Citibank 2010 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

240

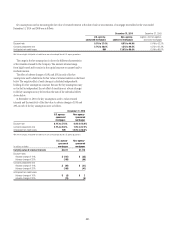

In addition, Citibank (South Dakota), N.A. had provided liquidity to a

third-party, non-consolidated multi-seller commercial paper conduit, which

is not a VIE. The commercial paper conduit had acquired notes issued by

the Omni Trust. The liquidity commitment to the third-party conduit was

$2.5 billion at December 31, 2009, of which none was drawn.

During 2009, all three of Citigroup’s primary credit card securitization

trusts—Master Trust, Omni Trust, and Broadway Trust—had bonds placed

on ratings watch with negative implications by rating agencies. As a result

of the ratings watch status, certain actions were taken by Citi with respect

to each of the trusts. In general, the actions subordinated certain senior

interests in the trust assets that were retained by Citi, which effectively placed

these interests below investor interests in terms of priority of payment.

As a result of these actions, based on the applicable regulatory capital

rules, Citigroup began including the sold assets for all three of the credit card

securitization trusts in its risk-weighted assets for purposes of calculating its

risk-based capital ratios during 2009. The increase in risk-weighted assets

occurred in the quarter during 2009 in which the respective actions took

place. The effect of these changes increased Citigroup’s risk-weighted assets

by approximately $82 billion, and decreased Citigroup’s Tier 1 Capital ratio

by approximately 100 basis points as of March 31, 2009, with respect to

each of the master and Omni Trusts. The inclusion of the Broadway Trust

increased Citigroup’s risk-weighted assets by an additional approximate

$900 million at June 30, 2009. With the consolidation of the trusts, beginning

in 2010 the credit card receivables that had previously been considered sold

under SFAS 140 are now included in the Consolidated Balance Sheet and

accordingly these assets continue to be included in Citigroup’s risk-weighted

assets. All bond ratings for each of the trusts have been affirmed by the rating

agencies and no downgrades have occurred since December 31, 2010.

Mortgage Securitizations

The Company provides a wide range of mortgage loan products to a diverse

customer base.

Once originated, the Company often securitizes these loans through the

use of SPEs, which prior to 2010 were QSPEs. These SPEs are funded through

the issuance of trust certificates backed solely by the transferred assets. These

certificates have the same average life as the transferred assets. In addition to

providing a source of liquidity and less expensive funding, securitizing these

assets also reduces the Company’s credit exposure to the borrowers. These

mortgage loan securitizations are primarily non-recourse, thereby effectively

transferring the risk of future credit losses to the purchasers of the securities

issued by the trust. However, the Company’s Consumer business generally

retains the servicing rights and in certain instances retains investment

securities, interest-only strips and residual interests in future cash flows from

the trusts and also provides servicing for a limited number of Securities and

Banking securitizations. Securities and Banking and Special Asset Pool

do not retain servicing for their mortgage securitizations.

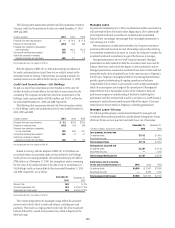

The Company securitizes mortgage loans generally through either a

government-sponsored agency, such as Ginnie Mae, FNMA or Freddie Mac

(U.S. agency-sponsored mortgages), or private label (non-agency-sponsored

mortgages) securitization. The Company is not the primary beneficiary of

its U.S. agency-sponsored mortgage securitizations, because Citigroup does

not have the power to direct the activities of the SPE that most significantly

impact the entity’s economic performance. Therefore, Citi does not

consolidate these U.S. agency-sponsored mortgage securitizations. In certain

instances, the Company has (1) the power to direct the activities and (2) the

obligation to either absorb losses or right to receive benefits that could be

potentially significant to its non-agency-sponsored mortgage securitizations

and, therefore, is the primary beneficiary and consolidates the SPE.

Mortgage Securitizations—Citicorp

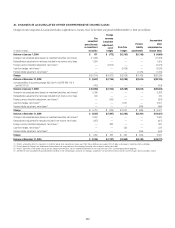

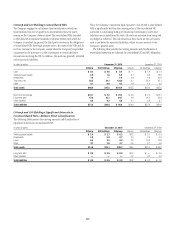

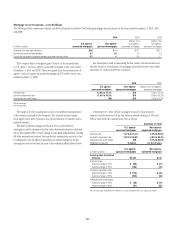

The following tables summarize selected cash flow information related to mortgage securitizations for the years ended December 31, 2010, 2009 and 2008:

2010 2009 2008

In billions of dollars

U.S. agency-

sponsored

mortgages

Non-agency-

sponsored

mortgages

Agency- and

non-agency-

sponsored

mortgages

Agency- and

non-agency-

sponsored

mortgages

Proceeds from new securitizations $63.0 $2.1 $15.7 $6.3

Contractual servicing fees received 0.5 — — —

Cash flows received on retained interests and other net cash flows 0.1 — 0.1 0.2

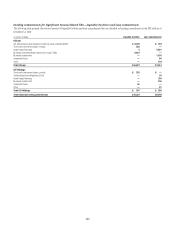

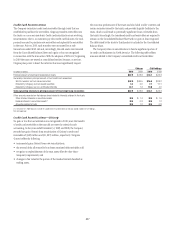

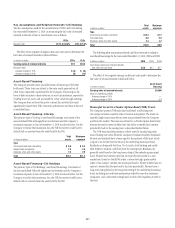

Gains (losses) recognized on the securitization of U.S. agency-sponsored

mortgages during 2010 were $(2) million. For the year ended December 31,

2010, gains (losses) recognized on the securitization of non-agency-

sponsored mortgages were $(3) million.

Agency and non-agency mortgage securitization gains (losses) for

the years ended December 31, 2009 and 2008 were $18 million and

$(15) million, respectively.