Citibank 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.113

COUNTRY AND CROSS-BORDER RISK

COUNTRY RISK

Overview

Country risk is the risk that an event in a country (precipitated by

developments within or external to a country) could directly or indirectly

impair the value of Citi’s franchise or adversely affect the ability of obligors

within that country to honor their obligations to Citi, any of which could

negatively impact Citi’s results of operations or financial condition. Country

risk events could include sovereign volatility or defaults, banking failures

or defaults, redenomination events (which could be accompanied by a

revaluation (either devaluation or appreciation) of the affected currency),

currency crises, foreign exchange and/or capital controls and/or political

events and instability. Country risk events could result in mandatory loan

loss and other reserve requirements imposed by U.S. regulators due to a

particular country’s economic situation. See also “Risk Factors—Market and

Economic Risks” above.

Citi has instituted a risk management process to monitor, evaluate and

manage the principal risks it assumes in conducting its activities, which

include the credit, market and operations risks associated with Citi’s country

risk exposures. The risk management organization is structured to facilitate

the management of risk across three dimensions: businesses, regions and

critical products. The Chief Risk Officer monitors and controls major risk

exposures and concentrations across the organization, and subjects those

risks to alternative stress scenarios in order to assess the potential economic

impact they may have on Citi. Citi’s independent risk management, working

with input from the businesses and finance, provides periodic updates to

senior management on significant potential areas of concern across Citi

that can arise from risk concentrations, financial market participants and

other systemic issues including, for example, Eurozone debt issues and other

developments in the European Monetary Union (EMU). These areas of focus

are intended to be forward-looking assessments of the potential economic

impacts to Citi that may arise from these exposures. For a discussion of Citi’s

risk management policies and practices generally, see “Managing Global

Risk—Risk Management—Overview” above.

While Citi continues to work to mitigate its exposures to potential country

risk events, the impact of any such event is highly uncertain and will be

based on the specific facts and circumstances. As a result, there can be no

assurance that the various steps Citi has taken to protect its businesses, results

of operations and financial condition against these events will be sufficient.

In addition, there could be negative impacts to Citi’s businesses, results of

operations or financial condition that are currently unknown to Citi and thus

cannot be mitigated as part of its ongoing contingency planning.

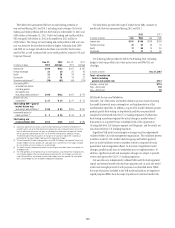

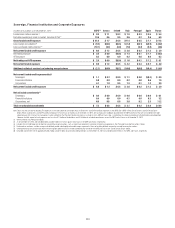

Several European countries, including Greece, Ireland, Italy, Portugal,

Spain (GIIPS) and France, have been the subject of credit deterioration due

to weaknesses in their economic and fiscal situations. Moreover, the ongoing

Eurozone debt and economic crisis and other developments in the EMU

could lead to the withdrawal of one or more countries from the EMU or a

partial or complete break-up of the EMU. Given investor interest in this area,

the narrative and tables below set forth certain information regarding Citi’s

country risk exposures on these topics as of December 31, 2012.

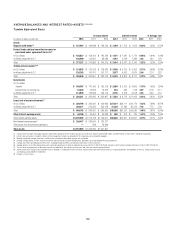

Credit Risk

Generally, credit risk measures Citi’s net exposure to a credit or market risk

event. Citi’s credit risk reporting is based on Citi’s internal risk management

measures and systems. The country designation in Citi’s internal risk

management systems is based on the country to which the client relationship,

taken as a whole, is most directly exposed to economic, financial,

sociopolitical or legal risks. As a result, Citi’s reported credit risk exposures

in a particular country may include exposures to subsidiaries within the

client relationship that are actually domiciled outside of the country (e.g.,

Citi’s Greece credit risk exposures may include loans, derivatives and other

exposures to a U.K. subsidiary of a Greece-based corporation).

Citi believes that the risk of loss associated with the exposures set forth

below, which are based on Citi’s internal risk management measures and

systems, is likely materially lower than the exposure amounts disclosed

below and is sized appropriately relative to its franchise in these countries.

In addition, the sovereign entities of the countries disclosed below, as well as

the financial institutions and corporations domiciled in these countries, are

important clients in the global Citi franchise. Citi fully expects to maintain

its presence in these markets to service all of its global customers. As such,

Citi’s credit risk exposure in these countries may vary over time based on its

franchise, client needs and transaction structures.