Citibank 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

OVERVIEW

Introduction

Citigroup’s history dates back to the founding of Citibank in 1812.

Citigroup’s original corporate predecessor was incorporated in 1988 under

the laws of the State of Delaware. Following a series of transactions over a

number of years, Citigroup Inc. was formed in 1998 upon the merger of

Citicorp and Travelers Group Inc.

Citigroup is a global diversified financial services holding company whose

businesses provide consumers, corporations, governments and institutions

with a broad range of financial products and services. Citi has approximately

200 million customer accounts and does business in more than 160 countries

and jurisdictions.

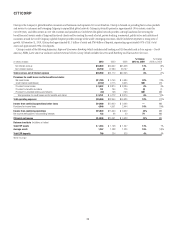

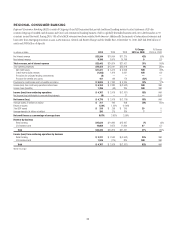

Citigroup currently operates, for management reporting purposes, via two

primary business segments: Citicorp, consisting of Citi’s Regional Consumer

Banking businesses and Institutional Clients Group; and Citi Holdings,

consisting of Citi’s Brokerage and Asset Management and Local Consumer

Lending businesses, and a Special Asset Pool. There is also a third segment,

Corporate/Other. For a further description of the business segments and

the products and services they provide, see “Citigroup Segments” below,

“Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and Note 4 to the Consolidated Financial Statements.

Throughout this report, “Citigroup”, “Citi” and “the Company” refer to

Citigroup Inc. and its consolidated subsidiaries.

Additional information about Citigroup is available on the company’s Web

site at www.citigroup.com. Citigroup’s recent annual reports on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K, as well as its

other filings with the SEC are available free of charge through the company’s

Web site by clicking on the “Investors” page and selecting “All SEC Filings.”

The SEC’s Web site also contains periodic and current reports, proxy and

information statements, and other information regarding Citi at www.sec.gov.

Within this Form 10-K, please refer to the tables of contents on pages 23

and 149 for page references to Management’s Discussion and Analysis of

Financial Condition and Results of Operations and Notes to Consolidated

Financial Statements, respectively.

At December 31, 2010, Citi had approximately 260,000 full-time

employees compared to approximately 265,300 full-time employees at

December 31, 2009.

Please see “Risk Factors” below for a discussion of

certain risks and uncertainties that could materially impact

Citigroup’s financial condition and results of operations.

Certain reclassifications have been made to the prior periods’ financial

statements to conform to the current period’s presentation.

Impact of Adoption of SFAS 166/167

As previously disclosed, effective January 1, 2010, Citigroup adopted

Accounting Standards Codification (ASC) 860, Transfers and Servicing,

formerly SFAS No. 166, Accounting for Transfers of Financial

Assets, an amendment of FASB Statement No. 140 (SFAS 166), and

ASC 810, Consolidations, formerly SFAS No. 167, Amendments to FASB

Interpretation No. 46(R) (SFAS 167). Among other requirements, the

adoption of these standards includes the requirement that Citi consolidate

certain of its credit card securitization trusts and cease sale accounting

for transfers of credit card receivables to those trusts. As a result, reported

and managed-basis presentations are comparable for periods beginning

January 1, 2010. For comparison purposes, prior period revenues, net credit

losses, provisions for credit losses and for benefits and claims and loans are

presented where indicated on a managed basis in this Form 10-K. Managed

presentations were applicable only to Citi’s North American branded

and retail partner credit card operations in North America Regional

Consumer Banking and Citi Holdings—Local Consumer Lending

and any aggregations in which they are included. See “Capital Resources

and Liquidity” and Note 1 to the Consolidated Financial Statements for

an additional discussion of the adoption of SFAS 166/167 and its impact

on Citigroup.