Citibank 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78

Citigroup remains subject to restrictions on its ability to

pay common stock dividends and to redeem or repurchase

Citigroup equity or trust preferred securities for so long

as its trust preferred securities continue to be held by the

U.S government.

Pursuant to its agreements with certain U.S. government entities, dated June 9,

2009, executed in connection with Citi’s exchange offers consummated in

July and September 2009, Citigroup remains subject to dividend and share

repurchase restrictions for so long as the U.S. government continues to hold

any Citigroup trust preferred securities acquired in connection with the

exchange offers. These restrictions, subject to certain exceptions, generally

prohibit Citigroup from paying regular cash dividends in excess of $0.01 per

share of common stock per quarter or from redeeming or repurchasing any

Citigroup equity securities or trust preferred securities. As of December 31, 2010,

approximately $3.025 billion of trust preferred securities issued to the FDIC

remains outstanding (of which approximately $800 million is being held for

the benefit of the U.S. Treasury). In addition, even if Citigroup were no longer

contractually bound by the dividend and share purchase restrictions of these

agreements, any decision by Citigroup to pay common stock dividends or

initiate a share repurchase will be subject to further regulatory approval.

Citi could be harmed competitively if it is unable to hire

or retain qualified employees as a result of regulatory

uncertainty regarding compensation practices or otherwise.

Citigroup’s performance and competitive standing is heavily dependent on

the talents and efforts of the highly skilled individuals that it is able to attract

and retain, including without limitation in its S&B business. Competition

for such individuals within the financial services industry has been, and will

likely continue to be, intense.

Compensation is a key element of attracting and retaining highly

qualified employees. Banking regulators in the U.S., European Union and

elsewhere are in the process of developing principles, regulations and other

guidance governing what are deemed to be sound compensation practices

and policies, and the outcome of these processes is uncertain. In addition,

compensation for certain employees of financial institutions, such as

bankers, continues to be a legislative focus both in Europe and in the U.S.

Changes required to be made to the compensation policies and

practices of Citigroup, or those of the banking industry generally, may

hinder Citi’s ability to compete in or manage its businesses effectively, to

expand into or maintain its presence in certain businesses and regions,

or to remain competitive in offering new financial products and services.

This is particularly the case in emerging markets, where Citigroup is often

competing for qualified employees with other financial institutions that seek

to expand in these markets. Moreover, new disclosure requirements may

result from the worldwide regulatory processes described above. If this were

to occur, Citi could be required to make additional disclosures relating to the

compensation of its employees in a manner that creates competitive harm

through the disclosure of previously confidential information, or through

the direct or indirect new disclosures of the identity of certain employees

and their compensation. Any such additional public disclosure of employee

compensation, or any future legislation or regulation that requires Citigroup

to restrict or modify its compensation policies, could hurt Citi’s ability to hire,

retain and motivate its key employees and thus harm it competitively.

Citigroup is subject to a significant number of legal and

regulatory proceedings that are often highly complex, slow

to develop and are thus difficult to predict or estimate.

At any given time, Citigroup is defending a significant number of legal

and regulatory proceedings, and the volume of claims and the amount of

damages and penalties claimed in litigation, arbitration and regulatory

proceedings against financial institutions generally remain high.

Proceedings brought against Citi may result in judgments, settlements, fines,

penalties, injunctions, business improvement orders, or other results adverse

to it, which could materially and negatively affect Citigroup’s businesses,

financial condition or results of operations, require material changes in

Citi’s operations, or cause Citigroup reputational harm. Moreover, the many

large claims asserted against Citi are highly complex and slow to develop,

and they may involve novel or untested legal theories. The outcome of such

proceedings may thus be difficult to predict or estimate until late in the

proceedings, which may last several years. Although Citigroup establishes

accruals for its litigation and regulatory matters according to accounting

requirements, the amount of loss ultimately incurred in relation to those

matters may be substantially higher or lower than the amounts accrued.

In addition, while Citi seeks to prevent and detect employee misconduct,

such as fraud, employee misconduct is not always possible to deter or

prevent, and the extensive precautions Citigroup takes to prevent and detect

this activity may not be effective in all cases, which could subject Citi to

additional liability. Moreover, the so-called “whistle-blower” provisions of

the Financial Reform Act, which apply to all corporations and other entities

and persons, provide substantial financial incentives for persons to report

alleged violations of law to the SEC and the Commodity Futures Trading

Commission. These provisions could increase the number of claims that

Citigroup will have to investigate or against which Citigroup will have to

defend itself, and may otherwise further increase Citigroup’s legal liabilities.

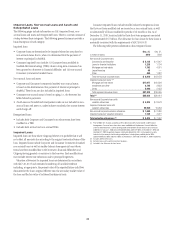

For additional information relating to Citigroup’s potential exposure

relating to legal and regulatory matters, see Note 29 to the Consolidated

Financial Statements.

The Financial Accounting Standards Board (FASB) is

currently reviewing or proposing changes to several key

financial accounting and reporting standards utilized by

Citi which, if adopted as proposed, could have a material

impact on how Citigroup records and reports its financial

condition and results of operations.

The FASB is currently reviewing or proposing changes to several of the

financial accounting and reporting standards that govern key aspects of

Citigroup’s financial statements. While the outcome of these reviews and

proposed changes is uncertain and difficult to predict, certain of these

changes could have a material impact on how Citigroup records and

reports its financial condition and results of operations, and could hinder