Citibank 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

Other Activities

In addition to the exposures described above, like other banks, Citi also

provides settlement and clearing facilities for a variety of clients in France

and actively monitors and manages these intra-day exposures.

Credit Default Swaps—GIIPS and France

Citi buys and sells credit protection, through credit default swaps (CDS), on

underlying GIIPS and French entities as part of its market-making activities

for clients in its trading portfolios. Citi also purchases credit protection,

through CDS, to hedge its own credit exposure to these underlying entities

that arises from loans to these entities or derivative transactions with

these entities.

Citi buys and sells CDS as part of its market-making activity, and

purchases CDS for credit protection, primarily with investment grade, global

financial institutions predominantly outside the GIIPS and France. The

counterparty credit exposure that can arise from the purchase or sale of CDS,

including any GIIPS or French counterparties, is managed and mitigated

through legally enforceable netting and margining agreements with a given

counterparty. Thus, the credit exposure to that counterparty is measured

and managed in aggregate across all products covered by a given netting or

margining agreement.

The notional amount of credit protection purchased or sold on GIIPS and

French underlying single reference entities as of December 31, 2012 is set

forth in the table below. The net notional contract amounts, less mark-to-

market adjustments, are included in “Net current funded exposure” in the

table under “Sovereign, Financial Institution and Corporate Exposures”

above, and appear in either “Net trading exposure” when part of a trading

strategy or in “Purchased credit protection” when purchased as a hedge

against a credit exposure.

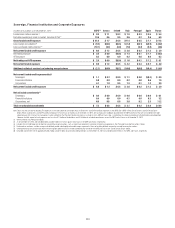

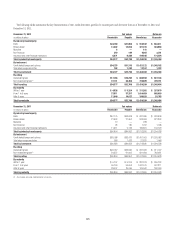

CDS purchased or sold on underlying single reference entities in these countries

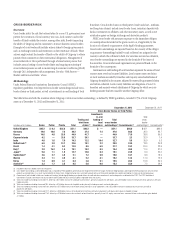

In billions of U.S. dollars as of December 31, 2012 GIIPS Greece Ireland Italy Portugal Spain France

Notional CDS contracts on underlying reference entities

Net purchased (1) $(15.9) $(0.5) $(0.7) $(10.6) $(2.2) $(5.9) $(9.0)

Net sold (1) 6.1 0.4 0.7 3.0 2.1 3.9 6.0

Sovereign underlying reference entity

Net purchased (1) (11.9) — (0.6) (8.7) (1.7) (3.8) (3.8)

Net sold (1) 4.7 — 0.6 2.0 1.6 3.3 4.0

Financial institution underlying reference entity

Net purchased (1) (2.6) (0.0) (0.0) (1.5) (0.3) (1.2) (1.7)

Net sold (1) 2.2 0.0 0.0 1.4 0.3 1.0 1.4

Corporate underlying reference entity

Net purchased (1) (3.9) (0.5) (0.2) (2.0) (0.7) (1.9) (5.4)

Net sold (1) 1.7 0.4 0.1 1.2 0.6 0.7 2.5

(1) The summation of notional amounts for each GIIPS country does not equal the notional amount presented in the GIIPS total column in the table above, as additional netting is achieved at the agreement level with a

specific counterparty across various GIIPS countries.

When Citi purchases CDS as a hedge against a credit exposure, it generally

seeks to purchase products from counterparties that would not be correlated

with the underlying credit exposure it is hedging. In addition, Citi generally

seeks to purchase products with a maturity date similar to the exposure

against which the protection is purchased. While certain exposures may have

longer maturities that extend beyond the CDS tenors readily available in the

market, Citi generally will purchase credit protection with a maximum tenor

that is readily available in the market.

The above table contains all net CDS purchased or sold on GIIPS and

French underlying single reference entities, whether part of a trading

strategy or as purchased credit protection. With respect to the $15.9 billion

net purchased CDS contracts on underlying GIIPS reference entities,

approximately 91% was purchased from non-GIIPS counterparties and 83%

was purchased from investment grade counterparties as of December 31,

2012. With respect to the $9.0 billion net purchased CDS contracts on

underlying French reference entities, approximately 97% was purchased from

non-French counterparties and 93% was purchased from investment grade

counterparties as of December 31, 2012.