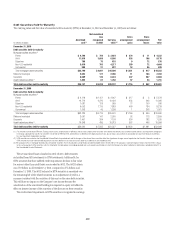

Citibank 2010 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212

Mortgage-backed securities

For U.S. mortgage-backed securities (and in particular for Alt-A and other

mortgage-backed securities that have significant unrealized losses as a

percentage of amortized cost), credit impairment is assessed using a cash

flow model that estimates the cash flows on the underlying mortgages, using

the security-specific collateral and transaction structure. The model estimates

cash flows from the underlying mortgage loans and distributes those cash

flows to various tranches of securities, considering the transaction structure

and any subordination and credit enhancements that exist in that structure.

The cash flow model incorporates actual cash flows on the mortgage-backed

securities through the current period and then projects the remaining cash

flows using a number of assumptions, including default rates, prepayment

rates, and recovery rates (on foreclosed properties).

Management develops specific assumptions using as much market data

as possible and includes internal estimates as well as estimates published

by rating agencies and other third-party sources. Default rates are projected

by considering current underlying mortgage loan performance, generally

assuming the default of (1) 10% of current loans, (2) 25% of 30–59 day

delinquent loans, (3) 70% of 60–90 day delinquent loans and (4) 100%

of 91+ day delinquent loans. These estimates are extrapolated along a

default timing curve to estimate the total lifetime pool default rate. Other

assumptions used contemplate the actual collateral attributes, including

geographic concentrations, rating agency loss projections, rating actions and

current market prices.

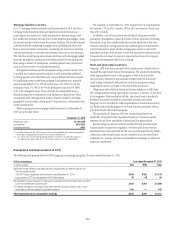

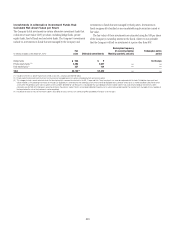

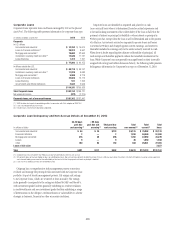

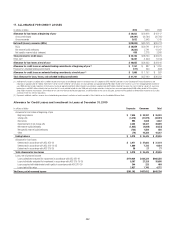

The key assumptions for mortgage-backed securities as of December 31,

2010 are in the table below:

December 31, 2010

Prepayment rate (1) 3%–8% CRR

Loss severity (2) 45%–85%

Unemployment rate 9.8%

(1) Conditional Repayment Rate (CRR) represents the annualized expected rate of voluntary prepayment

of principal for mortgage-backed securities over a certain period of time.

(2) Loss severity rates are estimated considering collateral characteristics and generally range from

45%–60% for prime bonds, 50%–85% for Alt-A bonds, and 65%–85% for subprime bonds.

The valuation as of December 31, 2010 assumes that U.S. housing prices

will increase 1.2% in 2011, increase 1.8% in 2012 and increase 3% per year

from 2013 onwards.

In addition, cash flow projections are developed using more stressful

parameters. Management assesses the results of those stress tests (including

the severity of any cash shortfall indicated and the likelihood of the stress

scenarios actually occurring based on the underlying pool’s characteristics

and performance) to assess whether management expects to recover the

amortized cost basis of the security. If cash flow projections indicate that the

Company does not expect to recover its amortized cost basis, the Company

recognizes the estimated credit loss in earnings.

State and municipal securities

Citigroup’s AFS state and municipal bonds consist mainly of bonds that are

financed through Tender Option Bond programs. The process for identifying

credit impairment for bonds in this program as well as for bonds that

were previously financed in this program is largely based on third-party

credit ratings. Individual bond positions must meet minimum ratings

requirements, which vary based on the sector of the bond issuer.

Citigroup monitors the bond issuer and insurer ratings on a daily basis.

The average portfolio rating, ignoring any insurance, is Aa3/AA-. In the event

of a downgrade of the bond below Aa3/AA-, the subject bond is specifically

reviewed for potential shortfall in contractual principal and interest.

Citigroup has not recorded any credit impairments on bonds held as part of

the Tender Option Bond program or on bonds that were previously held as

part of the Tender Option Bond program.

The remainder of Citigroup’s AFS state and municipal bonds are

specifically reviewed for credit impairment based on instrument-specific

estimates of cash flows, probability of default and loss given default.

Because Citigroup does not intend to sell the AFS state and municipal

bond securities or expect to be required to sell them prior to recovery, the

unrealized losses associated with the AFS state and municipal bond portfolio

(other than credit-related losses) remain classified in Accumulated other

comprehensive income and are not reclassified into earnings as other-than-

temporary impairment.

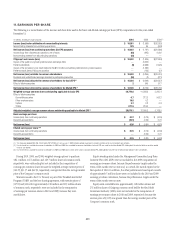

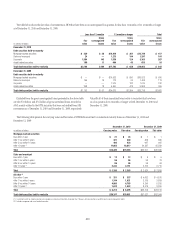

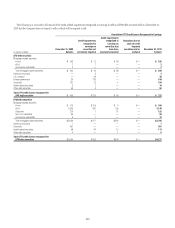

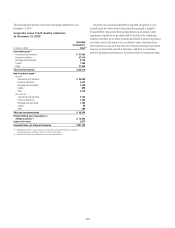

Recognition and Measurement of OTTI

The following table presents the total OTTI recognized in earnings during the 12 months ended December 31, 2010:

OTTI on Investments Year ended December 31, 2010

In millions of dollars AFS HTM Total

Impairment losses related to securities that the Company does not intend to sell nor will

likely be required to sell:

Total OTTI losses recognized during the year ended December 31, 2010 $ 298 $ 855 $ 1,153

Less: portion of OTTI loss recognized in AOCI (before taxes) 36 48 84

Net impairment losses recognized in earnings for securities that the Company does not intend

to sell nor will likely be required to sell $ 262 $ 807 $ 1,069

OTTI losses recognized in earnings for securities that the Company intends to sell or more-

likely-than-not will be required to sell before recovery 342 — 342

Total impairment losses recognized in earnings $ 604 $807 $1,411