Citibank 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

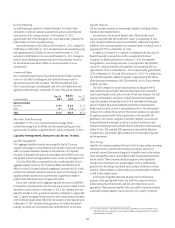

Citigroup Inc. and Citibank, N.A.—Potential Derivative Triggers

As of December 31, 2012, Citi estimates that a hypothetical one-notch

downgrade of the senior debt/long-term rating of Citigroup across all three

major rating agencies could impact Citigroup’s funding and liquidity due to

derivative triggers by approximately $1.7 billion. Other funding sources, such

as secured financing transactions and other margin requirements, for which

there are no explicit triggers, could also be adversely affected.

In addition, as of December 31, 2012, Citi estimates that a hypothetical one-

notch downgrade of the senior debt/long-term rating of Citibank, N.A. across all

three major rating agencies could impact Citibank, N.A.’s funding and liquidity

due to derivative triggers by approximately $3.4 billion.

In total, Citi estimates that a one-notch downgrade of Citigroup and

Citibank, N.A., across all three major rating agencies, could result in

aggregate cash obligations and collateral requirements of approximately

$5.1 billion (see also Note 23 to the Consolidated Financial Statements).

As set forth under “Aggregate Liquidity Resources” above, the aggregate

liquidity resources of Citi’s non-bank entities were approximately $65 billion,

and the aggregate liquidity resources of Citi’s significant Citibank entities and

other Citibank and Banamex entities were approximately $289 billion, for a

total of approximately $354 billion as of December 31, 2012. These liquidity

resources are available in part as a contingency for the potential events

described above.

In addition, a broad range of mitigating actions are currently included

in Citigroup’s and Citibank, N.A.’s detailed contingency funding plans.

For Citigroup, these mitigating factors include, but are not limited to,

accessing surplus funding capacity from existing clients, tailoring levels of

secured lending, adjusting the size of select trading books and collateralized

borrowings from Citi’s significant bank subsidiaries. Mitigating actions

available to Citibank, N.A. include, but are not limited to, selling or

financing highly liquid government securities, tailoring levels of secured

lending, adjusting the size of select trading books, reducing loan originations

and renewals, raising additional deposits, or borrowing from the FHLBs

or central banks. Citi believes these mitigating actions could substantially

reduce the funding and liquidity risk, if any, of the potential downgrades

described above.

Citibank, N.A.—Additional Potential Impacts

In addition to the above derivative triggers, Citi believes that a potential one-

notch downgrade of Citibank, N.A.’s senior debt/long-term rating by S&P and

Fitch could also have an adverse impact on the commercial paper/short-term

rating of Citibank, N.A. As of December 31, 2012, Citibank, N.A. had liquidity

commitments of approximately $18.7 billion to asset-backed commercial

paper conduits. This included $11.1 billion of commitments to consolidated

conduits and $7.6 billion of commitments to unconsolidated conduits (each

as referenced in Note 22 to the Consolidated Financial Statements).

In addition to the above-referenced aggregate liquidity resources of Citi’s

significant Citibank entities and other Citibank and Banamex entities, as

well as the various mitigating actions previously noted, mitigating actions

available to Citibank, N.A. to reduce the funding and liquidity risk, if any,

of the potential downgrades described above, include repricing or reducing

certain commitments to commercial paper conduits.

In addition, in the event of the potential downgrades described above,

Citi believes that certain corporate customers could re-evaluate their deposit

relationships with Citibank, N.A. Among other things, this re-evaluation

could include adjusting their discretionary deposit levels or changing their

depository institution, each of which could potentially reduce certain deposit

levels at Citibank, N.A. As a potential mitigant, however, Citi could choose to

adjust pricing or offer alternative deposit products to its existing customers,

or seek to attract deposits from new customers, as well as utilize the other

mitigating actions referenced above.