Citibank 2010 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

243

Mortgage Servicing Rights

In connection with the securitization of mortgage loans, the Company’s

U.S. Consumer mortgage business retains the servicing rights, which entitle

the Company to a future stream of cash flows based on the outstanding

principal balances of the loans and the contractual servicing fee. Failure to

service the loans in accordance with contractual requirements may lead to a

termination of the servicing rights and the loss of future servicing fees.

The fair value of capitalized mortgage servicing rights (MSRs) was

$4.6 billion and $6.5 billion at December 31, 2010 and 2009, respectively.

The MSRs correspond to principal loan balances of $455 billion and

$555 billion as of December 31, 2010 and 2009, respectively. The following

table summarizes the changes in capitalized MSRs for the years ended

December 31, 2010 and 2009:

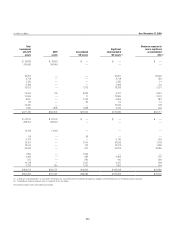

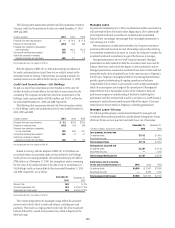

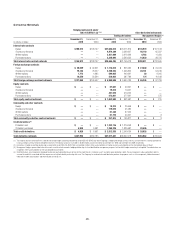

In millions of dollars 2010 2009

Balance, beginning of year $ 6,530 $ 5,657

Originations 658 1,035

Changes in fair value of MSRs due to changes

in inputs and assumptions (1,067) 1,546

Other changes (1) (1,567) (1,708)

Balance, end of year $ 4,554 $ 6,530

(1) Represents changes due to customer payments and passage of time.

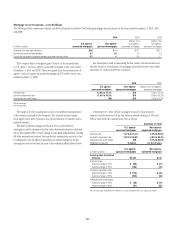

The market for MSRs is not sufficiently liquid to provide participants

with quoted market prices. Therefore, the Company uses an option-adjusted

spread valuation approach to determine the fair value of MSRs. This

approach consists of projecting servicing cash flows under multiple interest

rate scenarios and discounting these cash flows using risk-adjusted discount

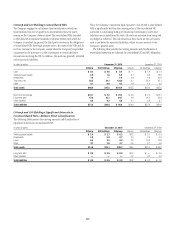

rates. The key assumptions used in the valuation of MSRs include mortgage

prepayment speeds and discount rates. The model assumptions and the

MSRs’ fair value estimates are compared to observable trades of similar MSR

portfolios and interest-only security portfolios, as available, as well as to MSR

broker valuations and industry surveys. The cash flow model and underlying

prepayment and interest rate models used to value these MSRs are subject to

validation in accordance with the Company’s model validation policies.

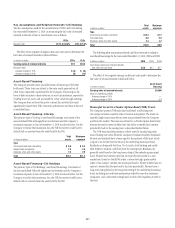

The fair value of the MSRs is primarily affected by changes in

prepayments that result from shifts in mortgage interest rates. In managing

this risk, the Company economically hedges a significant portion of the

value of its MSRs through the use of interest rate derivative contracts, forward

purchase commitments of mortgage-backed securities and purchased

securities classified as trading.

The Company receives fees during the course of servicing previously

securitized mortgages. The amounts of these fees for the years ended

December 31, 2010, 2009 and 2008 were as follows:

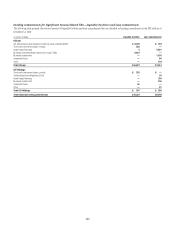

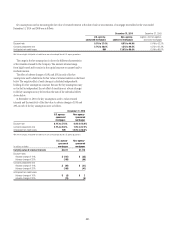

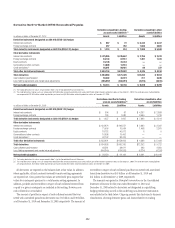

In millions of dollars 2010 2009 2008

Servicing fees $1,356 $1,635 $2,121

Late fees 87 93 123

Ancillary fees 214 77 81

Total MSR fees $1,657 $1,805 $2,325

These fees are classified in the Consolidated Statement of Income as

Other revenue.

Re-securitizations

The Company engages in re-securitization transactions in which debt

securities are transferred to a VIE in exchange for new beneficial interests.

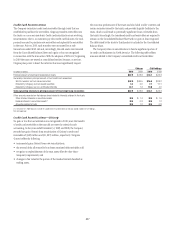

During the year ended December 31, 2010, Citi transferred non-agency

(private-label) securities with original loan proceeds of approximately

$4,868 million to re-securitization entities. These securities are backed by

either residential or commercial mortgages and are often structured on

behalf of clients. For the year ended December 31, 2010, Citi recognized

losses on the sale of securities to private-label re-securitization entities of

approximately $119 million. As of December 31, 2010, the market value

of Citi-owned interests in re-securitization transactions structured by Citi

totaled approximately $435 million and are recorded in trading assets. Of this

amount, approximately $104 million and $331 million relate to senior and

subordinated beneficial interests, respectively.

The Company also re-securitizes U.S. government-agency guaranteed

mortgage-backed (Agency) securities. For the year ended December 31,

2010, Citi transferred agency securities with principal of approximately

$28,295 million to re-securitization entities. As of December 31, 2010, the

market value of Citi-owned interests in agency re-securitization transactions

structured by Citi totaled approximately $351 million and are recorded in

trading assets.

As of December 31, 2010, the Company did not consolidate any private-

label or agency re-securitization entities.

Citi-Administered Asset-Backed Commercial Paper Conduits

The Company is active in the asset-backed commercial paper conduit

business as administrator of several multi-seller commercial paper conduits,

and also as a service provider to single-seller and other commercial paper

conduits sponsored by third parties.

The multi-seller commercial paper conduits are designed to provide

the Company’s clients access to low-cost funding in the commercial paper

markets. The conduits purchase assets from or provide financing facilities to

clients and are funded by issuing commercial paper to third-party investors.

The conduits generally do not purchase assets originated by the Company.

The funding of the conduits is facilitated by the liquidity support and credit

enhancements provided by the Company.