Citibank 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

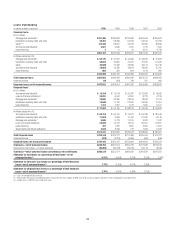

Renegotiated Loans

The following table presents Citi’s renegotiated loans, which represent loans

modified in TDRs.

In millions of dollars

Dec. 31,

2010

Dec. 31,

2009

Corporate renegotiated loans (1)

In U.S. offices

Commercial and industrial (2) $ 240 $ 203

Mortgage and real estate (3) 61 —

Other 699 —

$ 1,000 $ 203

In offices outside the U.S.

Commercial and industrial (2) $ 207 $ 145

Mortgage and real estate (3) 90 2

Other 18 —

$ 315 $ 147

Total Corporate renegotiated loans $ 1,315 $ 350

Consumer renegotiated loans (4)(5)(6)(7)

In U.S. offices

Mortgage and real estate $17,717 $11,165

Cards 4,747 992

Installment and other 1,986 2,689

$24,450 $14,846

In offices outside the U.S.

Mortgage and real estate $ 927 $ 415

Cards 1,159 1,461

Installment and other 1,875 1,401

$ 3,961 $ 3,277

Total Consumer renegotiated loans $28,411 $18,123

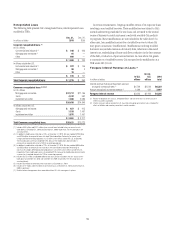

(1) Includes $553 million and $317 million of non-accrual loans included in the non-accrual assets

table above, at December 31, 2010 and December 31, 2009, respectively. The remaining loans are

accruing interest.

(2) In addition to modifications reflected as TDRs, at December 31, 2010, Citi also modified $190 million

and $416 million of commercial loans risk rated “Substandard Non-Performing” or worse (asset

category defined by banking regulators) in U.S. offices and in offices outside the U.S., respectively.

These modifications were not considered TDRs, because the modifications did not involve a

concession (a required element of a TDR for accounting purposes).

(3) In addition to modifications reflected as TDRs, at December 31, 2010, Citi also modified $695 million

and $155 million of commercial real estate loans risk rated “Substandard Non-Performing” or

worse (asset category defined by banking regulators) in U.S. offices and in offices outside the U.S.,

respectively. These modifications were not considered TDRs, because the modifications did not involve

a concession (a required element of a TDR for accounting purposes).

(4) Includes $2,751 million and $2,000 million of non-accrual loans included in the non-accrual assets

table above at December 31, 2010 and December 31, 2009, respectively. The remaining loans are

accruing interest.

(5) Includes $22 million of commercial real estate loans at December 31, 2010.

(6) Includes $177 million and $16 million of commercial loans at December 31, 2010 and December 31,

2009, respectively.

(7) Smaller-balance homogeneous loans were derived from Citi’s risk management systems.

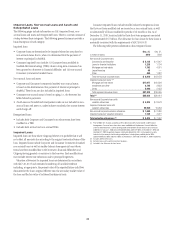

In certain circumstances, Citigroup modifies certain of its corporate loans

involving a non-troubled borrower. These modifications are subject to Citi’s

normal underwriting standards for new loans and are made in the normal

course of business to match customers’ needs with available Citi products

or programs (these modifications are not included in the table above). In

other cases, loan modifications involve a troubled borrower to whom Citi

may grant a concession (modification). Modifications involving troubled

borrowers may include extension of maturity date, reduction in the stated

interest rate, rescheduling of future cash flows, reduction in the face amount

of the debt, or reduction of past accrued interest. In cases where Citi grants

a concession to a troubled borrower, Citi accounts for the modification as a

TDR under ASC 310-40.

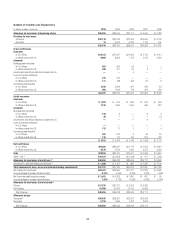

Foregone Interest Revenue on Loans (1)

In millions of dollars

In U.S.

offices

In non-

U.S.

offices

2010

total

Interest revenue that would have been accrued

at original contractual rates (2) $4,709 $1,593 $6,302

Amount recognized as interest revenue (2) 1,666 431 2,097

Foregone interest revenue $3,043 $1,162 $4,205

(1) Relates to Corporate non-accruals, renegotiated loans and Consumer loans on which accrual of

interest has been suspended.

(2) Interest revenue in offices outside the U.S. may reflect prevailing local interest rates, including the

effects of inflation and monetary correction in certain countries.