Citibank 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Three other interrelated factors are at work here: increasing

urbanization, massive investment needs and the role of

sovereign wealth funds. Approximately 1.5 million people move

to a city each day, with almost all of this migration taking place

in emerging markets. This urbanization already is creating

fresh demand for financial services and also is prompting

massive investment needs for infrastructure projects, including

roads, transit systems, power grids and telecom. By some

estimates, as much as $3 trillion will be required per year to

upgrade aging infrastructure in developed markets and to meet

the demands of urbanization in emerging markets. These

investment needs, in turn, will create demand for capital

markets in these countries, including active equity markets to

support the expected growth.

Sovereign wealth funds represent a $4 trillion capital pool that

will only grow larger as global current account imbalances,

driven by trade surpluses in several Asian and Middle Eastern

countries, continue to swell. These funds have large and

fast-growing needs for solid investments in which to put their

money. As a result, they are likely to play an important role in

making up for capital investment shortfalls that may arise as

more and more capital is allocated to infrastructure.

2) Regulatory reform: The regulatory landscape is changing,

but we don’t yet know exactly what forms those changes will

take. Many of the rules required by Dodd-Frank remain to be

written, and much of Basel III is not yet finalized. We support

both reforms. While the Dodd-Frank rules may impose

additional costs, they also may create opportunities to develop

new and profitable business models. And we expect to meet the

new Basel capital and liquidity requirements well before they

become effective.

Whatever changes may come, there are some clear themes

that will define Citi’s future and principles. Customers will place

a premium on those who practice what we call Responsible

Finance. This means acting in ways that are in our clients’

interests and that are systemically responsible. Responsible

Finance also means supporting the real economy and its

underlying growth trends. This is less about economics and

more about behavior. The financial services industry plays a

crucial role in enhancing economic growth and prosperity, and

we must always make promoting broad-based growth one of

our central priorities.

3) Changes in consumer preferences: A new generation of

globally minded and tech-savvy people is coming of age and

entering the financial system. Globalization has harmonized,

to some extent, these consumers’ tastes, spending habits

and expectations in ways that make people who live in the

world’s largest and most sophisticated urban centers more

like one another than ever before. These consumers also have

different — and higher — expectations from businesses than

their parents. The demands on businesses that rely on

information technology will be especially high: consumers

have come to expect instant, fast, reliable, always-on access

to a plethora of data. In addition, consumers in differing

circumstances and markets increasingly demand products

and services tailored to their specific needs.

Keeping up with — and staying ahead of — those expectations

will require changes to the global retail banking business model

that are every bit as significant as the changes being wrought

by new regulation. Social networking and technology pose

perhaps the greatest challenge. More than 750 million people

around the world now use social networking sites, which are

radically changing the way consumers communicate — with

each other and with businesses. What used to be simple

messages are now interactive and ongoing dialogues.

Industries and businesses that succeed in the new environment

are harnessing social network technology to offer highly

personalized service and virtual, online communities.

In short, consumers everywhere are becoming more knowl-

edgeable and sophisticated. We must treat them accordingly.

4) Technological advances: Rapid technological advances over

the next several years will reshape our industry beyond driving

changes in consumer preferences. The incremental cost of

computer memory already is close to zero. The cost of

processing is approaching zero. The expansion of broadband is

improving connectivity and the speed of information

processing. Cloud computing will meaningfully increase the

ability to store and manipulate data.

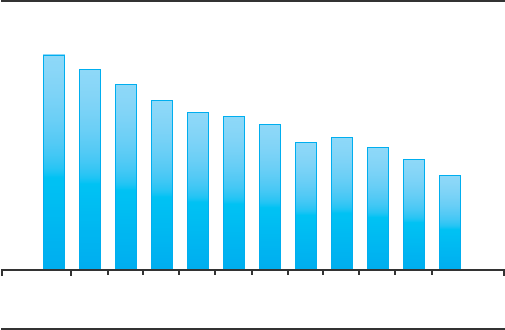

1Q

’08

3Q

’08

1Q

’09

3Q

’09

1Q

’10

3Q

’10

2Q

’08

4Q

’08

2Q

’09

4Q

’09

2Q

’10

4Q

’10

$8271705 599 556 5032421762 650 582 487 465 359

Citi Holdings Assets

(in billions of dollars)

1Peak quarter.

2The adoption of SFAS 166/167 brought $43 billion on balance sheet

as of January 1, 2010.