Citibank 2010 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.185

Stock Award Programs

Citigroup issues (and has issued) shares of its common stock in the form of

restricted stock awards, deferred stock awards, and stock payments pursuant

to the 2009 Stock Incentive Plan (and predecessor plans) to its officers,

employees and non-employee directors.

Citigroup’s primary stock award program is the Capital Accumulation

Program (CAP). Generally, CAP awards of restricted or deferred stock

constitute a percentage of annual incentive compensation and vest ratably

over four-year periods, beginning on the first anniversary of the award date.

Continuous employment within Citigroup is generally required to

vest in CAP and other stock award programs. Typically, exceptions allow

vesting for participants whose employment is terminated involuntarily

during the vesting period for a reason other than “gross misconduct,” who

meet specified age and service requirements before leaving employment

(retirement-eligible participants), or who die or become disabled during the

vesting period. Post-employment vesting by retirement-eligible participants is

generally conditioned upon their refraining from competing with Citigroup

during the remaining vesting period.

From 2003 to 2007, Citigroup granted annual stock awards under its

Citigroup Ownership Program (COP) to a broad base of employees who were

not eligible for CAP. The COP awards of restricted or deferred stock vest after

three years, but otherwise have terms similar to CAP.

Non-employee directors receive part of their compensation in the form of

deferred stock awards that vest in two years, and may elect to receive part of

their retainer in the form of a stock payment, which they may elect to defer.

From time to time, restricted or deferred stock awards and/or stock option

grants are made to induce talented employees to join Citigroup or as special

retention awards to key employees. Vesting periods vary, but are generally two

to four years. Generally, recipients must remain employed through the vesting

dates to vest in the awards, except in cases of death, disability, or involuntary

termination other than for “gross misconduct.” Unlike CAP, these awards do not

usually provide for post-employment vesting by retirement-eligible participants.

For all stock awards, during the applicable vesting period, the shares

awarded are not issued to participants (in the case of a deferred stock award)

or cannot be sold or transferred by the participants (in the case of a restricted

stock award), until after the vesting conditions have been satisfied. Recipients

of deferred stock awards do not have any stockholder rights until shares

are delivered to them, but they generally are entitled to receive dividend-

equivalent payments during the vesting period. Recipients of restricted

stock awards are entitled to a limited voting right and to receive dividend

or dividend-equivalent payments during the vesting period. Once a stock

award vests, the shares become freely transferable (but certain executives are

required to hold the shares subject to a stock ownership commitment).

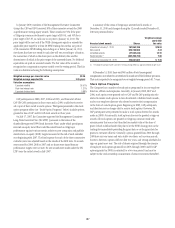

CAP awards made in January 2011 to “identified staff” in the European

Union have several features that differ from the generally applicable CAP

provisions described above. “Identified staff” are those Citigroup employees

whose compensation is subject to various banking regulations on sound

incentive compensation policies in the European Union. These CAP

awards vest in full after three years of service, are subject to a six-month

sale restriction after vesting, and are subject to cancellation if there is a

material downturn in Citigroup’s or the employee’s business unit’s financial

performance or a material failure of risk management (the EU clawback).

A portion of the immediately vested cash incentive compensation awarded

in January 2011 to selected highly compensated employees was delivered in

immediately-vested stock payments. In the European Union, this stock was

subject to a six-month sale restriction.

Annual incentive awards made in January 2011, January 2010, and

December 2009 to certain executive officers and highly compensated

employees were made in the form of long-term restricted stock (LTRS), with

terms prescribed by the Emergency Economic Stabilization Act of 2008, as

amended (EESA). The senior executive officers and next 20 most highly

compensated employees for 2010 (the 2010 Top 25), and the senior executive

officers and the next 95 most highly compensated employees for 2009 (the

2009 Top 100), were eligible for LTRS awards. LTRS awards vest in full after

three years of service and there are no provisions for early vesting of LTRS in

the event of retirement, involuntary termination of employment or change in

control, but early vesting will occur upon death or disability.

Annual incentive awards made in January 2011 to executive officers

have a performance-based vesting condition. If Citigroup has pretax net

losses during any of the years of the deferral period, the Personnel and

Compensation Committee of Citigroup’s Board of Directors may exercise its

discretion to eliminate or reduce the number of shares that vest for that year.

This performance-based vesting condition applies to CAP and LTRS awards

made in January 2011 to executive officers.

All CAP and LTRS awards made in January 2011 provide for a clawback

that applies in the case of employee misconduct or where the awards

were based on earnings that were misstated or on materially inaccurate

performance metric criteria. For EU participants who are “identified staff,”

this clawback is in addition to the EU clawback described above.