Citibank 2010 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

193

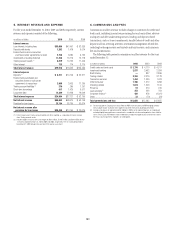

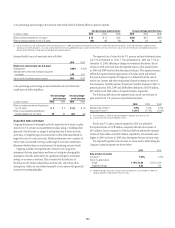

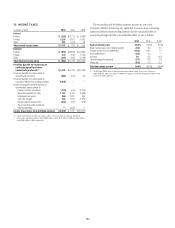

The following table shows the change in Accumulated other comprehensive

income (loss) for the year ended December 31, 2010:

In millions of dollars 2010

Balance, January 1, 2010, net of tax (1) $(3,461)

Actuarial assumptions changes and plan experience (2) (1,257)

Net asset gain due to actual returns exceeding expected returns 479

Net amortizations 137

Foreign exchange impact and other (437)

Change in deferred taxes, net $ 434

Change, net of tax $ (644)

Balance, December 31, 2010, net of tax (1) $(4,105)

(1) See Note 21 to the Consolidated Financial Statements for further discussion of net accumulated other

comprehensive income (loss) balance.

(2) Includes $33 million in net actuarial losses related to U.S. nonqualified pension plans.

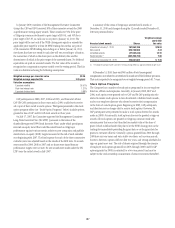

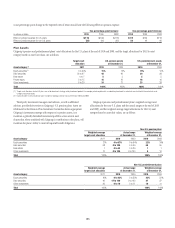

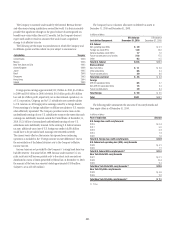

At the end of 2010 and 2009, for both qualified and nonqualified plans

and for both funded and unfunded plans, the aggregate projected benefit

obligation (PBO), the aggregate accumulated benefit obligation (ABO), and

the aggregate fair value of plan assets for pension plans with a projected

benefit obligation in excess of plan assets, and pension plans with an

accumulated benefit obligation in excess of plan assets, were as follows:

PBO exceeds fair value of plan

assets

ABO exceeds fair value of plan

assets

U.S. plans (1) Non-U.S. plans U.S. plans (1) Non-U.S. plans

In millions of dollars 2010 2009 2010 2009 2010 2009 2010 2009

Projected benefit obligation $12,388 $11,815 $2,305 $1,662 $12,388 $11,815 $1,549 $1,288

Accumulated benefit obligation 12,337 11,765 1,949 1,414 12,337 11,765 1,340 1,127

Fair value of plan assets 11,561 9,934 1,732 1,169 11,561 9,934 1,046 842

(1) In 2010, the PBO and ABO of the U.S. plans include $11,730 million and $11,689 million, respectively, relating to the qualified plan and $658 million and $648 million, respectively, relating to the nonqualified plans. In

2009, the PBO and ABO of the U.S. plans include $11,178 million and $11,129 million, respectively, relating to the qualified plan and $637 million and $636 million, respectively, relating to the nonqualified plans.

At December 31, 2010, combined accumulated benefit obligations for

the U.S. and non-U.S. pension plans, excluding U.S. nonqualified plans,

exceeded plan assets by $0.4 billion. At December 31, 2009, combined

accumulated benefit obligations for the U.S. and non-U.S. pension plans,

excluding U.S. nonqualified plans, exceeded plan assets by $0.5 billion.

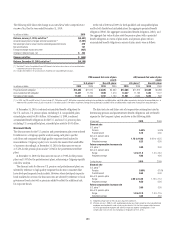

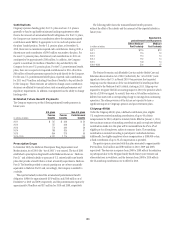

Discount Rate

The discount rates for the U.S. pension and postretirement plans were selected

by reference to a Citigroup-specific analysis using each plan’s specific

cash flows and compared with high quality corporate bond indices for

reasonableness. Citigroup’s policy is to round to the nearest five hundredths

of a percent. Accordingly, at December 31, 2010, the discount rate was set

at 5.45% for the pension plans and at 5.10% for the postretirement welfare

plans.

At December 31, 2009, the discount rate was set at 5.90% for the pension

plans and 5.55% for the postretirement plans, referencing a Citigroup-specific

cash flow analysis.

The discount rates for the non-U.S. pension and postretirement plans are

selected by reference to high quality corporate bond rates in countries that

have developed corporate bond markets. However, where developed corporate

bond markets do not exist, the discount rates are selected by reference to local

government bond rates with a premium added to reflect the additional risk

for corporate bonds.

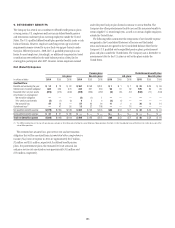

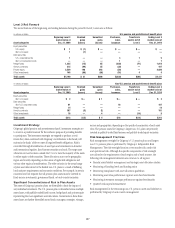

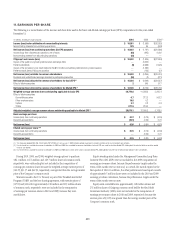

The discount rate and future rate of compensation assumptions used in

determining pension and postretirement benefit obligations and net benefit

expense for the Company’s plans are shown in the following table:

At year end 2010 2009

Discount rate

U.S. plans (1)

Pension 5.45% 5.90%

Postretirement 5.10 5.55

Non-U.S. pension plans

Range 1.75 to 14.00 2.00 to 13.25

Weighted average 6.23 6.50

Future compensation increase rate

U.S. plans (2) 3.00 3.00

Non-U.S. pension plans

Range 1.0 to 11.0 1.0 to 12.0

Weighted average 4.66 4.60

During the year 2010 2009

Discount rate

U.S. plans (1)

Pension 5.90% 6.10%

Postretirement 5.55 6.00

Non-U.S. pension plans

Range 2.00 to 13.25 1.75 to 17.0

Weighted average 6.50 6.60

Future compensation increase rate

U.S. plans (2) 3.00 3.00

Non-U.S. pension plans

Range 1.0 to 12.0 1.0 to 11.5

Weighted average 4.60 4.50

(1) Weighted-average rates for the U.S. plans equal the stated rates.

(2) Effective January 1, 2008, the U.S. qualified pension plan was frozen except for certain grandfathered

employees accruing benefits under a final pay plan formula. Only the future compensation increases

for these grandfathered employees will affect future pension expense and obligations. Future

compensation increase rates for small groups of employees were 4% or 6%.