Citibank 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324

|

|

104

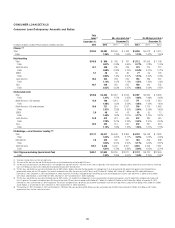

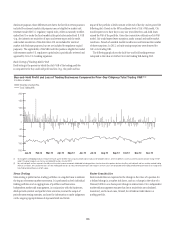

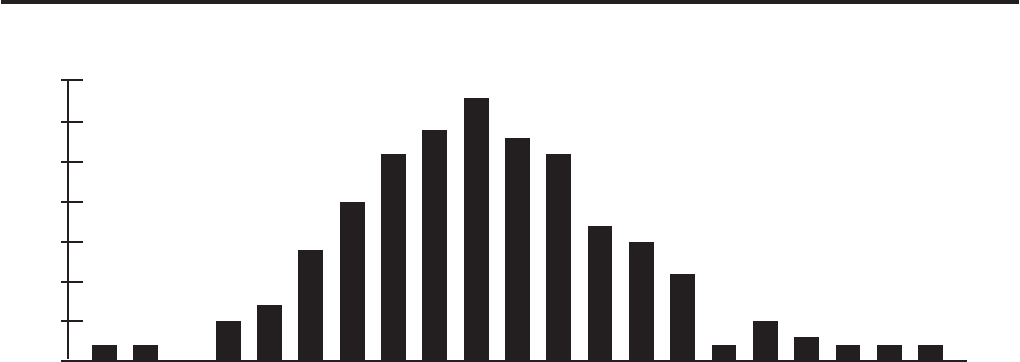

Price Risk—Trading Portfolios

Price risk in Citi’s trading portfolios is monitored using a series of measures,

including but not limited to:

• Value at risk (VAR)

• Stress testing

• Factor sensitivity

Each trading portfolio across Citi’s business segments (Citicorp, Citi

Holdings and Corporate/Other) has its own market risk limit framework

encompassing these measures and other controls, including trading

mandates, permitted product lists and a new product approval process for

complex products. All trading positions are marked to market, with the

results reflected in earnings.

The following histogram of total daily trading-related revenue (loss)

captures trading volatility and shows the number of days in which revenues

for Citi’s trading businesses fell within particular ranges. As shown in the

histogram, positive trading-related revenue was achieved for 96% of the

trading days in 2012.

0

5

10

15

20

25

30

35

(20) to (10)

(40) to (30)

(30) to (20)

50 to 60

40 to 50

30 to 40

20 to 30

10 to 20

0 to 10

(10) to (0)

60 to 70

70 to 80

80 to 90

90 to 100

100 to 110

110 to 120

120 to 130

130 to 140

140 to 150

150 to 160

> 160

Histogram of Daily Trading-Related Revenue(1)—Twelve Months Ended December 31, 2012

In millions of dollars

Frequency (number of days)

(1) Daily trading-related revenue includes trading, net interest and other revenue associated with Citi’s trading businesses. It excludes DVA and CVA, net of associated hedges. In addition, it excludes fees and other

revenue associated with capital markets origination activities.

Value at Risk

Value at risk (VAR) estimates, at a 99% confidence level, the potential decline

in the value of a position or a portfolio under normal market conditions.

VAR statistics can be materially different across firms due to differences in

portfolio composition, differences in VAR methodologies, and differences in

model parameters. Citi believes VAR statistics can be used more effectively as

indicators of trends in risk taking within a firm, rather than as a basis for

inferring differences in risk taking across firms.

Citi uses a single, independently approved Monte Carlo simulation

VAR model (see “VAR Model Review and Validation” below) that has

been designed to capture material risk sensitivities (such as first- and

second-order sensitivities of positions to changes in market prices) of various

asset classes/risk types (such as interest rate, foreign exchange, equity and

commodity risks). Citi’s VAR includes all positions that are measured at fair

value; it does not include investment securities classified as available-for-sale

or held-to-maturity. For information on these securities, see Note 15 to the

Consolidated Financial Statements.

Citi believes its VAR model is conservatively calibrated to incorporate the

greater of short-term (most recent month) and long-term (three years)

market volatility. The Monte Carlo simulation involves approximately

300,000 market factors, making use of 180,000 time series, with sensitivities

updated daily and model parameters updated weekly. The conservative

features of the VAR calibration contribute approximately 15% add-on to

what would be a VAR estimated under the assumption of stable and perfectly

normally distributed markets.