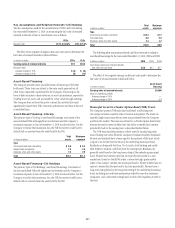

Citibank 2010 Annual Report Download - page 241

Download and view the complete annual report

Please find page 241 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

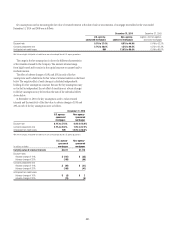

239

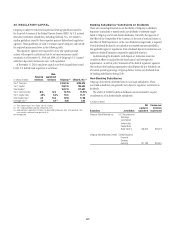

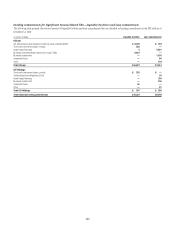

Managed Loans—Citi Holdings

The following tables present a reconciliation between the managed and

on-balance-sheet credit card portfolios and the related delinquencies (loans

which are 90 days or more past due) and credit losses, net of recoveries:

In millions of dollars,

except loans in billions

December 31,

2010

December 31,

2009

Loan amounts, at period end

On balance sheet $ 52.8 $ 27.0

Securitized amounts —38.8

Total managed loans $ 52.8 $ 65.8

Delinquencies, at period end

On balance sheet $1,554 $1,250

Securitized amounts —1,326

Total managed delinquencies $1,554 $2,576

Credit losses, net of recoveries,

for the years ended December 31, 2010 2009 2008

On balance sheet $7,230 $4,540 $3,052

Securitized amounts —4,590 3,107

Total managed credit losses $7,230 $9,130 $6,159

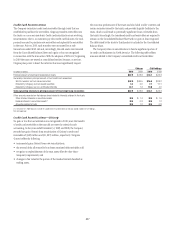

Funding, Liquidity Facilities and Subordinated Interests

Citigroup securitizes credit card receivables through two securitization

trusts—Citibank Credit Card Master Trust (Master Trust), which is part of

Citicorp, and the Citibank OMNI Master Trust (Omni Trust), which is part of

Citi Holdings. Citigroup previously securitized credit card receivables through

the Broadway Credit Card Trust (Broadway Trust); however, this Trust was

sold as part of a disposition during 2010.

Master Trust issues fixed- and floating-rate term notes as well as

commercial paper (CP). Some of the term notes are issued to multi-seller

commercial paper conduits. In 2009, the Master Trust issued $4.3 billion

of notes that are eligible for the Term Asset-Backed Securities Loan Facility

(TALF) program, where investors can borrow from the Federal Reserve using

the trust securities as collateral. The weighted average maturity of the term

notes issued by the Master Trust was 3.4 years as of December 31, 2010 and

3.6 years as of December 31, 2009. Beginning in 2010, the liabilities of the

trusts are included in the Consolidated Balance Sheet.

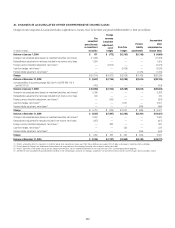

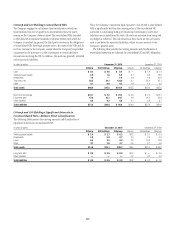

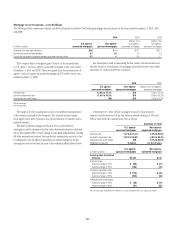

Master Trust Liabilities (at par value)

In billions of dollars

December 31,

2010

December 31,

2009

Term notes issued to multi-seller

CP conduits $ 0.3 $ 0.8

Term notes issued to third parties 41.8 51.2

Term notes retained by

Citigroup affiliates 3.4 5.0

Commercial paper —14.5

Total Master Trust

liabilities $45.5 $71.5

The Omni Trust issues fixed- and floating-rate term notes, some of which

are purchased by multi-seller commercial paper conduits. The Omni Trust

also issues commercial paper. During 2009, a portion of the Omni Trust

commercial paper had been purchased by the Federal Reserve Commercial

Paper Funding Facility (CPFF). In addition, some of the multi-seller conduits

that hold Omni Trust term notes had placed commercial paper with the CPFF.

No Omni Trust liabilities were funded through the CPFF as of December 31,

2010. The total amount of Omni Trust liabilities funded directly or indirectly

through the CPFF was $2.5 billion at December 31, 2009.

The weighted average maturity of the third-party term notes issued by

the Omni Trust was 1.8 years as of December 31, 2010 and 2.5 years as of

December 31, 2009.

Omni Trust Liabilities (at par value)

In billions of dollars

December 31,

2010

December 31,

2009

Term notes issued to multi-seller

CP conduits $ 7.2 $13.1

Term notes issued to third parties 9.2 9.2

Term notes retained by

Citigroup affiliates 7.1 9.8

Commercial paper —4.4

Total Omni Trust liabilities $23.5 $36.5

Citibank (South Dakota), N.A. is the sole provider of full liquidity facilities

to the commercial paper programs of the Master and Omni Trusts. Both

of these facilities, which represent contractual obligations on the part of

Citibank (South Dakota), N.A. to provide liquidity for the issued commercial

paper, are made available on market terms to each of the trusts. The liquidity

facilities require Citibank (South Dakota), N.A. to purchase the commercial

paper issued by each trust at maturity, if the commercial paper does not

roll over, as long as there are available credit enhancements outstanding,

typically in the form of subordinated notes. As there was no Omni Trust or

Master Trust commercial paper outstanding as of December 31, 2010, there

was no liquidity commitment at that time. The liquidity commitment related

to the Omni Trust commercial paper programs amounted to $4.4 billion at

December 31, 2009. The liquidity commitment related to the Master Trust

commercial paper program amounted to $14.5 billion at December 31, 2009.

As of December 31, 2009, none of the Omni Trust or Master Trust liquidity

commitments were drawn.