Citibank 2010 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

206

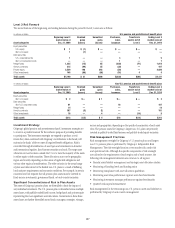

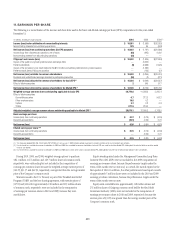

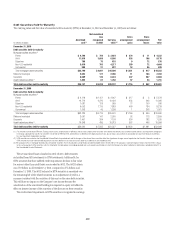

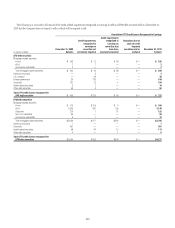

15. INVESTMENTS

In millions of dollars 2010 2009

Securities available-for-sale $274,572 $239,599

Debt securities held-to-maturity (1) 29,107 51,527

Non-marketable equity securities carried at fair value (2) 6,602 6,830

Non-marketable equity securities carried at cost (3) 7,883 8,163

Total investments $318,164 $306,119

(1) Recorded at amortized cost less impairment on securities that have credit-related impairment.

(2) Unrealized gains and losses for non-marketable equity securities carried at fair value are recognized in earnings.

(3) Non-marketable equity securities carried at cost primarily consist of shares issued by the Federal Reserve Bank, Federal Home Loan Bank, foreign central banks and various clearing houses of which Citigroup is a

member.

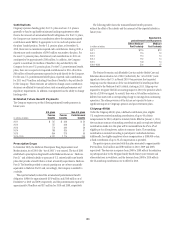

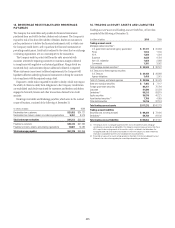

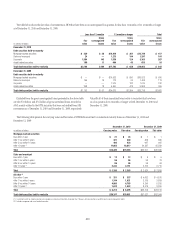

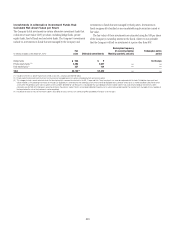

Securities Available-for-Sale

The amortized cost and fair value of securities available-for-sale (AFS) at December 31, 2010 and December 31, 2009 were as follows:

2010 2009

In millions of dollars

Amortized

cost

Gross

unrealized

gains

Gross

unrealized

losses Fair value

Amortized

cost

Gross

unrealized

gains

Gross

unrealized

losses Fair value

Debt securities AFS

Mortgage-backed securities (1)

U.S. government-sponsored agency guaranteed $ 23,433 $ 425 $ 235 $ 23,623 $ 20,625 $ 339 $ 50 $ 20,914

Prime 1,985 18 177 1,826 7,291 119 932 6,478

Alt-A 46 2 — 48 538 93 4 627

Subprime 119 1 1 119 1 — — 1

Non-U.S. residential 315 1 — 316 258 — 3 255

Commercial 592 21 39 574 883 10 100 793

Total mortgage-backed securities $ 26,490 $ 468 $ 452 $ 26,506 $ 29,596 $ 561 $ 1,089 $ 29,068

U.S. Treasury and federal agency securities

U.S. Treasury 58,069 435 56 58,448 26,857 36 331 26,562

Agency obligations 43,294 375 55 43,614 27,714 46 208 27,552

Total U.S. Treasury and federal agency securities $101,363 $ 810 $ 111 $102,062 $ 54,571 $ 82 $ 539 $ 54,114

State and municipal 15,660 75 2,500 13,235 16,677 147 1,214 15,610

Foreign government 99,110 984 415 99,679 101,987 860 328 102,519

Corporate 15,910 319 59 16,170 20,024 435 146 20,313

Asset-backed securities (1) 9,085 31 68 9,048 10,089 50 93 10,046

Other debt securities 1,948 24 60 1,912 2,179 21 77 2,123

Total debt securities AFS $269,566 $ 2,711 $3,665 $268,612 $235,123 $ 2,156 $ 3,486 $233,793

Marketable equity securities AFS $ 3,791 $ 2,380 $ 211 $ 5,960 $ 4,089 $ 1,929 $ 212 $ 5,806

Total securities AFS $273,357 $5,091 $3,876 $274,572 $239,212 $ 4,085 $ 3,698 $239,599

(1) The Company invests in mortgage-backed and asset-backed securities. These securitizations are generally considered VIEs. The Company's maximum exposure to loss from these VIEs is equal to the carrying amount

of the securities, which is reflected in the table above. For mortgage-backed and asset-backed securitizations in which the Company has other involvement, information is provided in Note 22 to the Consolidated

Financial Statements.

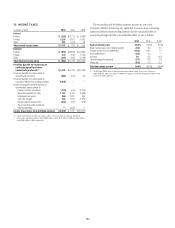

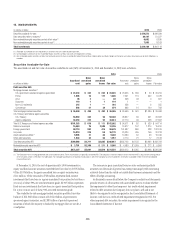

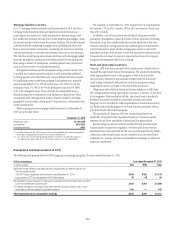

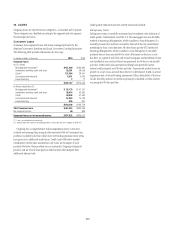

At December 31, 2010, the cost of approximately 3,000 investments in

equity and fixed-income securities exceeded their fair value by $3.876 billion.

Of the $3.876 billion, the gross unrealized loss on equity securities was

$211 million. Of the remainder, $728 million represents fixed-income

investments that have been in a gross-unrealized-loss position for less than a

year and, of these, 99% are rated investment grade; $2.937 billion represents

fixed-income investments that have been in a gross-unrealized-loss position

for a year or more and, of these, 90% are rated investment grade.

The available-for-sale mortgage-backed securities-portfolio fair value

balance of $26.506 billion consists of $23.623 billion of government-

sponsored agency securities, and $2.883 billion of privately sponsored

securities of which the majority is backed by mortgages that are not Alt-A

or subprime.

The increase in gross unrealized losses on state and municipal debt

securities was the result of general tax-exempt municipal yields increasing

relatively faster than the yields on taxable fixed income instruments and the

effects of hedge accounting.

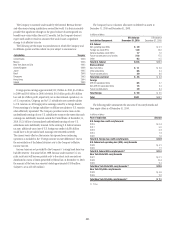

As discussed in more detail below, the Company conducts and documents

periodic reviews of all securities with unrealized losses to evaluate whether

the impairment is other than temporary. Any credit-related impairment

related to debt securities the Company does not plan to sell and is not

likely to be required to sell is recognized in the Consolidated Statement of

Income, with the non-credit-related impairment recognized in OCI. For

other impaired debt securities, the entire impairment is recognized in the

Consolidated Statement of Income.