Citibank 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

175

Revisions to the Earnings-per-Share Calculation

In June 2008, the FASB issued FSP EITF 03-6-1, “Determining Whether

Instruments Granted in Share-Based Payment Transactions are Participating

Securities” (now incorporated into ASC 260-10-45-59A, Earnings Per

Share: Participating Securities and the Two-Class Method). Under the FSP,

unvested share-based payment awards that contain nonforfeitable rights to

dividends are considered to be a separate class of common stock and included

in the EPS calculation using the “two-class method.” Citigroup’s restricted

and deferred share awards meet the definition of a participating security. In

accordance with the FSP, restricted and deferred shares are now included as a

separate class of common stock in the basic and diluted EPS calculation.

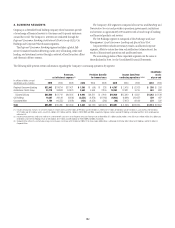

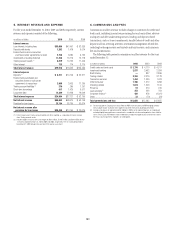

The following table shows the effect of adopting the FSP on Citigroup’s

basic and diluted EPS:

2010 2009 2008

Basic earnings per share

As reported N/A N/A $(5.59)

Two-class method $0.36 $(0.80) (5.63)

Diluted earnings per share (1)

As reported N/A N/A (5.59)

Two-class method 0.35 (0.80) (5.63)

(1) Diluted EPS is the same as Basic EPS in 2009 and 2008 due to the net loss available to common

shareholders. Using actual diluted shares would result in anti-dilution.

N/A Not applicable

Fair Value Disclosures About Pension Plan Assets

In December 2008, the FASB issued FSP FAS 132(R)-1, Employers’

Disclosures about Pensions and Other Postretirement Benefit Plan Assets

(now incorporated into ASC 715-20-50, Compensation and Benefits—

Disclosure). This FSP requires that more detailed information about plan

assets be disclosed on an annual basis. Citigroup is required to separate plan

assets into the three fair value hierarchy levels and provide a roll-forward of

the changes in fair value of plan assets classified as Level 3.

The disclosures about plan assets required by this FSP are effective for

fiscal years ending after December 15, 2009, but have no effect on the

Consolidated Balance Sheet or Statement of Income.

Additional Disclosures for Derivative Instruments

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative

Instruments and Hedging Activities, an Amendment to SFAS 133

(now incorporated into ASC 815-10-50, Derivatives and Hedging—

Disclosure). The Standard requires enhanced disclosures about derivative

instruments and hedged items that are accounted for under ASC 815 related

interpretations. The Standard is effective for all of the Company’s interim

and annual financial statements beginning with the first quarter of 2009.

The Standard expands the disclosure requirements for derivatives and hedged

items and has no impact on how Citigroup accounts for these instruments.

Determining Whether an Instrument (or Embedded

Feature) Is Indexed to an Entity’s Own Stock

Derivative contracts on a company’s own stock may be accounted for as

equity instruments, rather than as assets and liabilities, only if they are both

indexed solely to the company’s stock and settleable in shares.

In June 2008, the FASB ratified the consensus reached by the EITF on

Issue 07-5, “Determining Whether an Instrument (or Embedded Feature)

Is Indexed to an Entity’s Own Stock” (Issue 07-5) (now ASC 815-40-

15-5, Derivatives and Hedging: Evaluating Whether an Instrument

is Considered Indexed to an Entity’s Own Stock). An instrument (or

embedded feature) would not be considered indexed to an entity’s own stock

if its settlement amount is affected by variables other than those used to

determine the fair value of a “plain vanilla” option or forward contract on

equity shares, or if the instrument contains a feature (such as a leverage

factor) that increases exposure to those variables. An equity-linked financial

instrument (or embedded feature) would not be considered indexed to the

entity’s own stock if the strike price is denominated in a currency other than

the issuer’s functional currency.

This issue was effective for Citigroup on January 1, 2009 and did not have

a material impact.

Equity Method Investment Accounting Considerations

In November 2008, the FASB ratified the consensus reached by the EITF on

Issue 08-6, “Equity Method Investment Accounting Considerations” (Issue

08-6) (now ASC 323-10, Investments—Equity Method and Joint Ventures).

An entity shall measure its equity method investment initially at cost. Any

other-than-temporary impairment of an equity method investment should

be recognized in accordance with Opinion 18. An equity method investor

shall not separately test an investee’s underlying assets for impairment.

Share issuance by an investee shall be accounted for as if the equity method

investor had sold a proportionate share of its investment, with a gain or loss

recognized in earnings.

This issue was effective for Citigroup on January 1, 2009, and did not have

a material impact.