Citibank 2010 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

217

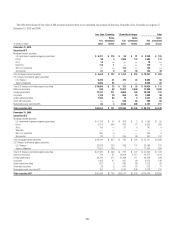

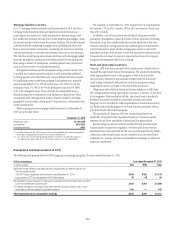

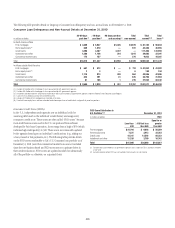

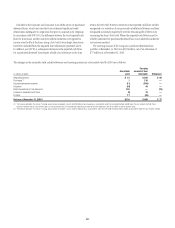

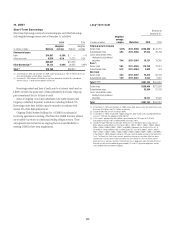

Residential Mortgage Loan to Values (LTVs)

Loan to value (LTV) ratios are important credit indicators for U.S. mortgage

loans. These ratios (loan balance divided by appraised value) are calculated

at origination and updated by applying market price data. The following

table provides details on the LTV ratios attributable to Citi’s U.S. mortgage

portfolios as of December 31, 2010. LTVs are updated monthly using the most

recent Core Logic HPI data available for substantially all of the portfolio

applied at the Metropolitan Statistical Area level, if available; otherwise at

the state level. The remainder of the portfolio is updated in a similar manner

using the Office of Federal Housing Enterprise Oversight indices.

LTV Distribution in U.S. Portfolio (1)(2) LTV

In millions of dollars

Less than or

equal to 80%

> 80% but less

than or equal

to 100%

Greater

than

100%

First mortgages $32,408 $25,311 $26,636

Home equity loans 12,698 10,940 20,670

Total $45,106 $36,251 $47,306

(1) Excludes loans guaranteed by U.S. government agencies, loans subject to LTSCs and loans recorded

at fair value.

(2) Excludes balances where LTV was not available. Such amounts are not material.

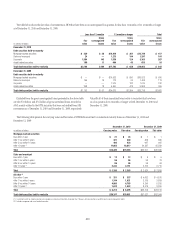

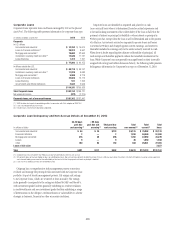

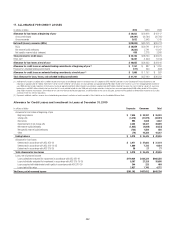

Impaired Consumer Loans

Impaired loans are those where Citigroup believes it is probable that it will

not collect all amounts due according to the original contractual terms

of the loan. Impaired Consumer loans include non-accrual commercial

market loans as well as smaller-balance homogeneous loans whose terms

have been modified due to the borrower’s financial difficulties and Citigroup

has granted a concession to the borrower. These modifications may include

interest rate reductions and/or principal forgiveness. Impaired Consumer

loans exclude smaller-balance homogeneous loans that have not been

modified and are carried on a non-accrual basis, as well as substantially all

loans modified pursuant to Citi’s short-term modification programs (i.e., for

periods of 12 months or less). At December 31, 2010, loans included in these

short-term programs amounted to $5.7 billion.

Valuation allowances for impaired Consumer loans are determined in

accordance with ASC 310-10-35 considering all available evidence including,

as appropriate, the present value of the expected future cash flows discounted

at the loan’s original contractual effective rate, the secondary market value of

the loan and the fair value of collateral less disposal costs.

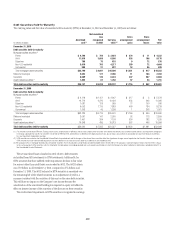

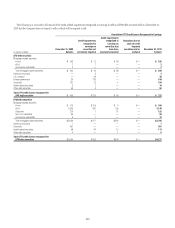

The following table presents information about total impaired Consumer loans at and for the periods ending December 31, 2010 and 2009, respectively:

Impaired Consumer Loans

At and for the period ended Dec. 31, 2010 Dec. 31, 2009

In millions of dollars

Recorded

investment (1)(2)

Principal

balance

Related specific

allowance (3)

Average

carrying value (4)

Interest income

recognized Recorded investment (1)

Mortgage and real estate $10,629

First mortgages $16,225 $17,287 $2,783 $13,606 $ 862

Home equity loans 1,205 1,256 393 1,010 40

Credit cards 5,906 5,906 3,237 5,314 131 2,453

Installment and other 3,853

Individual installment and other 3,286 3,348 1,172 3,627 393

Commercial market loans 706 934 145 909 26

Total (5) $27,328 $28,731 $ 7,730 $24,466 $ 1,452 $16,935

At and for the period ended

In millions of dollars

Dec. 31,

2009

Dec. 31,

2008

Average carrying value (4) $14,049 $5,266

Interest income recognized 792 276

(1) Recorded investment in a loan includes accrued credit card interest, and excludes net deferred loan

fees and costs, unamortized premium or discount and direct write-downs.

(2) $1,050 million of first mortgages, $6 million of home equity loans and $323 million of commercial

market loans do not have a specific allowance.

(3) Included in the Allowance for loan losses.

(4) Average carrying value does not include related specific allowance.

(5) Prior to 2008, the Company’s financial accounting systems did not separately track impaired smaller-

balance, homogeneous Consumer loans whose terms were modified due to the borrowers’ financial

difficulties and it was determined that a concession was granted to the borrower. Smaller-balance

Consumer loans modified since January 1, 2008 amounted to $26.6 billion and $15.9 billion at

December 31, 2010 and 2009, respectively. However, information derived from the Company’s risk

management systems indicates that the amounts of such outstanding modified loans, including those

modified prior to 2008, approximated $28.2 billion and $18.1 billion at December 31, 2010 and

2009, respectively.