Citibank 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

170

are now included in the scope of SFAS 167. Second, the FASB has changed

the method of analyzing which party to a VIE should consolidate the VIE

(known as the primary beneficiary) to a qualitative determination of which

party to the VIE has “power,” combined with potentially significant benefits

or losses, instead of the previous quantitative risks and rewards model. The

party that has “power” has the ability to direct the activities of the VIE that

most significantly impact the VIE’s economic performance. Third, the new

standard requires that the primary beneficiary analysis be re-evaluated

whenever circumstances change. The previous rules required reconsideration

of the primary beneficiary only when specified reconsideration

events occurred.

As a result of implementing these new accounting standards, Citigroup

consolidated certain of the VIEs and former QSPEs with which it currently

has involvement. Further, certain asset transfers, including transfers of

portions of assets, that would have been considered sales under SFAS 140, are

considered secured borrowings under the new standards.

In accordance with SFAS 167, Citigroup employed three approaches for

newly consolidating certain VIEs and former QSPEs as of January 1, 2010.

The first approach requires initially measuring the assets, liabilities, and

noncontrolling interests of the VIEs and former QSPEs at their carrying

values (the amounts at which the assets, liabilities, and noncontrolling

interests would have been carried in the Consolidated Financial Statements, if

Citigroup had always consolidated these VIEs and former QSPEs). The second

approach measures assets at their unpaid principal amount, and is applied

when determining carrying values is not practicable. The third approach is to

elect the fair value option, in which all of the financial assets and liabilities

of certain designated VIEs and former QSPEs are recorded at fair value upon

adoption of SFAS 167 and continue to be marked to market thereafter, with

changes in fair value reported in earnings.

Citigroup consolidated all required VIEs and former QSPEs, as of

January 1, 2010, at carrying values or unpaid principal amounts, except for

certain private label residential mortgage and mutual fund deferred sales

commissions VIEs, for which the fair value option was elected. The following

tables present the impact of adopting these new accounting standards

applying these approaches.

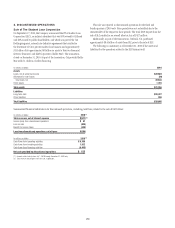

The incremental impact of these changes on GAAP assets and resulting risk-

weighted assets for those VIEs and former QSPEs that were consolidated or

deconsolidated for accounting purposes as of January 1, 2010 was as follows:

Incremental

In billions of dollars

GAAP

assets

Risk-

weighted

assets (1)

Impact of consolidation

Credit cards $ 86.3 $ 0.8

Commercial paper conduits 28.3 13.0

Student loans 13.6 3.7

Private label Consumer mortgages 4.4 1.3

Municipal tender option bonds 0.6 0.1

Collateralized loan obligations 0.5 0.5

Mutual fund deferred sales commissions 0.5 0.5

Subtotal $134.2 $19.9

Impact of deconsolidation

Collateralized debt obligations(2) $ 1.9 $ 3.6

Equity-linked notes(3) 1.2 0.5

Total $137.3 $24.0

(1) The net increase in risk-weighted assets (RWA) was $10 billion, principally reflecting the deduction

from gross RWA of $13 billion of loan loss reserves (LLR) recognized from the adoption of SFAS

166/167, which exceeded the 1.25% limitation on LLRs includable in Tier 2 Capital.

(2) The implementation of SFAS 167 resulted in the deconsolidation of certain synthetic and cash

collateralized debt obligation (CDO) VIEs that were previously consolidated under the requirements of

ASC 810 (FIN 46(R)). Due to the deconsolidation of these synthetic CDOs, Citigroup’s Consolidated

Balance Sheet now reflects the recognition of current receivables and payables related to purchased

and written credit default swaps entered into with these VIEs, which had previously been eliminated in

consolidation. The deconsolidation of certain cash CDOs has a minimal impact on GAAP assets, but

causes a sizable increase in risk-weighted assets. The impact on risk-weighted assets results from

replacing, in Citigroup’s trading account, largely investment grade securities owned by these VIEs

when consolidated, with Citigroup’s holdings of non-investment grade or unrated securities issued by

these VIEs when deconsolidated.

(3) Certain equity-linked note client intermediation transactions that had previously been consolidated

under the requirements of ASC 810 (FIN 46 (R)) because Citigroup had repurchased and held a

majority of the notes issued by the VIE were deconsolidated with the implementation of SFAS 167,

because Citigroup does not have the power to direct the activities of the VIE that most significantly

impact the VIE’s economic performance. Upon deconsolidation, Citigroup’s Consolidated Balance

Sheet reflects both the equity-linked notes issued by the VIEs and held by Citigroup as trading assets,

as well as related trading liabilities in the form of prepaid equity derivatives. These trading assets and

trading liabilities were formerly eliminated in consolidation.