Citibank 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

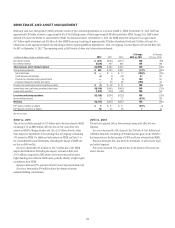

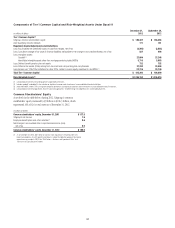

Federal Funds Sold and Securities Borrowed or

Purchased Under Agreements to Resell (Reverse Repos)

Federal funds sold consist of unsecured advances to third parties of excess

balances in reserve accounts held at the Federal Reserve Banks. During 2011

and 2012, Citi’s federal funds sold were not significant.

Reverse repos and securities borrowing transactions decreased by

$15 billion, or 5%, during 2012, and declined $17 billion, or 6%, compared to

the third quarter of 2012. The majority of this decrease was due to changes in

the mix of assets within certain Securities and Banking businesses between

reverse repos and trading account assets.

For further information regarding these balance sheet categories, see

Notes 1 and 12 to the Consolidated Financial Statements.

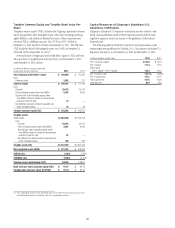

Trading Account Assets

Trading account assets includes debt and marketable equity securities,

derivatives in a net receivable position, residual interests in securitizations

and physical commodities inventory. In addition, certain assets that

Citigroup has elected to carry at fair value, such as certain loans and

purchase guarantees, are also included in Trading account assets.

During 2012, trading account assets increased $29 billion, or 10%,

primarily due to increases in equity securities ($24 billion, or 72%), foreign

government securities ($10 billion, or 12%), and mortgage-backed securities

($4 billion, or 13%), partially offset by an $8 billion, or 12%, decrease in

derivative assets. A significant portion of the increase in Citi’s trading account

assets (approximately half of which occurred in the first quarter of 2012,

with the remainder of the growth occurring steadily during the rest of 2012)

was the reversal of reductions in trading positions during the second half of

2011 as a result of the economic uncertainty that largely began in the third

quarter of 2011 and continued into the fourth quarter. During 2011, Citi

reduced its rates trading in the G10, particularly in Europe, given the market

environment in the region, and credit trading and securitized markets also

declined due to reduced client volume and less market liquidity. In 2012,

the increases in trading assets and the assets classes noted above were the

result of a more favorable market environment and more robust trading

activities, as well as a change in the asset mix of positions held in certain

equities businesses.

Average trading account assets were $251 billion in 2012, compared to

$270 billion in 2011. The decrease versus the prior year reflected the higher

levels of trading assets (excluding derivative assets) during the first half of

2011, prior to the de-risking and market-related reductions noted above.

For further information on Citi’s trading account assets, see Notes 1 and

14 to the Consolidated Financial Statements.

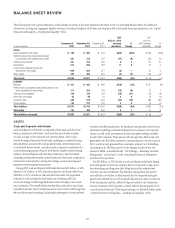

Investments

Investments consist of debt and equity securities that are available-for-sale,

debt securities that are held-to-maturity, non-marketable equity securities

that are carried at fair value, and non-marketable equity securities carried

at cost. Debt securities include bonds, notes and redeemable preferred

stock, as well as certain mortgage-backed and asset-backed securities and

other structured notes. Marketable and non-marketable equity securities

carried at fair value include common and nonredeemable preferred stock.

Nonmarketable equity securities carried at cost primarily include equity

shares issued by the Federal Reserve Bank and the Federal Home Loan Banks

that Citigroup is required to hold.

During 2012, investments increased by $19 billion, or 6%, primarily due

to a $23 billion, or 9%, increase in AFS, predominantly foreign government

and U.S. Treasury securities, partially offset by a $1 billion decrease in held-

to-maturity securities. The majority of this increase occurred during the

fourth quarter of 2012, where investments increased $17 billion, or 6%, in

total. The increase in AFS was part of the continued balance sheet strategy to

redeploy excess cash into higher-yielding investments.

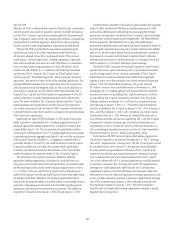

As noted above, the increase in AFS included growth in foreign

government securities (as the increase in deposits in many countries resulted

in higher liquid resources and drove the investment in foreign government

AFS, primarily in Asia and Latin America) and U.S. Treasury securities.

This growth and reallocation was supplemented by smaller increases in

mortgage-backed securities (both U.S. government agency MBS and non-U.S.

residential MBS), municipal securities and other asset-backed securities,

partially offset by a reduction in U.S. federal agency securities.

For further information regarding investments, see Notes 1 and 15 to the

Consolidated Financial Statements.