Citibank 2010 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

180

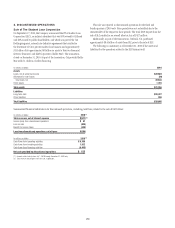

Sale of Nikko Cordial

On October 1, 2009 the Company announced the successful completion

of the sale of Nikko Cordial Securities to Sumitomo Mitsui Banking

Corporation. The transaction had a total cash value to Citi of 776 billion

yen (U.S. $8.7 billion at an exchange rate of 89.60 yen to U.S. $1.00 as of

September 30, 2009). The cash value is composed of the purchase price for

the transferred business of 545 billion yen, the purchase price for certain

Japanese-listed equity securities held by Nikko Cordial Securities of 30 billion

yen, and 201 billion yen of excess cash derived through the repayment of

outstanding indebtedness to Citi. After considering the impact of foreign

exchange hedges of the proceeds of the transaction, the sale resulted in an

immaterial gain in 2009. A total of about 7,800 employees were included in

the transaction.

The Nikko Cordial operations had total assets and total liabilities of

approximately $24 billion and $16 billion, respectively, at the time of sale,

which were reflected in Citi Holdings prior to the sale.

Results for all of the Nikko Cordial businesses sold are reported as

Discontinued operations for all periods presented.

Summarized financial information for Discontinued operations,

including cash flows, related to the sale of Nikko Cordial is as follows:

In millions of dollars 2010 2009 2008

Total revenues, net of interest expense (1) $ 92 $ 646 $1,194

Income (loss) from discontinued

operations $ (7) $ (623) $ (694)

Gain on sale 94 97 —

Benefit for income taxes (122) (78) (286)

Income (loss) from discontinued

operations, net of taxes $ 209 $ (448) $ (408)

In millions of dollars 2010 2009 2008

Cash flows from operating activities $(134) $(1,830) $ (675)

Cash flows from investing activities 185 1,824 768

Cash flows from financing activities —— —

Net cash provided by (used in)

discontinued operations $ 51 $ (6) $ 93

(1) Total revenues include gain or loss on sale, if applicable.

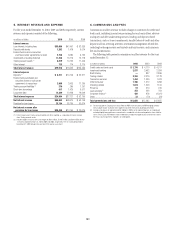

Sale of Citigroup’s German Retail Banking Operations

On December 5, 2008, Citigroup sold its German retail banking operations

to Crédit Mutuel for 5.2 billion Euro in cash plus the German retail bank’s

operating net earnings accrued in 2008 through the closing. The sale

resulted in an after-tax gain of approximately $3.9 billion, including the

after-tax gain on the foreign currency hedge of $383 million recognized

during the fourth quarter of 2008.

The sale does not include the corporate and investment banking business

or the Germany-based European data center.

The German retail banking operations had total assets and total liabilities

as of November 30, 2008 of $15.6 billion and $11.8 billion, respectively.

Results for all of the German retail banking businesses sold, as well as

the net gain recognized in 2008 from this sale, are reported as Discontinued

operations for all periods presented.

Summarized financial information for Discontinued operations,

including cash flows, related to the sale of the German retail banking

operations is as follows:

In millions of dollars 2010 2009 2008

Total revenues, net of interest

expense (1) $ 55 $ 87 $ 6,592

Income (loss) from discontinued

operations $(15) $(22) $ 1,438

Gain on sale 15 (41) 3,695

Provision (benefit) for income taxes (55) (42) 426

Income (loss) from discontinued

operations, net of taxes (2)(3) $ 55 $(21) $ 4,707

In millions of dollars 2010 2009 2008

Cash flows from operating activities $ 2 $ 5 $ (4,719)

Cash flows from investing activities 91 18,547

Cash flows from financing activities (3) (6) (14,226)

Net cash provided by (used in)

discontinued operations $ 8 $ — $ (398)

(1) Total revenues include gain or loss on sale, if applicable.

(2) During 2010, the Company completed an income tax audit in Germany related to the business sold

in 2008. As a result of completing this audit, the Company has released reserves of approximately

$68 million after-tax.

(3) During 2010, the Company recorded a $19 million after-tax write-down of goodwill related to an

accounting error, which affected the German business sold in 2008.