Citibank 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.109

Payment deferrals that do not continue to accrue interest (extensions)

primarily occur in the U.S. residential mortgage business. Under an

extension, payments that are contractually due are deferred to a later date,

thereby extending the maturity date by the number of months of payments

being deferred. Extensions assist delinquent borrowers who have experienced

short-term financial difficulties that have been resolved by the time the

extension is granted. An extension can only be offered to borrowers who are

past due on their monthly payments but have since demonstrated the ability

and willingness to pay as agreed. Other payment deferrals continue to accrue

interest and are not deemed to offer concessions to the customer. Other types

of concessions are not material.

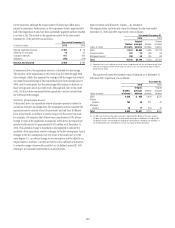

Impact of Modification Programs

Citi considers various metrics in analyzing the success of U.S. modification

programs. Payment behavior of customers during the modification (both

short-term and long-term) is monitored. For short-term modifications,

performance is also measured for an additional period of time after the

expiration of the concession. Balance reductions and annualized loss rates

are also important metrics that are monitored. Based on actual experience,

program terms, including eligibility criteria, interest charged and loan tenor,

may be refined. The main objective of the modification programs is to reduce

the payment burden for the borrower and improve the net present value of

Citi’s expected cash flows.

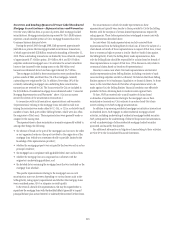

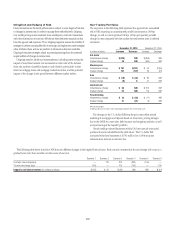

Mortgage Modification Programs

With respect to long-term mortgage modification programs, for

modifications in the “Other” category (as noted in the “Long-Term

Modification Programs—Summary” table above and preceding narrative),

generally at 24 months after modification, the total balance reduction has

been approximately 32% (as a percentage of the balance at the time of

modification), consisting of approximately 20% of paydowns and 12% of net

credit losses. In addition, at 18 months after an “Other” loan modification,

Citi currently estimates that credit loss rates are reduced by approximately

one-third compared to loans that were not modified.

For modifications under CFNA’s long-term AOT program, the total balance

reduction has been approximately 13% (as a percentage of the balance

at the time of modification) 24 months after modification, consisting of

approximately 4% of paydowns and 9% of net credit losses.

Regarding HAMP, in Citi’s experience to date, Citi continues to believe that

re-default rates for HAMP modified loans will be significantly lower versus

non-HAMP programs. Moreover, the first HAMP modified loans have been on

the books for approximately 12 months and, as of December 31, 2010, were

exhibiting re-default rates of approximately 15%. The CSM program has

less vintage history and limited loss data but is currently tracking to Citi’s

expectations and is currently expected to perform better than the “Other”

modifications discussed above. Generally, the other long-term mortgage

modification programs discussed above do not have sufficient history, as of

December 31, 2010, to summarize the impact of such programs. Similarly,

the short-term AOT program has less vintage history and limited loss data.

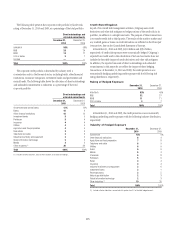

Cards Modification Programs

Generally, at 24 months after modification, the total balance reduction

for long-term card modification programs is approximately 64% (as

a percentage of the balance at the time of modification), consisting of

approximately 35% of paydowns and 29% of net credit losses. Citi has also

generally observed that these credit losses are approximately one-half

lower, depending upon the individual program and vintage, than those

of similar card accounts that were not modified. Similarly, twenty-four

months after starting a short-term modification, balances are typically

reduced by approximately 64% (as a percentage of the balance at the time of

modification), consisting of approximately 24% of paydowns and 40% of net

credit losses, and Citi has observed that the credit losses are approximately

one-fourth lower, depending upon the individual program and vintage, than

those of similar accounts that were not modified.

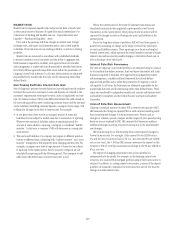

As previously disclosed, Citigroup implemented certain changes to

its credit card modification programs beginning in the fourth quarter

of 2010, including revisions to the eligibility criteria for such programs.

These programs are continually evaluated and additional changes may

occur in 2011, depending upon factors such as program performance and

overall credit conditions. As a result of these changes, as well as the overall

improving portfolio trends, the overall volume of new entrants to Citi’s card

modification programs decreased, as expected, by approximately 25% during

the fourth quarter of 2010 as compared to the third quarter. New entrants

to short-term card modification programs decreased by approximately

50% in the fourth quarter of 2010 as compared to the prior quarter. While

Citi currently expects these changes to negatively impact net credit losses

beginning in 2011, Citi believes overall that net credit losses will continue

to improve in 2011 for each of the North America cards businesses. Citi

considered these changes to its cards modification programs and their

potential effect on net credit losses in determining the loan loss reserve as of

December 31, 2010.

Installment Loan Modification Programs

With respect to the long-term CFNA AOT program, the total balance

reduction is approximately 49% (as a percentage of the balance at the time

of modification) 24 months after modification, consisting of approximately

13% of paydowns and 36% of net credit losses. The short-term Temporary

AOT program has less vintage history and limited loss data.