Citibank 2012 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

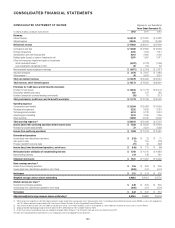

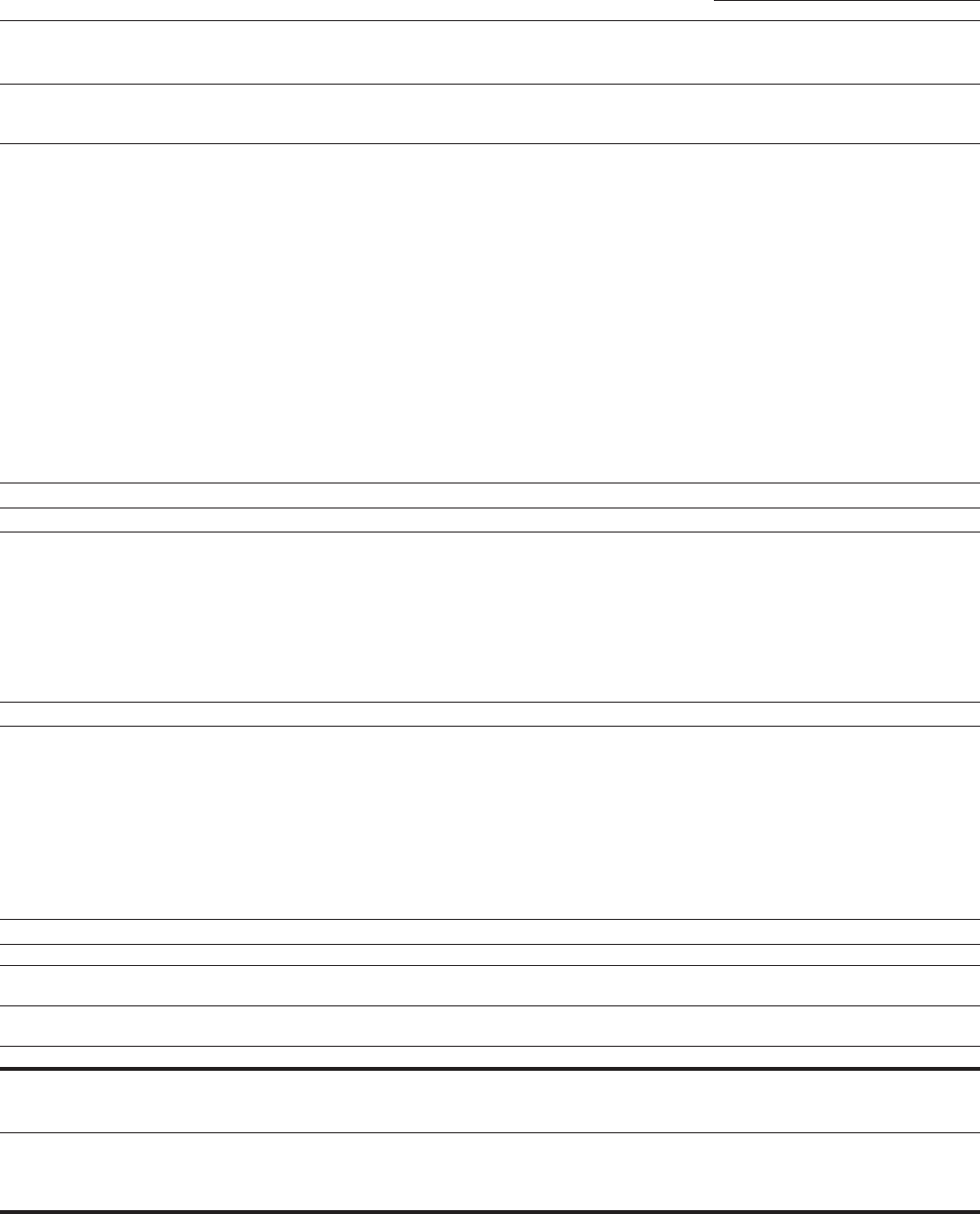

CONSOLIDATED STATEMENT OF CASH FLOWS Citigroup Inc. and Subsidiaries

Years ended December 31,

In millions of dollars 2012 2011 2010

Cash flows from operating activities of continuing operations

Net income before attribution of noncontrolling interests $ 7,760 $ 11,215 $ 10,883

Net income attributable to noncontrolling interests 219 148 281

Citigroup’s net income $ 7,541 $ 11,067 $ 10,602

(Loss) income from discontinued operations, net of taxes (148) 17 215

(Loss) gain on sale, net of taxes (1) 95 (283)

Income from continuing operations—excluding noncontrolling interests $ 7,690 $ 10,955 $ 10,670

Adjustments to reconcile net income to net cash provided by (used in) operating activities of continuing operations

Amortization of deferred policy acquisition costs and present value of future profits 203 250 302

(Additions) reductions to deferred policy acquisition costs 85 (54) (98)

Depreciation and amortization 2,507 2,872 2,664

Deferred tax benefit (4,091) (74) (964)

Provision for credit losses 10,832 11,824 25,077

Realized gains from sales of investments (3,251) (1,997) (2,411)

Net impairment losses recognized in earnings 4,971 2,254 1,411

Change in trading account assets (29,195) 38,238 15,601

Change in trading account liabilities (10,533) (2,972) (8,458)

Change in federal funds sold and securities borrowed or purchased under agreements to resell 14,538 (29,132) (24,695)

Change in federal funds purchased and securities loaned or sold under agreements to repurchase 12,863 8,815 35,277

Change in brokerage receivables net of brokerage payables 945 8,383 (6,676)

Change in loans held-for-sale (1,106) 1,021 2,483

Change in other assets (524) 14,933 (7,538)

Change in other liabilities (1,457) (3,814) (293)

Other, net 9,794 3,277 (6,666)

Total adjustments $ 6,581 $ 53,824 $ 25,016

Net cash provided by operating activities of continuing operations $ 14,271 $ 64,779 $ 35,686

Cash flows from investing activities of continuing operations

Change in deposits with banks $ 53,650 $ 6,653 $ 4,977

Change in loans (28,817) (31,597) 60,730

Proceeds from sales and securitizations of loans 7,287 10,022 9,918

Purchases of investments (256,907) (314,250) (406,046)

Proceeds from sales of investments 143,853 182,566 183,688

Proceeds from maturities of investments 102,020 139,959 189,814

Capital expenditures on premises and equipment and capitalized software (3,604) (3,448) (2,363)

Proceeds from sales of premises and equipment, subsidiaries and affiliates, and repossessed assets 1,089 1,323 2,619

Net cash provided by (used in) investing activities of continuing operations $ 18,571 $ (8,772) $ 43,337

Cash flows from financing activities of continuing operations

Dividends paid $ (143) $ (107) $ (9)

Issuance of preferred stock 2,250 — —

Issuance of ADIA Upper DECs equity units purchase contract —3,750 3,750

Treasury stock acquired (5) (1) (6)

Stock tendered for payment of withholding taxes (194) (230) (806)

Issuance of long-term debt 27,843 30,242 33,677

Payments and redemptions of long-term debt (117,575) (89,091) (75,910)

Change in deposits 64,624 23,858 9,065

Change in short-term borrowings (2,164) (25,067) (47,189)

Net cash used in financing activities of continuing operations $ (25,364) $ (56,646) $ (77,428)

Effect of exchange rate changes on cash and cash equivalents $ 274 $ (1,301) $ 691

Discontinued operations

Net cash provided by discontinued operations $ — $ 2,669 $ 214

Change in cash and due from banks $ 7,752 $ 729 $ 2,500

Cash and due from banks at beginning of year 28,701 27,972 25,472

Cash and due from banks at end of year $ 36,453 $ 28,701 $ 27,972

Supplemental disclosure of cash flow information for continuing operations

Cash paid during the year for income taxes $ 3,900 $ 2,705 $ 4,307

Cash paid during the year for interest $ 19,739 $ 21,230 $ 23,209

Non-cash investing activities

Transfers to OREO and other repossessed assets $ 500 $ 1,284 $ 2,595

Transfers to trading account assets from investments (available-for-sale) —— $ 12,001

Transfers to trading account assets from investments (held-to-maturity) —$ 12,700 —

The Notes to the Consolidated Financial Statements are an integral part of these Consolidated Financial Statements.