Citibank 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

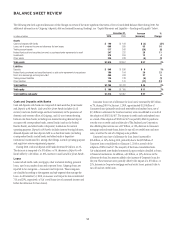

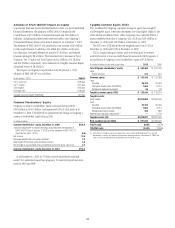

BALANCE SHEET REVIEW

The following sets forth a general discussion of the changes in certain of the more significant line items of Citi’s Consolidated Balance Sheet during 2010. For

additional information on Citigroup’s deposits, debt and secured financing (lending), see “Capital Resources and Liquidity—Funding and Liquidity” below.

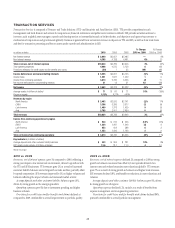

In billions of dollars

December 31, Increase

(decrease)

%

Change2010 2009

Assets

Cash and deposits with banks $ 190 $ 193 $ (3) (2)%

Loans, net of unearned income and allowance for loan losses 608 555 53 10

Trading account assets 317 343 (26) (8)

Federal funds sold and securities borrowed or purchased under agreements to resell 247 222 25 11

Investments 318 306 12 4

Other assets 234 238 (4) (2)

Total assets $1,914 $1,857 $ 57 3%

Liabilities

Deposits $ 845 $ 836 $ 9 1%

Federal funds purchased and securities loaned or sold under agreements to repurchase 190 154 36 23

Short-term borrowings and long-term debt 460 433 27 6

Trading account liabilities 129 138 (9) (7)

Other liabilities 124 141 (17) (12)

Total liabilities $1,748 $1,702 $ 46 3%

Total equity $ 166 $ 155 $ 11 7%

Total liabilities and equity $1,914 $1,857 $ 57 3%

Cash and Deposits with Banks

Cash and deposits with banks are composed of Cash and due from banks

and Deposits with banks. Cash and due from banks includes (i) all

currency and coin (both foreign and local currencies) in the possession of

domestic and overseas offices of Citigroup, and (ii) non-interest-bearing

balances due from banks, including non-interest-bearing demand deposit

accounts with correspondent banks, central banks (such as the Federal

Reserve Bank), and other banks or depository institutions for normal

operating purposes. Deposits with banks includes interest-bearing balances,

demand deposits and time deposits held in or due from banks (including

correspondent banks, central banks and other banks or depository

institutions) maintained for, among other things, normal operating purposes

and regulatory reserve requirement purposes.

During 2010, cash and deposits with banks decreased $3 billion, or 2%.

The decrease is composed of a $5 billion, or 3%, decrease in Deposits with

banks offset by a $3 billion, or 10%, increase in Cash and due from banks.

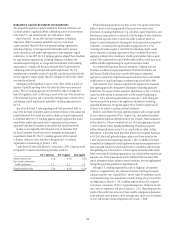

Loans

Loans include credit cards, mortgages, other real estate lending, personal

loans, auto loans, student loans and corporate loans. Citigroup loans are

reported in two categories—Consumer and Corporate. These categories

are classified according to the segment and sub-segment that manage the

loans. As of December 31, 2010, Consumer and Corporate loans constituted

71% and 29%, respectively, of Citi’s total loans (net of unearned income and

before the allowance for loan losses).

Consumer loans (net of allowance for loan losses) increased by $27 billion,

or 7%, during 2010. On January 1, 2010, approximately $120 billion of

Consumer loans (primarily credit card receivables and student loans, net of

$13 billion in allowance for loan loss reserves) were consolidated as a result of

the adoption of SFAS 166/167. The increase in credit cards and student loans

as a result of the adoption of SFAS 166/167 was partially offset by paydowns

over the year on credit cards and the sale of The Student Loan Corporation.

Also offsetting the increase was a $27 billion, or 12%, decrease in Consumer

mortgage and real estate loans, driven by run-off, net credit losses and asset

sales, as well as the sale of a Citigroup auto portfolio.

Corporate loans (net of allowance for loan losses) increased by

$26 billion, or 16%, during 2010, primarily due to the $28 billion of

Corporate loans consolidated as of January 1, 2010 as a result of the

adoption of SFAS 166/167. The majority of the loans consolidated were

Citi-administered asset-backed commercial paper conduits classified as loans

to financial institutions. In addition, a $2 billion, or 32%, decrease in the

allowance for loan loss reserves added to the increase of Corporate loans for

the year. These increases were partially offset by the impact of a $7 billion, or

21%, decrease in Corporate mortgage and real estate loans, primarily due to

run-off and net credit losses.