Citibank 2010 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.178

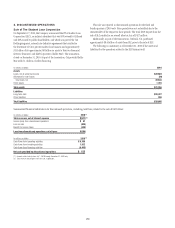

2. BUSINESS DEVELOPMENTS

DIVESTITURES

The following divestitures occurred in 2008, 2009 and 2010 and do

not qualify as Discontinued operations. Divestitures that qualified as

Discontinued operations are discussed in Note 3 to the Consolidated

Financial Statements.

Sale of Primerica

In April 2010, Citi completed the IPO of Primerica and sold approximately

34% to public investors. In the same month, Citi completed the sale of

approximately 22% of Primerica to Warburg Pincus, a private equity firm.

Citi contributed 4% of the Primerica shares to Primerica for employee

and agent stock-based awards immediately prior to the sales. Citi retains

an approximate 40% interest in Primerica after the sales and records the

investment under the equity method. Citi recorded an after-tax gain on sale

of $26 million.

Concurrent with the sale of the shares, Citi entered into co-insurance

agreements with Primerica to reinsure up to 90% of the risk associated with

the in-force insurance policies.

Sale of Phibro LLC

On December 31, 2009, the Company sold 100% of its interest in Phibro

LLC to Occidental Petroleum Corporation for a purchase price equal to

approximately the net asset value of the business.

The decision to sell Phibro was the outcome of an evaluation of a variety

of alternatives and is consistent with Citi’s core strategy of a client-centered

business model. The sale of Phibro does not affect Citi’s client-facing

commodities business lines, which will continue to operate and serve the

needs of Citi’s clients throughout the world.

Sale of Citi’s Nikko Asset Management Business

and Trust and Banking Corporation

On October 1, 2009, the Company completed the sale of its entire stake in

Nikko Asset Management (Nikko AM) to the Sumitomo Trust and Banking

Co., Ltd. (Sumitomo Trust) and completed the sale of Nikko Citi Trust and

Banking Corporation to Nomura Trust & Banking Co. Ltd.

The Nikko AM transaction was valued at 120 billion yen (U.S. $1.3 billion

at an exchange rate of 89.60 yen to U.S. $1.00 as of September 30,

2009). The Company received all-cash consideration of 75.6 billion yen

(U.S. $844 million), after certain deal-related expenses and adjustments,

for its 64% beneficial ownership interest in Nikko AM. Sumitomo Trust also

acquired the beneficial ownership interests in Nikko AM held by various

minority investors in Nikko AM, bringing Sumitomo Trust’s total ownership

stake in Nikko AM to 98.55% at closing.

For the sale of Nikko Citi Trust and Banking Corporation, the Company

received all-cash consideration of 19 billion yen (U.S. $212 million at an

exchange rate of 89.60 yen to U.S. $1.00 as of September 30, 2009) as part of

the transaction, subject to certain post-closing purchase price adjustments.

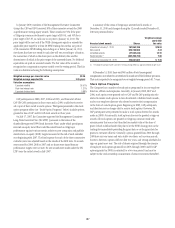

Retail Partner Cards Sales

During 2009, Citigroup sold its Financial Institutions (FI) and Diners Club

North America credit card businesses. Total credit card receivables disposed

of in these transactions was approximately $2.2 billion. During 2010,

Citigroup sold its Canadian MasterCard business and U.S. retail sales finance

portfolios. Total credit card receivables disposed of in these transactions was

approximately $3.6 billion. Each of these businesses is in Local Consumer

Lending.

Joint Venture with Morgan Stanley

On June 1, 2009, Citi and Morgan Stanley established a joint venture (JV)

that combines the Global Wealth Management platform of Morgan Stanley

with Citigroup’s Smith Barney, Quilter and Australia private client networks.

Citi sold 100% of these businesses to Morgan Stanley in exchange for a 49%

stake in the JV and an upfront cash payment of $2.75 billion. The Brokerage

and Asset Management business recorded a pretax gain of approximately

$11.1 billion ($6.7 billion after-tax) on this sale. Both Morgan Stanley and

Citi will access the JV for retail distribution, and each firm’s institutional

businesses will continue to execute order flow from the JV.

Citigroup’s 49% ownership in the JV is recorded as an equity method

investment. In determining the value of its 49% interest in the JV, Citigroup

utilized the assistance of an independent third-party valuation firm and

utilized both the income and the market approaches.

Sale of Citigroup Technology Services Limited

On December 23, 2008, Citigroup announced an agreement with Wipro

Limited to sell all of Citigroup’s interest in Citi Technology Services Ltd.

(CTS), Citigroup’s India-based captive provider of technology infrastructure

support and application development, for all-cash consideration of

approximately $127 million. A substantial portion of the proceeds from

this sale will be recognized over the period in which Citigroup has a service

contract with Wipro Limited. This transaction closed on January 20, 2009

and a loss of approximately $7 million was booked at that time.

Sale of Upromise Cards Portfolio

During 2008, the Company sold substantially all of the Upromise Cards

portfolio to Bank of America for an after-tax gain of $127 million

($201 million pretax). The portfolio sold had balances of approximately

$1.2 billion of credit card receivables. This transaction was reflected in the

North America Regional Consumer Banking business results.

Sale of CitiStreet

On July 1, 2008, Citigroup and State Street Corporation completed the sale

of CitiStreet, a benefits servicing business, to ING Group in an all-cash

transaction valued at $900 million. CitiStreet is a joint venture formed in

2000 that, prior to the sale, was owned 50% each by Citigroup and State

Street. The transaction closed on July 1, 2008, and generated an after-tax

gain of $222 million ($347 million pretax).

Divestiture of Diners Club International

On June 30, 2008, Citigroup completed the sale of Diners Club International

(DCI) to Discover Financial Services, resulting in an after-tax gain of

approximately $56 million ($111 million pretax).

Citigroup will continue to issue Diners Club cards and support its brand

and products through ownership of its many Diners Club card issuers around

the world.

Sale of Citigroup Global Services Limited

In 2008, Citigroup sold all of its interest in Citigroup Global Services

Limited (CGSL) to Tata Consultancy Services Limited (TCS) for all-cash

consideration of approximately $515 million, resulting in an after-tax gain

of $192 million ($263 million pretax). CGSL was the Citigroup captive

provider of business process outsourcing services solely within the Banking

and Financial Services sector.

In addition to the sale, Citigroup signed an agreement with TCS for TCS

to provide, through CGSL, process outsourcing services to Citigroup and its

affiliates in an aggregate amount of $2.5 billion over a period of 9.5 years.