Citibank 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

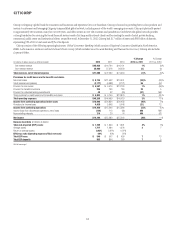

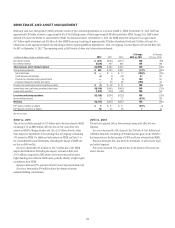

The discussion of the results of operations for Asia RCB below excludes the impact of FX translation for all periods presented. Presentation of the results

of operations, excluding the impact of FX translation, are non-GAAP financial measures. Citi believes the presentation of Asia RCB’s results excluding

the impact of FX translation is a more meaningful depiction of the underlying fundamentals of the business. For a reconciliation of certain of these

metrics to the reported results, see the table above.

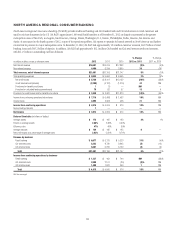

2012 vs. 2011

Net income decreased 4% primarily due to higher expenses.

Revenues were flat year-over-year. Net interest revenue decreased 3%,

as the benefit of higher loan and deposit balances was offset by spread

compression, mainly in retail lending. Spread compression continued to

reflect improvements in the customer risk profile, stricter underwriting

criteria and certain regulatory changes in Korea where, as previously

disclosed, policy actions, including rate caps and other initiatives, have

been implemented to slow the growth of consumer credit in that market,

thus impacting volume growth, lending rates and fees. Spread compression

is expected to continue to have a negative impact on net interest revenue

as regulatory pressure and low interest rates persist. Non-interest revenue

increased 6%, reflecting growth in Citi-branded cards purchase sales, partially

offset by a decrease in revenue from foreign exchange products. Despite the

continued spread compression and regulatory changes in the region, the

underlying business metrics continued to grow, with average retail loans up

6% and average card loans up 2%.

Expenses increased 4%, primarily due to approximately $78 million of

repositioning charges in the fourth quarter of 2012, largely in Korea, and

increased investment spending, including China cards and branches, higher

volume-driven expenses and increased regulatory costs.

Provisions decreased 1%, reflecting continued overall credit quality

improvement. Net credit losses continued to improve, declining 3% due to

the ongoing improvement in credit quality. Citi believes that net credit losses

in Asia RCB will largely remain stable, with increases largely in line with

portfolio growth.

2011 vs. 2010

Net income decreased 12%, driven by higher operating expenses, lower

loan loss reserve releases and a higher effective tax rate, partially offset by

higher revenue. The higher effective tax rate was due to lower tax benefits

Accounting Principles Bulletin (APB) 23 and a tax charge of $66 million due

to a write-down in the value of deferred tax assets due to a change in the tax

law, each in Japan.

Revenues increased 4%, primarily driven by higher business volumes,

partially offset by continued spread compression and $65 million of net

charges relating to the repurchase of certain Lehman structured notes. Net

interest revenue increased 1%, as investment initiatives and economic growth

in the region drove higher lending and deposit volumes. Spread compression

continued to partly offset the benefit of higher balances and continued to

be driven by stricter underwriting criteria, resulting in a lowering of the risk

profile for personal and other loans. Non-interest revenue increased 10%,

primarily due to a 9% increase in Citi-branded cards purchase sales and

higher revenues from foreign exchange products, partially offset by a 16%

decrease in investment sales, particularly in the second half of 2011, and the

net charges for the repurchase of certain Lehman structured notes.

Expenses increased 8%, due to investment spending, growth in business

volumes, repositioning charges and higher legal and related costs, partially

offset by ongoing productivity savings.

Provisions increased 5% as lower loan loss reserve releases were

partially offset by lower net credit losses. The increase in provisions reflected

increasing volumes in the region, partially offset by continued credit quality

improvement. India was a significant driver of the improvement in credit

quality, as it continued to de-risk elements of its legacy portfolio.