Citibank 2010 Annual Report Download - page 255

Download and view the complete annual report

Please find page 255 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

253

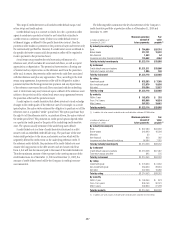

activities together with gains and losses related to non-derivative instruments

within the same trading portfolios, as this represents the way these portfolios

are risk managed.

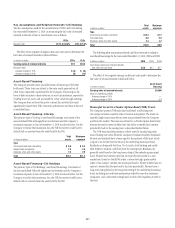

In millions of dollars 2010 (1) 2009

(1)

Interest rate contracts $ 3,231 $ 6,211

Foreign exchange 1,852 2,762

Equity contracts 995 (334)

Commodity and other 126 924

Credit derivatives 1,313 (3,495)

Total Citigroup (2) $ 7,517 $ 6,068

(1) Beginning in the second quarter of 2010, for clarity purposes, Citigroup reclassified the MSR mark-

to-market and MSR hedging activities from multiple income statement lines into Other revenue. All

periods presented reflect this reclassification.

(2) Also see Note 7 to the Consolidated Financial Statements.

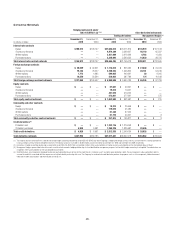

The amounts recognized in Other revenue in the Consolidated Statement

of Income for the years ended December 31, 2010 and December 31, 2009

related to derivatives not designated in a qualifying hedging relationship and

not recorded in Trading account assets or Trading account liabilities are

shown below. The table below does not include the offsetting gains/losses on

the hedged items, which amounts are also recorded in Other revenue.

In millions of dollars 2010

(1) 2009

(1)

Interest rate contracts $ (391) $ (73)

Foreign exchange (2,098) 3,851

Equity contracts —(7)

Commodity and other ——

Credit derivatives (502) —

Total Citigroup (2) $(2,991) $ 3,771

(1) Beginning in the second quarter of 2010, for clarity purposes, Citigroup reclassified the MSR mark-

to-market and MSR hedging activities from multiple income statement lines into Other revenue. All

periods presented reflect this reclassification.

(2) Non-designated derivatives are derivative instruments not designated in qualifying

hedging relationships.

Accounting for Derivative Hedging

Citigroup accounts for its hedging activities in accordance with ASC 815,

Derivatives and Hedging (formerly SFAS 133). As a general rule, hedge

accounting is permitted where the Company is exposed to a particular risk,

such as interest-rate or foreign-exchange risk, that causes changes in the fair

value of an asset or liability or variability in the expected future cash flows of an

existing asset, liability or a forecasted transaction that may affect earnings.

Derivative contracts hedging the risks associated with the changes in fair

value are referred to as fair value hedges, while contracts hedging the risks

affecting the expected future cash flows are called cash flow hedges. Hedges

that utilize derivatives or debt instruments to manage the foreign exchange

risk associated with equity investments in non-U.S.-dollar functional

currency foreign subsidiaries (net investment in a foreign operation) are

called net investment hedges.

If certain hedging criteria specified in ASC 815 are met, including testing

for hedge effectiveness, special hedge accounting may be applied. The hedge

effectiveness assessment methodologies for similar hedges are performed

in a similar manner and are used consistently throughout the hedging

relationships. For fair value hedges, the changes in value of the hedging

derivative, as well as the changes in value of the related hedged item due to

the risk being hedged, are reflected in current earnings. For cash flow hedges

and net investment hedges, the changes in value of the hedging derivative are

reflected in Accumulated other comprehensive income (loss) in Citigroup’s

stockholders’ equity, to the extent the hedge is effective. Hedge ineffectiveness,

in either case, is reflected in current earnings.

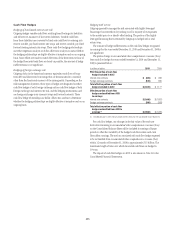

For asset/liability management hedging, the fixed-rate long-term debt

may be recorded at amortized cost under current U.S. GAAP. However, by

electing to use ASC 815 (SFAS 133) hedge accounting, the carrying value

of the debt is adjusted for changes in the benchmark interest rate, with any

such changes in value recorded in current earnings. The related interest-rate

swap is also recorded on the balance sheet at fair value, with any changes

in fair value reflected in earnings. Thus, any ineffectiveness resulting from

the hedging relationship is recorded in current earnings. Alternatively, an

economic hedge, which does not meet the ASC 815 hedging criteria, would

involve recording only the derivative at fair value on the balance sheet, with

its associated changes in fair value recorded in earnings. The debt would

continue to be carried at amortized cost and, therefore, current earnings

would be impacted only by the interest rate shifts and other factors that

cause the change in the swap’s value and the underlying yield of the debt.

This type of hedge is undertaken when hedging requirements cannot be

achieved or management decides not to apply ASC 815 hedge accounting.

Another alternative for the Company would be to elect to carry the debt at

fair value under the fair value option. Once the irrevocable election is made

upon issuance of the debt, the full change in fair value of the debt would

be reported in earnings. The related interest rate swap, with changes in fair

value, would also be reflected in earnings, and provides a natural offset to the

debt’s fair value change. To the extent the two offsets are not exactly equal,

the difference would be reflected in current earnings. This type of economic

hedge is undertaken when the Company prefers to follow this simpler method

that achieves generally similar financial statement results to an ASC 815 fair

value hedge.

Key aspects of achieving ASC 815 hedge accounting are documentation

of hedging strategy and hedge effectiveness at the hedge inception and

substantiating hedge effectiveness on an ongoing basis. A derivative must

be highly effective in accomplishing the hedge objective of offsetting either

changes in the fair value or cash flows of the hedged item for the risk

being hedged. Any ineffectiveness in the hedge relationship is recognized

in current earnings. The assessment of effectiveness excludes changes in

the value of the hedged item that are unrelated to the risks being hedged.

Similarly, the assessment of effectiveness may exclude changes in the fair

value of a derivative related to time value that, if excluded, are recognized in

current earnings.