Citibank 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

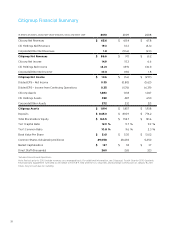

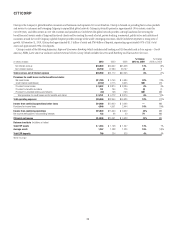

Operating Expenses

Citigroup operating expenses were down 1% versus the prior year at

$47.4 billion in 2010, as increased investment spending, FX translation, and

inflation in Citicorp were more than offset by lower expenses in Citi Holdings.

In Citicorp, expenses increased 10% year over year to $35.9 billion, mainly

due to higher investment spending across all Citicorp businesses as well

as FX translation and inflation. In Citi Holdings, operating expenses were

down 31% year over year to $9.6 billion, reflecting the continued reduction

of assets.

Capital and Loan Loss Reserve Positions

Citi increased its Tier 1 Common and Tier 1 Capital ratios during 2010. At

December 31, 2010, Citi’s Tier 1 Common ratio was 10.8% and its Tier 1

Capital ratio was 12.9%, compared to 9.6% and 11.7% at December 31, 2009,

respectively. Tier 1 Common was relatively flat year over year at $105 billion,

even after absorbing a $14.2 billion reduction from the impact of SFAS

166/167 in the first quarter, while total risk-weighted assets declined 10% to

$978 billion.

Citigroup ended the year with a total allowance for loan losses of

$40.7 billion, up $4.6 billion, or 13%, from the prior year, reflecting the

impact of adopting SFAS 166/167 which added $13.4 billion on January

1, 2010. The allowance represented 6.31% of total loans and 209% of

non-accrual loans as of December 31, 2010, up from 6.09% and 114%,

respectively, at the end of 2009. The consumer loan loss reserve was

$35.4 billion at December 31, 2010, representing 7.77% of total loans, versus

$28.4 billion, or 6.70%, at December 31, 2009.

Liquidity and Funding

Citigroup maintained a high level of liquidity, with aggregate liquidity

resources (including cash at major central banks and unencumbered liquid

securities) of $322 billion at year-end 2010, up from $316 billion at year-end

2009. Citi also continued to grow its deposit base, closing 2010 with $845

billion in deposits, up 1% from year-end 2009. Structural liquidity (defined as

deposits, long-term debt and equity as a percentage of total assets) remained

strong at 73% as of December 31, 2010, flat compared to December 31, 2009,

and up from 66% at December 31, 2008.

Citigroup issued approximately $22 billion (excluding local country and

securitizations) of long-term debt in 2010, representing just over half of its

2010 long-term maturities, due to its strong liquidity position and proceeds

received from asset reductions in Citi Holdings. For additional information,

see “Capital Resources and Liquidity—Funding and Liquidity” below.

2011 Business Outlook

In 2011, management will continue its focus on growing and investing in

the core Citicorp franchise, while economically rationalizing Citi Holdings.

However, Citigroup’s results will continue to be affected by factors outside

of its control, such as the global economic and regulatory environment

in the regions in which Citi operates. In particular, the macroeconomic

environment in the U.S. remains challenging, with unemployment levels

still elevated and continued pressure and uncertainty in the housing market,

including home prices. Additionally, the continued implementation of

the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

(Financial Reform Act), including the ongoing extensive rulemaking and

interpretive issues, as well as the new capital standards for bank holding

companies as adopted by the Basel Committee on Banking Supervision

(Basel Committee) and U.S. regulators, will remain a significant source

of uncertainty in 2011. Moreover, the implementation of the change in

methodology for calculating FDIC insurance premiums, to be effective in

the second quarter 2011, will have a negative impact on Citi’s earnings.

(For additional information on these factors, see “Capital Resources and

Liquidity” and “Risk Factors” below.)

In Citicorp, Securities and Banking results for 2011 will depend on the

level of client activity and on macroeconomic conditions, market valuations

and volatility, interest rates and other market factors. Transaction Services

business performance will also continue to be impacted by macroeconomic

conditions as well as market factors, including interest rate levels, global

economic and trade activity, volatility in capital markets, foreign exchange

and market valuations.

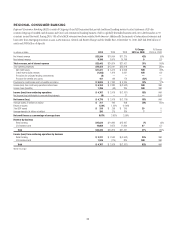

In Regional Consumer Banking, results during the year are likely to

be driven by different trends in North America versus the international

regions. In North America, if economic recovery is sustained, revenues could

grow modestly, particularly in the second half of the year, assuming loan

demand begins to recover. However, net credit margin in North America will

likely continue to be driven primarily by improvement in net credit losses.

Internationally, given continued economic expansion in these regions, net

credit margin is likely to be driven by revenue growth, particularly in the

second half of the year, as investment spending should continue to generate

volume growth to outpace spread compression. International credit costs are

likely to increase in 2011, reflecting a growing loan portfolio.

In Citi Holdings, revenues for Local Consumer Lending should continue

to decline reflecting a shrinking loan balance resulting from paydowns and

asset sales. Based on current delinquency trends and ongoing loss-mitigation

actions, credit costs are expected to continue to improve. Overall, however,

Local Consumer Lending will likely continue to drive results in Citi Holdings.

Operating expenses are expected to show some variability across quarters

as the Company continues to invest in Citicorp while rationalizing Citi

Holdings and maintaining expense discipline. Although Citi currently

expects net interest margin (NIM) to remain under pressure during the

first quarter of 2011, driven by continued low yields on investments and the

run-off of higher yielding loan assets, NIM could begin to stabilize during the

remainder of the year.