Citibank 2012 Annual Report Download - page 302

Download and view the complete annual report

Please find page 302 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.280

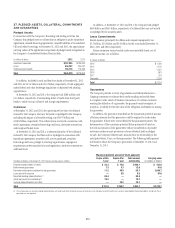

28. CONTINGENCIES

Overview

In addition to the matters described below, in the ordinary course of business,

Citigroup, its affiliates and subsidiaries, and current and former officers,

directors and employees (for purposes of this section, sometimes collectively

referred to as Citigroup and Related Parties) routinely are named as

defendants in, or as parties to, various legal actions and proceedings. Certain

of these actions and proceedings assert claims or seek relief in connection

with alleged violations of consumer protection, securities, banking,

antifraud, antitrust, anti-money laundering, employment and other statutory

and common laws. Certain of these actual or threatened legal actions and

proceedings include claims for substantial or indeterminate compensatory

or punitive damages, or for injunctive relief, and in some instances seek

recovery on a class-wide basis.

In the ordinary course of business, Citigroup and Related Parties also

are subject to governmental and regulatory examinations, information-

gathering requests, investigations and proceedings (both formal and

informal), certain of which may result in adverse judgments, settlements,

fines, penalties, restitution, disgorgement, injunctions or other relief. In

addition, certain affiliates and subsidiaries of Citigroup are banks, registered

broker-dealers, futures commission merchants, investment advisers or

other regulated entities and, in those capacities, are subject to regulation

by various U.S., state and foreign securities, banking, commodity futures,

consumer protection and other regulators. In connection with formal and

informal inquiries by these regulators, Citigroup and such affiliates and

subsidiaries receive numerous requests, subpoenas and orders seeking

documents, testimony and other information in connection with various

aspects of their regulated activities. From time to time Citigroup and Related

Parties also receive grand jury subpoenas and other requests for information

or assistance, formal or informal, from federal or state law enforcement

agencies, including among others various United States Attorneys’ Offices,

the Asset Forfeiture and Money Laundering Section and other divisions of

the Department of Justice, the Financial Crimes Enforcement Network of

the United States Department of the Treasury, and the Federal Bureau of

Investigation, relating to Citigroup and its customers.

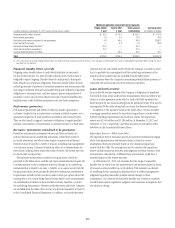

Because of the global scope of Citigroup’s operations, and its presence

in countries around the world, Citigroup and Related Parties are subject to

litigation and governmental and regulatory examinations, information-

gathering requests, investigations and proceedings (both formal and

informal) in multiple jurisdictions with legal and regulatory regimes that

may differ substantially, and present substantially different risks, from those

Citigroup and Related Parties are subject to in the United States. In some

instances Citigroup and Related Parties may be involved in proceedings

involving the same subject matter in multiple jurisdictions, which may result

in overlapping, cumulative or inconsistent outcomes.

Citigroup seeks to resolve all litigation and regulatory matters in the

manner management believes is in the best interests of Citigroup and its

shareholders, and contests liability, allegations of wrongdoing and, where

applicable, the amount of damages or scope of any penalties or other relief

sought as appropriate in each pending matter.

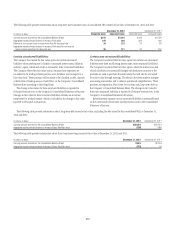

Accounting and Disclosure Framework

ASC 450 (formerly SFAS 5) governs the disclosure and recognition of loss

contingencies, including potential losses from litigation and regulatory

matters. ASC 450 defines a “loss contingency” as “an existing condition,

situation, or set of circumstances involving uncertainty as to possible loss

to an entity that will ultimately be resolved when one or more future events

occur or fail to occur.” It imposes different requirements for the recognition

and disclosure of loss contingencies based on the likelihood of occurrence

of the contingent future event or events. It distinguishes among degrees of

likelihood using the following three terms: “probable,” meaning that “the

future event or events are likely to occur”; “remote,” meaning that “the

chance of the future event or events occurring is slight”; and “reasonably

possible,” meaning that “the chance of the future event or events occurring

is more than remote but less than likely.” These three terms are used below

as defined in ASC 450.

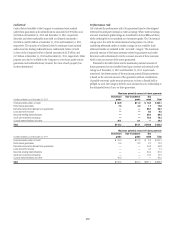

Accruals. ASC 450 requires accrual for a loss contingency when it is

“probable that one or more future events will occur confirming the fact

of loss” and “the amount of the loss can be reasonably estimated.” In

accordance with ASC 450, Citigroup establishes accruals for all litigation

and regulatory matters, including matters disclosed herein, when Citigroup

believes it is probable that a loss has been incurred and the amount of the

loss can be reasonably estimated. When the reasonable estimate of the loss is

within a range of amounts, the minimum amount of the range is accrued,

unless some higher amount within the range is a better estimate than any

other amount within the range. Once established, accruals are adjusted from

time to time, as appropriate, in light of additional information. The amount

of loss ultimately incurred in relation to those matters may be substantially

higher or lower than the amounts accrued for those matters.

Disclosure. ASC 450 requires disclosure of a loss contingency if “there is

at least a reasonable possibility that a loss or an additional loss may have

been incurred” and there is no accrual for the loss because the conditions

described above are not met or an exposure to loss exists in excess of the

amount accrued. In accordance with ASC 450, if Citigroup has not accrued

for a matter because Citigroup believes that a loss is reasonably possible but

not probable, or that a loss is probable but not reasonably estimable, and

the matter thus does not meet the criteria for accrual, and the reasonably

possible loss is material, it discloses the loss contingency. In addition,

Citigroup discloses matters for which it has accrued if it believes a reasonably

possible exposure to material loss exists in excess of the amount accrued.

In accordance with ASC 450, Citigroup’s disclosure includes an estimate of

the reasonably possible loss or range of loss for those matters as to which an

estimate can be made. ASC 450 does not require disclosure of an estimate

of the reasonably possible loss or range of loss where an estimate cannot

be made. Neither accrual nor disclosure is required for losses that are

deemed remote.