Citibank 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

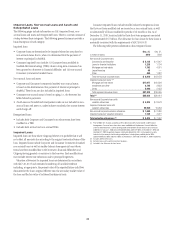

Impaired Loans, Non-Accrual Loans and Assets and

Renegotiated Loans

The following pages include information on Citi’s impaired loans, non-

accrual loans and assets and renegotiated loans. There is a certain amount of

overlap between these categories. The following general summary provides a

basic description of each category:

Impaired loans:

Corporate loans are determined to be impaired when they are placed on •

non-accrual status; that is, when it is determined that the payment of

interest or principal is doubtful.

Consumer impaired loans include: (i) Consumer loans modified in •

troubled debt restructurings (TDRs) where a long-term concession has

been granted to a borrower in financial difficulty; and (ii) non-accrual

Consumer (commercial market) loans.

Non-accrual loans and assets:

Corporate and Consumer (commercial market) non-accrual status •

is based on the determination that payment of interest or principal is

doubtful. These loans are also included in impaired loans.

Consumer non-accrual status is based on aging, i.e., the borrower has •

fallen behind in payments.

North America• branded and retail partner cards are not included in non-

accrual loans and assets as, under industry standards, they accrue interest

until charge-off.

Renegotiated loans:

Includes both Corporate and Consumer loans whose terms have been •

modified in a TDR.

Includes both accrual and non-accrual TDRs.•

Impaired Loans

Impaired loans are those where Citigroup believes it is probable that it will

not collect all amounts due according to the original contractual terms of the

loan. Impaired loans include Corporate and Consumer (commercial market)

non-accrual loans as well as smaller-balance homogeneous loans whose

terms have been modified due to the borrower’s financial difficulties and

Citigroup having granted a concession to the borrower. Such modifications

may include interest rate reductions and/or principal forgiveness.

Valuation allowances for impaired loans are determined in accordance

with ASC 310-10-35 and estimated considering all available evidence

including, as appropriate, the present value of the expected future cash flows

discounted at the loan’s original effective rate, the secondary market value of

the loan and the fair value of collateral less disposal costs.

Consumer impaired loans exclude smaller-balance homogeneous loans

that have not been modified and are carried on a non-accrual basis, as well

as substantially all loans modified for periods of 12 months or less. As of

December 31, 2010, loans included in these short-term programs amounted

to approximately $5.7 billion. The allowance for loan losses for these loans is

materially consistent with the requirements of ASC 310-10-35.

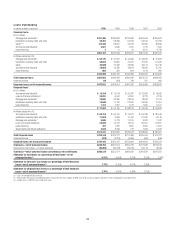

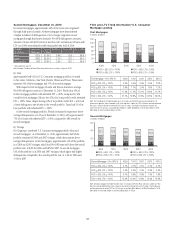

The following table presents information about impaired loans:

In millions of dollars

Dec. 31,

2010

Dec. 31,

2009

Non-accrual Corporate loans

Commercial and industrial $ 5,125 $ 6,347

Loans to financial institutions 1,258 1,794

Mortgage and real estate 1,782 4,051

Lease financing 45 —

Other 400 1,287

Total non-accrual corporate loans $ 8,610 $13,479

Impaired Consumer loans (1)(2)

Mortgage and real estate $17,677 $10,629

Installment and other 3,745 3,853

Cards 5,906 2,453

Total impaired Consumer loans $27,328 $16,935

Total (3) $35,938 $30,414

Non-accrual Corporate loans with

valuation allowances $ 6,324 $ 8,578

Impaired Consumer loans with

valuation allowances 25,949 16,453

Non-accrual Corporate valuation allowance $ 1,689 $ 2,480

Impaired Consumer valuation allowance 7,735 4,977

Total valuation allowances (4) $ 9,424 $ 7,457

(1) Prior to 2008, Citi’s financial accounting systems did not separately track impaired smaller-balance,

homogeneous Consumer loans whose terms were modified due to the borrowers’ financial difficulties

and it was determined that a concession be granted to the borrower. Smaller-balance Consumer loans

modified since January 1, 2008 amounted to $26.6 billion and $15.9 billion at December 31, 2010 and

December 31, 2009, respectively. However, information derived from Citi’s risk management systems

indicates that the amounts of outstanding modified loans, including those modified prior to 2008,

approximated $28.2 billion and $18.1 billion at December 31, 2010 and December 31, 2009, respectively.

(2) Excludes deferred fees/costs.

(3) Excludes loans purchased for investment purposes.

(4) Included in the Allowance for loan losses.