally classified as non-accrual.

(2) Citi generally does not manage Corporate loans on a delinquency basis. Non-accrual loans generally include those loans that are ≥ 90 days past due or those loans for which Citi believes, based on actual experience

and a forward-looking assessment of the collectability of the loan in full that the payment or interest or principal is doubtful.

(3) Loans less than 30 days past due are considered current.

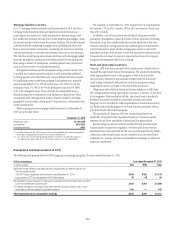

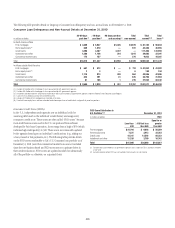

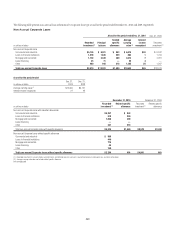

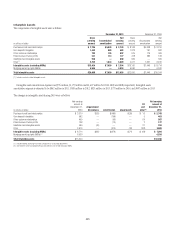

Citigroup has a comprehensive risk management process to monitor,

evaluate and manage the principal risks associated with its Corporate loan

portfolio. As part of its risk management process, Citi assigns risk ratings

to its Corporate loans, which are reviewed at least annually. The ratings

scale generally corresponds to the ratings as defined by S&P and Moody’s,

with investment grade facilities generally exhibiting no evident weakness

in creditworthiness and non-investment grade facilities exhibiting a range

of deterioration in the obligor’s creditworthiness or vulnerability to adverse

changes in business, financial or other economic conditions.