Citibank 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

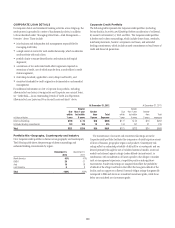

Whole Loan Sales (principally reflected in Citi Holdings—Local

Consumer Lending)

Citi is exposed to representation and warranty repurchase claims primarily

as a result of its whole loan sales to the GSEs and, to a lesser extent, private

investors through its Consumer business in CitiMortgage. When selling a

loan to these investors, Citi makes various representations and warranties to,

among other things, the following:

• Citi’s ownership of the loan;

• the validity of the lien securing the loan;

• the absence of delinquent taxes or liens against the property securing

the loan;

• the effectiveness of title insurance on the property securing the loan;

• the process used in selecting the loans for inclusion in a transaction;

• the loan’s compliance with any applicable loan criteria established by the

buyer; and

• the loan’s compliance with applicable local, state and federal laws.

To date, the majority of Citi’s repurchases have been due to GSE

repurchase claims and relates to loans originated from 2006 through

2008, which also represent the vintages with the highest loss severity. An

insignificant percentage of repurchases and make-whole payments have

been from vintages pre-2006 and post-2008. Citi attributes this to better credit

performance of these vintages and to the enhanced underwriting standards

implemented beginning in the second half of 2008.

During the period 2006 through 2008, Citi sold a total of approximately

$321 billion of whole loans, substantially all to the GSEs (this amount

has not been adjusted for subsequent borrower repayments of principal,

defaults or repurchase activity to date). The vast majority of these loans

were either originated by Citi or purchased from third-party sellers that Citi

believes would be unlikely to honor back-to-back claims because they are

in bankruptcy, liquidation or financial distress and, thus, are no longer

financially viable. As discussed below, however, Citi’s repurchase reserve

takes into account estimated reimbursements, if any, to be received from

third-party sellers.

Private-Label Residential Mortgage Securitizations

Citi is also exposed to representation and warranty repurchase claims as a

result of mortgage loans sold through private-label residential mortgage

securitizations. These representations were generally made or assigned to the

issuing trust and related to, among other things, the following:

• the absence of fraud on the part of the borrower, the seller or any

appraiser, broker or other party involved in the origination of the

loan (sometimes wholly or partially limited to the knowledge of the

representation provider);

• whether the property securing the loan was occupied by the borrower as

his or her principal residence;

• the loan’s compliance with applicable federal, state and local laws;

• whether the loan was originated in conformity with the originator’s

underwriting guidelines; and

• detailed data concerning the loans that were included on the mortgage

loan schedule.

During the period 2005 through 2008, Citi sold loans into and sponsored

private-label securitizations through both its Consumer business in

CitiMortgage and its legacy S&B business. Citi sold approximately $91 billion

of mortgage loans through private-label securitizations during this period.

CitiMortgage (principally reflected in Citi Holdings—Local

Consumer Lending)

During the period 2005 through 2008, Citi sold approximately $24.6 billion

of loans through private-label mortgage securitization trusts via its

Consumer business in CitiMortgage. These $24.6 billion of securitization

trusts were composed of approximately $15.4 billion in prime trusts and

$9.2 billion in Alt-A trusts, each as classified at issuance.

As of December 31, 2012, approximately $8.7 billion of the $24.6 billion

remained outstanding as a result of repayments of approximately

$14.6 billion and cumulative losses (incurred by the issuing trusts) of

approximately $1.3 billion. The remaining outstanding amount is composed

of approximately $4.4 billion in prime trusts and approximately $4.3 billion

in Alt-A trusts, as classified at issuance. As of December 31, 2012, the

remaining outstanding amount had a 90 days or more delinquency rate

in the aggregate of approximately 15.5%. Similar to the whole loan sales

discussed above, the vast majority of these loans either were originated by

Citi or purchased from third-party sellers that Citi believes would be unlikely

to honor back-to-back claims because they are no longer financially viable.

Citi’s repurchase reserve takes into account estimated reimbursements, if any,

to be received from third-party sellers.