Citibank 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

The credit rating agencies continuously review the ratings

of Citigroup and its subsidiaries, and have particularly

focused on the impact of the Financial Reform Act on

the ratings support assumptions of U.S. bank holding

companies, including Citigroup. Reductions in Citigroup’s

and its subsidiaries’ credit ratings could have a significant

and immediate impact on Citi’s funding and liquidity

through cash obligations, reduced funding capacity and

collateral triggers.

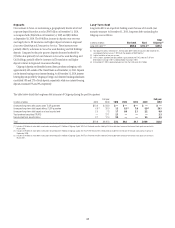

Each of Citigroup’s and Citibank, N.A.’s long-term/senior debt and short-

term/commercial paper ratings are currently rated investment grade by Fitch,

Moody’s and Standard & Poor’s (S&P). The rating agencies continuously

evaluate Citigroup and its subsidiaries, and their ratings of Citigroup’s and

its subsidiaries’ long-term and short-term debt are based on a number of

factors, including financial strength, as well as factors not entirely within

the control of Citigroup and its subsidiaries, such as conditions affecting the

financial services industry generally.

Moreover, each of Fitch, Moody’s and S&P has indicated that they are

evaluating the impact of the Financial Reform Act on the rating support

assumptions currently included in their methodologies as related to large

U.S. bank holding companies, including Citigroup. These evaluations

are generally a result of the rating agencies’ belief that the Financial

Reform Act, including the establishment and development of the new

orderly liquidation regime, increases the uncertainty regarding the U.S.

government’s willingness and ability to provide extraordinary support to such

companies. Consistent with this belief and to bring Citigroup in line with

other large U.S. banks, during 2010, S&P and Moody’s revised their outlooks

on Citigroup’s supported ratings from stable to negative, and Fitch placed

Citigroup’s supported ratings on negative rating watch. The ultimate timing

of the completion of the credit rating agencies’ evaluations, as well as the

outcomes, is uncertain.

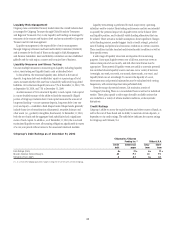

In light of these reviews and the continued focus on the financial services

industry generally, Citigroup and its subsidiaries may not be able to maintain

their current respective ratings. Ratings downgrades by Fitch, Moody’s or

S&P could have a significant and immediate impact on Citi’s funding and

liquidity through cash obligations, reduced funding capacity and collateral

triggers. A reduction in Citigroup’s or its subsidiaries’ credit ratings could also

widen Citi’s credit spreads or otherwise increase its borrowing costs and limit

its access to the capital markets. For additional information on the potential

impact of a reduction in Citigroup’s or its subsidiaries’ credit ratings,

see “Capital Resources and Liquidity—Funding and Liquidity—Credit

Ratings” above.

The restrictions imposed on proprietary trading and funds-

related activities by the Financial Reform Act and the

regulations thereunder will limit Citigroup’s trading for

its own account and could also, depending on the scope of

the final regulations, adversely impact Citigroup’s market-

making activities and force Citi to dispose of certain of its

investments at less than fair market value.

The so-called “Volcker Rule” provisions of the Financial Reform Act restrict

the proprietary trading activities of depository institutions, entities that

own or control depository institutions and their affiliates. The ultimate

contours of the restrictions on proprietary trading will depend on the

final regulations. The rulemaking must address, among other things, the

scope of permissible market-making and hedging activities. The ultimate

outcome of the rulemaking process as to these and other issues is currently

uncertain and, accordingly, so is the level of compliance and monitoring

costs and the degree to which Citigroup’s trading activities, and the results of

operations from those activities, will be negatively impacted. In addition, any

restrictions imposed by final regulations in this area will affect Citigroup’s

trading activities globally, and thus will likely impact it disproportionately

in comparison to foreign financial institutions which will not be subject to

the Volcker Rule provisions of the Financial Reform Act with respect to their

activities outside of the United States.

In addition, the Volcker Rule restricts Citigroup’s funds-related activities,

including Citi’s ability to sponsor or invest in private equity and/or hedge

funds. Under the Financial Reform Act, bank regulators have the flexibility to

provide firms with extensions allowing them to hold their otherwise restricted

investments in private equity and hedge funds for some time beyond

the statutory divestment period. If the regulators elect not to grant such

extensions, Citi could be forced to divest certain of its investments in illiquid

funds in the secondary market on an untimely basis. Based on the illiquid

nature of the investments and the prospect that other industry participants

subject to similar requirements would likely be divesting similar assets at

the same time, such sales could be at substantial discounts to their otherwise

current fair market value.

The establishment of the new Bureau of Consumer

Financial Protection, as well as other provisions of the

Financial Reform Act and ensuing regulations, could affect

Citi’s practices and operations with respect to a number of

its U.S. Consumer businesses and increase its costs.

The Financial Reform Act established the Bureau of Consumer Financial

Protection (CFPB), an independent agency within the Federal Reserve

Board. The CFPB was given rulemaking authority over most providers of

consumer financial services in the U.S. as well as enforcement authority

over the consumer operations of banks with assets over $10 billion, such as

Citibank, N.A. The CFPB was also given interpretive authority with respect

to numerous existing consumer financial services regulations (such as

Regulation Z, Truth in Lending) that were previously interpreted by the

Federal Reserve Board. Because this is an entirely new agency, the impact

on Citigroup, including its retail banking, mortgages and cards businesses,