Citibank 2010 Annual Report Download - page 259

Download and view the complete annual report

Please find page 259 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

257

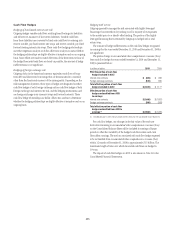

The range of credit derivatives sold includes credit default swaps, total

return swaps and credit options.

A credit default swap is a contract in which, for a fee, a protection seller

agrees to reimburse a protection buyer for any losses that occur due to

a credit event on a reference entity. If there is no credit default event or

settlement trigger, as defined by the specific derivative contract, then the

protection seller makes no payments to the protection buyer and receives only

the contractually specified fee. However, if a credit event occurs as defined in

the specific derivative contract sold, the protection seller will be required to

make a payment to the protection buyer.

A total return swap transfers the total economic performance of a

reference asset, which includes all associated cash flows, as well as capital

appreciation or depreciation. The protection buyer receives a floating rate

of interest and any depreciation on the reference asset from the protection

seller and, in return, the protection seller receives the cash flows associated

with the reference asset plus any appreciation. Thus, according to the total

return swap agreement, the protection seller will be obligated to make a

payment anytime the floating interest rate payment and any depreciation

of the reference asset exceed the cash flows associated with the underlying

asset. A total return swap may terminate upon a default of the reference asset

subject to the provisions of the related total return swap agreement between

the protection seller and the protection buyer.

A credit option is a credit derivative that allows investors to trade or hedge

changes in the credit quality of the reference asset. For example, in a credit

spread option, the option writer assumes the obligation to purchase or sell the

reference asset at a specified “strike” spread level. The option purchaser buys

the right to sell the reference asset to, or purchase it from, the option writer at

the strike spread level. The payments on credit spread options depend either

on a particular credit spread or the price of the underlying credit-sensitive

asset. The options usually terminate if the underlying assets default.

A credit-linked note is a form of credit derivative structured as a debt

security with an embedded credit default swap. The purchaser of the note

writes credit protection to the issuer, and receives a return which will be

negatively affected by credit events on the underlying reference credit. If

the reference entity defaults, the purchaser of the credit-linked note may

assume the long position in the debt security and any future cash flows

from it, but will lose the amount paid to the issuer of the credit-linked note.

Thus the maximum amount of the exposure is the carrying amount of the

credit-linked note. As of December 31, 2010 and December 31, 2009, the

amount of credit-linked notes held by the Company in trading inventory

was immaterial.

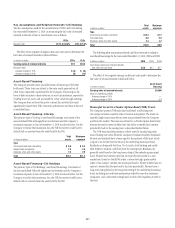

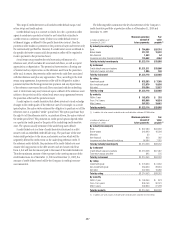

The following tables summarize the key characteristics of the Company’s

credit derivative portfolio as protection seller as of December 31, 2010 and

December 31, 2009:

In millions of dollars as of

December 31, 2010

Maximum potential

amount of

future payments

Fair

value

payable (1)

By industry/counterparty

Bank $ 784,080 $20,718

Broker-dealer 312,131 10,232

Non-financial 1,463 54

Insurance and other financial institutions 125,442 4,954

Total by industry/counterparty $1,223,116 $35,958

By instrument

Credit default swaps and options $1,221,211 $35,800

Total return swaps and other 1,905 158

Total by instrument $1,223,116 $35,958

By rating

Investment grade $ 532,283 $ 7,385

Non-investment grade 372,579 15,636

Not rated 318,254 12,937

Total by rating $1,223,116 $35,958

By maturity

Within 1 year $ 162,075 $ 353

From 1 to 5 years 853,808 16,524

After 5 years 207,233 19,081

Total by maturity $1,223,116 $35,958

(1) In addition, fair value amounts receivable under credit derivatives sold were $22,638 million.

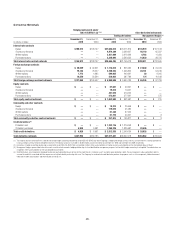

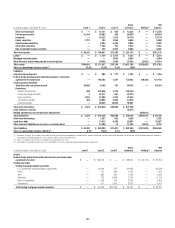

In millions of dollars as of

December 31, 2009

Maximum potential

amount of

future payments

Fair

value

payable (1)

By industry/counterparty

Bank $ 807,484 $34,666

Broker-dealer 340,949 16,309

Monoline 33 —

Non-financial 623 262

Insurance and other financial institutions 64,964 7,025

Total by industry/counterparty $1,214,053 $58,262

By instrument

Credit default swaps and options $1,213,208 $57,987

Total return swaps and other 845 275

Total by instrument $1,214,053 $58,262

By rating

Investment grade $ 576,930 $ 9,632

Non-investment grade 339,920 28,664

Not rated 297,203 19,966

Total by rating $1,214,053 $58,262

By maturity

Within 1 year $ 165,056 $ 873

From 1 to 5 years 806,143 30,181

After 5 years 242,854 27,208

Total by maturity $1,214,053 $58,262

(1) In addition, fair value amounts receivable under credit derivatives sold were $24,234 million.