Citibank 2010 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.246

A securitized collateralized loan obligation (CLO) is substantially similar

to the CDO transactions described above, except that the assets owned by

the SPE (either cash instruments or synthetic exposures through derivative

instruments) are corporate loans and to a lesser extent corporate bonds,

rather than asset-backed debt securities.

Where a CDO vehicle issues preferred shares, the preferred shares generally

represent an insufficient amount of equity (less than 10%) and create the

presumption that the preferred shares are insufficient to finance the entity’s

activities without subordinated financial support. In addition, although the

preferred shareholders generally have full exposure to expected losses on the

collateral and uncapped potential to receive expected residual rewards, it is

not always clear whether they have the ability to make decisions about the

entity that have a significant effect on the entity’s financial results because

of their limited role in making day-to-day decisions and their limited ability

to remove the third-party asset manager. Because one or both of the above

conditions will generally be met, we have assumed that, even where a CDO

vehicle issued preferred shares, the vehicle should be classified as a VIE.

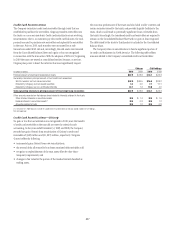

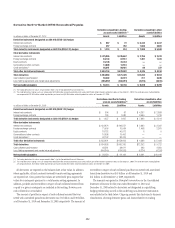

Consolidation and Subsequent Deconsolidation of CDOs

Substantially all of the CDOs that the Company is involved with are managed

by a third-party asset manager. In general, the third-party asset manager,

through its ability to purchase and sell assets or—where the reinvestment

period of a CDO has expired—the ability to sell assets, will have the power to

direct the activities of the vehicle that most significantly impact the economic

performance of the CDO. However, where a CDO has experienced an event of

default, the activities of the third-party asset manager may be curtailed and

certain additional rights will generally be provided to the investors in a CDO

vehicle, including the right to direct the liquidation of the CDO vehicle.

The Company has retained significant portions of the “super-senior”

positions issued by certain CDOs. These positions are referred to as “super-

senior” because they represent the most senior positions in the CDO and, at

the time of structuring, were senior to tranches rated AAA by independent

rating agencies. These positions include facilities structured in the form

of short-term commercial paper, where the Company wrote put options

(“liquidity puts”) to certain CDOs. Under the terms of the liquidity puts, if

the CDO was unable to issue commercial paper at a rate below a specified

maximum (generally LIBOR + 35 bps to LIBOR + 40 bps), the Company

was obligated to fund the senior tranche of the CDO at a specified interest

rate. As of December 31, 2010, the Company no longer had exposure to this

commercial paper as all of the underlying CDOs had been liquidated.

Since the inception of many CDO transactions, the subordinate tranches of

the CDOs have diminished significantly in value and in rating. The declines

in value of the subordinate tranches and in the super-senior tranches indicate

that the super-senior tranches are now exposed to a significant portion of the

expected losses of the CDOs, based on current market assumptions.

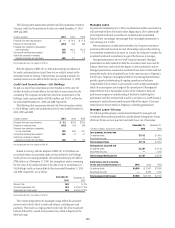

The Company does not generally have the power to direct the activities of

the vehicle that most significantly impact the economic performance of the

CDOs as this power is held by the third-party asset manager of the CDO. As

such, certain synthetic and cash CDOs that were consolidated under ASC 810,

were deconsolidated upon the adoption of SFAS 167. The deconsolidation of

certain synthetic CDOs resulted in the recognition of current receivables and

payables related to purchased and written credit default swaps entered into

by Citigroup with the CDOs, which had previously been eliminated upon

consolidation of these vehicles.

Where (i) an event of default has occurred for a CDO vehicle, (ii) the

Company has the unilateral ability to remove the third-party asset manager

without cause or liquidate the CDO, and (iii) the Company has exposure to

the vehicle that is potentially significant to the vehicle, the Company will

consolidate the CDO. In addition, where the Company is the asset manager

of the CDO vehicle and has exposure to the vehicle that is potentially

significant, the Company will generally consolidate the CDO.

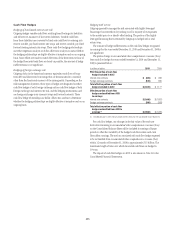

The net impact of adopting SFAS 167 for CDOs was an increase in

the Company’s assets of $1.9 billion and liabilities of $1.9 billion as of

January 1, 2010. The Company continues to monitor its involvement in

unconsolidated CDOs. If the Company were to acquire additional interests

in these vehicles, be provided the right to direct the activities of a CDO (if

the Company obtains the unilateral ability to remove the third-party asset

manager without cause or liquidate the CDO), or if the CDOs’ contractual

arrangements were to be changed to reallocate expected losses or residual

returns among the various interest holders, the Company may be required

to consolidate the CDOs. For cash CDOs, the net result of such consolidation

would be to gross up the Company’s balance sheet by the current fair value

of the subordinate securities held by third parties, whose amounts are not

considered material. For synthetic CDOs, the net result of such consolidation

may reduce the Company’s balance sheet by eliminating intercompany

derivative receivables and payables in consolidation.