Citibank 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

BROKERAGE AND ASSET MANAGEMENT

Brokerage and Asset Management (BAM), which constituted approximately 8% of Citi Holdings by assets as of December 31, 2010, consists of Citi’s global

retail brokerage and asset management businesses. This segment was substantially reduced in size due to the sale in 2009 of Smith Barney to the Morgan

Stanley Smith Barney joint venture (MSSB JV) and of Nikko Cordial Securities (reported as discontinued operations within Corporate/Other for all periods

presented). At December 31, 2010, BAM had approximately $27 billion of assets, primarily consisting of Citi’s investment in, and assets related to, the MSSB JV.

Morgan Stanley has options to purchase Citi’s remaining stake in the MSSB JV over three years starting in 2012.

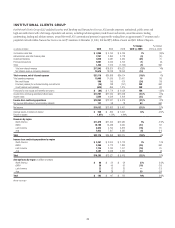

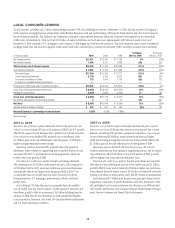

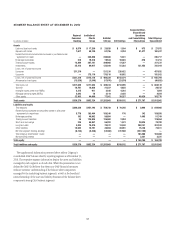

In millions of dollars 2010 2009 2008

% Change

2010 vs. 2009

% Change

2009 vs. 2008

Net interest revenue $(277) $ 390 $ 1,280 NM (70)%

Non-interest revenue 886 14,233 6,683 (94)% NM

Total revenues, net of interest expense $ 609 $14,623 $ 7,963 (96)% 84%

Total operating expenses $ 951 $ 3,141 $ 8,973 (70)% (65)%

Net credit losses $ 17 $ 1 $ 9 NM (89)%

Credit reserve build (release) (18) 36 8 NM NM

Provision for unfunded lending commitments (6) (5) — (20)% —

Provision (release) for benefits and claims 38 40 36 (5) 11

Provisions for credit losses and for benefits and claims $ 31 $ 72 $ 53 (57)% 36%

Income (loss) from continuing operations before taxes $(373) $11,410 $(1,063) NM NM

Income taxes (benefits) (170) 4,473 (212) NM NM

Income (loss) from continuing operations $(203) $ 6,937 $ (851) NM NM

Net income attributable to noncontrolling interests 11 12 (179) (8)% NM

Net income (loss) $(214) $ 6,925 $ (672) NM NM

EOP assets reflecting the sale of Nikko Cordial Securities

(in billions of dollars) $ 27 $ 30 $ 31 (10)% (3)%

EOP deposits (in billions of dollars) 58 60 58 (3) 3

NM Not meaningful

2010 vs. 2009

Revenues, net of interest expense decreased 96% versus the prior year

mainly driven by the absence of the $11.1 billion pretax gain on sale

($6.7 billion after tax) related to the MSSB JV transaction in the second

quarter of 2009 and a $320 million pretax gain on the sale of the managed

futures business to the MSSB JV in the third quarter of 2009. Excluding these

gains, revenue decreased primarily due to the absence of Smith Barney from

May 2009 onwards and the absence of Nikko Asset Management, partially

offset by higher revenues from the MSSB JV and an improvement in marks in

Retail Alternative Investments.

Operating expenses decreased 70% from the prior year, mainly driven

by the absence of Smith Barney from May 2009 onwards, lower MSSB JV

separation-related costs and the absence of Nikko and Colfondos, partially

offset by higher legal settlements and reserves associated with Smith Barney.

Provisions for credit losses and for benefits and claims decreased 57%,

mainly due to the absence of credit reserve builds.

Assets decreased 10% versus the prior year, mostly driven by the sales of the

Citi private equity business and the run-off of tailored loan portfolios.

2009 vs. 2008

Revenues, net of interest expense increased 84% versus the prior year

mainly driven by the gain on sale related to the MSSB JV transaction and the

gain on the sale of the managed futures business to the MSSB JV. Excluding

these gains, revenue decreased primarily due to the absence of Smith Barney

from May 2009 onwards and the absence of 2009 fourth-quarter revenue of

Nikko Asset Management, partially offset by an improvement in marks in

Retail Alternative Investments. Revenues in 2008 included a $347 million

pretax gain on the sale of CitiStreet and charges related to the settlement of

auction rate securities of $393 million pretax.

Operating expenses decreased 65% from 2008, mainly driven by the absence

of Smith Barney and Nikko Asset Management expenses, re-engineering

efforts and the absence of 2008 one-time expenses ($0.9 billion intangible

impairment, $0.2 billion of restructuring and $0.5 billion of write-downs and

other charges).

Provisions for credit losses and for benefits and claims increased 36%,

mainly reflecting an increase in reserve builds of $28 million.

Assets decreased 3% versus the prior year, mostly driven by the impact of

the sale of Nikko Asset Management.