Citibank 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82

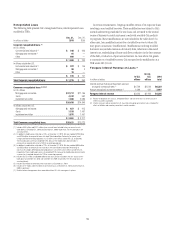

Risk Aggregation and Stress Testing

While Citi’s major risk areas are described individually on the following

pages, these risks also need to be reviewed and managed in conjunction with

one another and across the various businesses.

The Chief Risk Officer, as noted above, monitors and controls major

risk exposures and concentrations across the organization. This means

aggregating risks, within and across businesses, as well as subjecting those

risks to alternative stress scenarios in order to assess the potential economic

impact they may have on Citigroup.

Comprehensive stress tests are in place across Citi for mark-to-market,

available-for-sale and accrual portfolios. These firm-wide stress reports

measure the potential impact to Citi and its component businesses of very

large changes in various types of key risk factors (e.g., interest rates, credit

spreads, etc.), as well as the potential impact of a number of historical and

hypothetical forward-looking systemic stress scenarios.

Supplementing the stress testing described above, Citi risk management,

working with input from the businesses and finance, provides periodic

updates to senior management on significant potential areas of concern

across Citigroup that can arise from risk concentrations, financial market

participants, and other systemic issues. These areas of focus are intended to

be forward-looking assessments of the potential economic impacts to Citi that

may arise from these exposures. Risk management also reports to the Risk

Management and Finance Committee of the Board of Directors, as well as the

full Board of Directors, on these matters.

The stress testing and focus position exercises are a supplement to

the standard limit-setting and risk-capital exercises described below, as

these processes incorporate events in the marketplace and within Citi that

impact the firm’s outlook on the form, magnitude, correlation and timing

of identified risks that may arise. In addition to enhancing awareness

and understanding of potential exposures, the results of these processes

then serve as the starting point for developing risk management and

mitigation strategies.

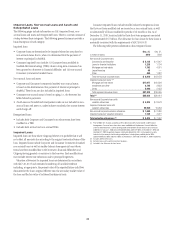

Risk Capital

Risk capital is defined as the amount of capital required to absorb potential

unexpected economic losses resulting from extremely severe events over a

one-year time period.

“Economic losses” include losses that are reflected on Citi’s Consolidated •

Income Statement and fair value adjustments to the Consolidated

Financial Statements, as well as any further declines in value not captured

on the Consolidated Income Statement.

“Unexpected losses” are the difference between potential extremely severe •

losses and Citigroup’s expected (average) loss over a one-year time period.

“Extremely severe” is defined as potential loss at a 99.9% and a 99.97% •

confidence level, based on the distribution of observed events and

scenario analysis.

The drivers of economic losses are risks which, for Citi, as referenced

above, are broadly categorized as credit risk, market risk and operational risk.

Credit risk losses primarily result from a borrower’s or counterparty’s •

inability to meet its financial or contractual obligations.

Market risk losses arise from fluctuations in the market value of trading •

and non-trading positions, including the changes in value resulting from

fluctuations in rates.

Operational risk losses result from inadequate or failed internal processes, •

systems or human factors or from external events.

These risks, discussed in more detail below, are measured and aggregated

within businesses and across Citigroup to facilitate the understanding

of Citi’s exposure to extreme downside events as described under “Risk

Aggregation and Stress Testing” above. The risk capital framework is

reviewed and enhanced on a regular basis in light of market developments

and evolving practices.