Citibank 2012 Annual Report Download - page 292

Download and view the complete annual report

Please find page 292 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.270

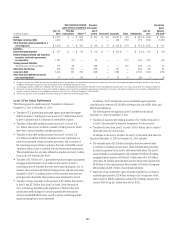

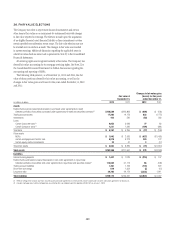

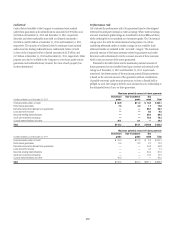

Own Debt Valuation Adjustments for Structured Debt

Own debt valuation adjustments are recognized on Citi’s debt liabilities

for which the fair value option has been elected using Citi’s credit spreads

observed in the bond market. The fair value of debt liabilities for which the

fair value option is elected (other than non-recourse and similar liabilities)

is impacted by the narrowing or widening of the Company’s credit spreads.

The estimated change in the fair value of these debt liabilities due to such

changes in the Company’s own credit risk (or instrument-specific credit

risk) was a loss of $2,009 million and a gain of $1,774 million for the years

ended December 31, 2012 and 2011, respectively. Changes in fair value

resulting from changes in instrument-specific credit risk were estimated by

incorporating the Company’s current credit spreads observable in the bond

market into the relevant valuation technique used to value each liability as

described above.

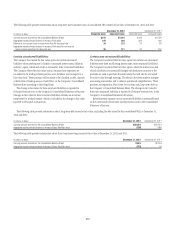

The Fair Value Option for Financial Assets and

Financial Liabilities

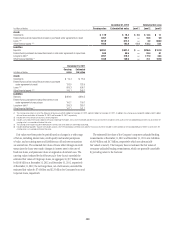

Selected portfolios of securities purchased under

agreements to resell, securities borrowed, securities sold

under agreements to repurchase, securities loaned and

certain non-collateralized short-term borrowings

The Company elected the fair value option for certain portfolios of fixed-

income securities purchased under agreements to resell and fixed-income

securities sold under agreements to repurchase, securities borrowed, securities

loaned (and certain non-collateralized short-term borrowings) on broker-

dealer entities in the United States, United Kingdom and Japan. In each case,

the election was made because the related interest-rate risk is managed on a

portfolio basis, primarily with derivative instruments that are accounted for

at fair value through earnings.

Changes in fair value for transactions in these portfolios are recorded in

Principal transactions. The related interest revenue and interest expense are

measured based on the contractual rates specified in the transactions and

are reported as interest revenue and expense in the Consolidated Statement

of Income.

Selected letters of credit and revolving loans hedged by

credit default swaps or participation notes

The Company has elected the fair value option for certain letters of credit

that are hedged with derivative instruments or participation notes. Citigroup

elected the fair value option for these transactions because the risk is

managed on a fair value basis and mitigates accounting mismatches.

There was no notional amount of these unfunded letters of credit at

December 31, 2012 and $0.6 billion at December 31, 2011. The amount

funded was insignificant with no amounts 90 days or more past due or on

non-accrual status at December 31, 2012 and 2011.

These items have been classified in Trading account assets or Trading

account liabilities on the Consolidated Balance Sheet. Changes in fair value

of these items are classified in Principal transactions in the Company’s

Consolidated Statement of Income.

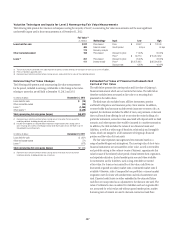

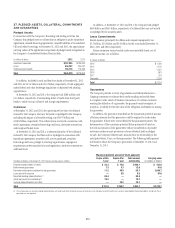

Certain loans and other credit products

Citigroup has elected the fair value option for certain originated and

purchased loans, including certain unfunded loan products, such as

guarantees and letters of credit, executed by Citigroup’s lending and trading

businesses. None of these credit products are highly leveraged financing

commitments. Significant groups of transactions include loans and

unfunded loan products that are expected to be either sold or securitized in

the near term, or transactions where the economic risks are hedged with

derivative instruments such as purchased credit default swaps or total return

swaps where the Company pays the total return on the underlying loans to a

third party. Citigroup has elected the fair value option to mitigate accounting

mismatches in cases where hedge accounting is complex and to achieve

operational simplifications. Fair value was not elected for most lending

transactions across the Company, including where management objectives

would not be met.

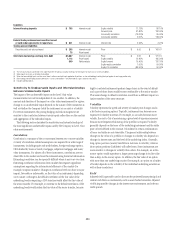

Certain investments in unallocated precious metals

Citigroup invests in unallocated precious metals accounts (gold, silver,

platinum and palladium) as part of its commodity trading business or to

economically hedge certain exposures from issuing structured liabilities.

Under ASC 815, the investment is bifurcated into a debt host contract and

a commodity forward derivative instrument. Citigroup elects the fair value

option for the debt host contract, and reports the debt host contract within

Trading account assets on the Company’s Consolidated Balance Sheet. The

total carrying amount of debt host contracts across unallocated precious

metals accounts at December 31, 2012 was approximately $5.5 billion.

The amounts are expected to fluctuate based on trading activity in the

future periods.