Citibank 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

The upsides in reducing costs and improving efficiency are

obvious — and not just in consumer businesses. On the

institutional side, volumes will increase as the marginal cost of

processing trades disappears. In addition, the convenience and

efficiency of technology introduce new security challenges that

banks must meet.

5) Large global unbanked population: While the expansion of

the global middle class will drive economic growth and demand

for banking services, there currently are some 2.5 billion

unbanked consumers — people who lack access to basic

financial services — in the world today. While much of this

population lives in emerging markets, there is a need for

greater financial inclusion in developed economies as well. For

example, in the U.S., about 8% of households do not have bank

accounts — a figure that may rise with the implementation of

recent regulatory changes. The social and economic benefits of

reaching the unbanked are enormous: greater financial security

and economic opportunity for low-income people and

expanding markets and prosperity for the entire world.

Policymakers have tried to address the problem but have yet to

develop a workable — and scalable — model to promote financial

inclusion and reach the poorest and most remote communities.

One promising avenue is the use of mobile phone technologies

to facilitate payments and deliver other banking services to the

unbanked population.

How Our Company Aligns with These Trends

Citi is, overall, the world’s best-positioned bank to harness

current trends.

Citi’s extensive global presence and network are unmatched

among financial institutions. We’ve developed deep and

long-standing relationships in every market where we operate.

We can fund projects and lend money using local deposits and

investments. And our long-term presence has allowed us to

accumulate a wealth of local knowledge and insights.

Moreover, we link the world not only through knowledge and

relationships but also through our global payments network to

create efficiency and accessibility for our clients. These

services allow us to play a major role in global trade and

commerce and to develop broad and deep relationships with

corporations, governments and institutional investors

throughout the world. Citi banks no less than 85% of the

world’s Fortune 1,000 companies.

Citi’s broad product set is aligned with our core strategy of

being the world’s global bank for consumers and institutions.

Our client-centric focus and emphasis on Responsible Finance

are well-suited to the newly enacted and still-coming regulatory

changes. We are a leader in most of our products across our

institutional and consumer businesses. Citi also has a long

history of innovation — including pioneering widespread use of

the ATM.

Our “globality,” brand and product breadth make us unique in

the industry and provide us the opportunity to attract the best

talent from all over the world. The best people know that a

career with us offers more opportunities for their own growth

and development.

And our nearly 200-year-old brand is one of the world’s

strongest. It has weathered the financial crisis remarkably well

and remains dominant in many of the emerging markets poised

for the fastest growth in the coming years.

Looking at these trends from the perspective of our three core

businesses — Securities and Banking, Global Transaction

Services and Regional Consumer Banking — our advantages

come into sharper focus.

In Securities and Banking, our approach is to leverage our

global network to build deep, enduring relationships with some

5,000 global priority clients across the corporate, public and

financial sectors. We believe that these clients represent the

most concentrated current and future opportunities. We put

our capital to work for these clients and earn significant

revenue streams from trading, foreign exchange, advisory and

other services. And we are working to develop the risk

management and operations and technology functions into

sources of competitive advantage.

In Global Transaction Services (GTS), we are leveraging our

global network, technology platforms and industry expertise to

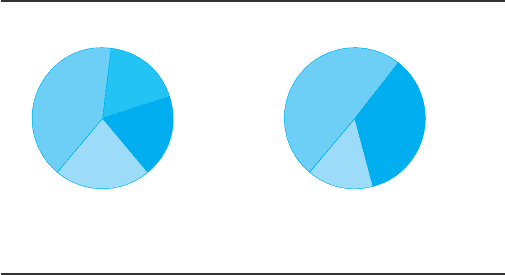

Citicorp Revenues

2010 Revenues: $65.6 billion

By Region By Business

RCB

49%

GTS

15%

S&B

35%

NA

41%

ASIA

22%

LATAM

19%

EMEA

18%

Note: Totals may not sum due to rounding.

RCB — Regional Consumer Banking

S&B — Securities and Banking

GTS — Global Transaction Services

NA — North America

EMEA — Europe, Middle East and Africa

LATAM — Latin America