Citibank 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312

|

|

137

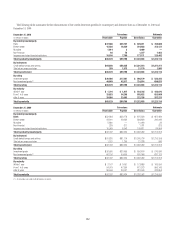

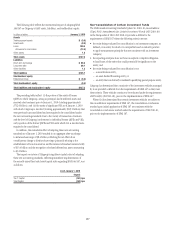

The following table reflects the incremental impact of adopting SFAS

166/167 on Citigroup’s GAAP assets, liabilities, and stockholders’ equity.

In billions of dollars January 1, 2010

Assets

Trading account assets $ (9.9)

Investments (0.6)

Loans 159.4

Allowance for loan losses (13.4)

Other assets 1.8

Total assets $137.3

Liabilities

Short-term borrowings $ 58.3

Long-term debt 86.1

Other liabilities 1.3

Total liabilities $145.7

Stockholders’ equity

Retained earnings $ (8.4)

Total stockholders’ equity (8.4)

Total liabilities and stockholders’ equity $137.3

The preceding tables reflect: (i) the portion of the assets of former

QSPEs to which Citigroup, acting as principal, had transferred assets and

received sales treatment prior to January 1, 2010 (totaling approximately

$712.0 billion), and (ii) the assets of significant VIEs as of January 1, 2010

with which Citigroup is involved (totaling approximately $219.2 billion) that

were previously unconsolidated and are required to be consolidated under

the new accounting standards. Due to the variety of transaction structures

and the level of Citigroup involvement in individual former QSPEs and VIEs,

only a portion of the former QSPEs and VIEs with which Citi is involved were

required to be consolidated.

In addition, the cumulative effect of adopting these new accounting

standards as of January 1, 2010 resulted in an aggregate after-tax charge

to Retained earnings of $8.4 billion, reflecting the net effect of an

overall pretax charge to Retained earnings (primarily relating to the

establishment of loan loss reserves and the reversal of residual interests held)

of $13.4 billion and the recognition of related deferred tax assets amounting

to $5.0 billion.

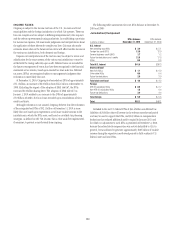

The impact on certain of Citigroup’s regulatory capital ratios of adopting

these new accounting standards, reflecting immediate implementation of

the recently issued final risk-based capital rules regarding SFAS 166/167, was

as follows:

As of January 1, 2010

Impact

Tier 1 Capital (141) bps

Total Capital (142) bps

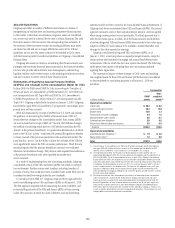

Non-Consolidation of Certain Investment Funds

The FASB issued Accounting Standards Update No. 2010-10, Consolidation

(Topic 810), Amendments for Certain Investment Funds (ASU 2010-10)

in the first quarter of 2010. ASU 2010-10 provides a deferral to the

requirements of SFAS 167 where the following criteria are met:

the entity being evaluated for consolidation is an investment company, as •

defined, or an entity for which it is acceptable based on industry practice

to apply measurement principles that are consistent with an investment

company;

the reporting enterprise does not have an explicit or implicit obligation •

to fund losses of the entity that could potentially be significant to the

entity; and

the entity being evaluated for consolidation is not:•

– a securitization entity;

– an asset-backed financing entity; or

– an entity that was formerly considered a qualifying special-purpose entity.

Citigroup has determined that a majority of the investment vehicles managed

by it are provided a deferral from the requirements of SFAS 167 as they meet

these criteria. These vehicles continue to be evaluated under the requirements

of FIN 46(R) (ASC 810-10), prior to the implementation of SFAS 167.

Where Citi has determined that certain investment vehicles are subject to

the consolidation requirements of SFAS 167, the consolidation conclusions

reached upon initial application of SFAS 167 are consistent with the

consolidation conclusions reached under the requirements of ASC 810-10,

prior to the implementation of SFAS 167.