Citibank 2012 Annual Report Download - page 286

Download and view the complete annual report

Please find page 286 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

264

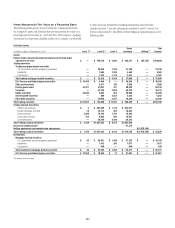

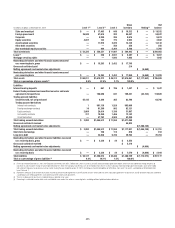

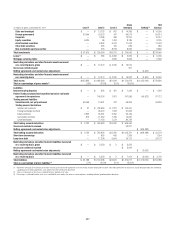

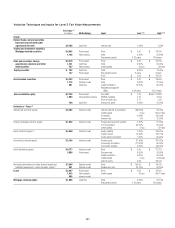

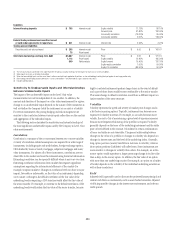

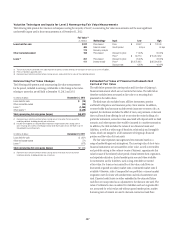

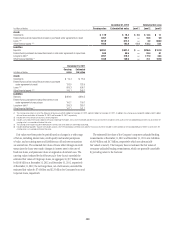

Liabilities

Interest-bearing deposits $ 785 Internal model Equity volatility 11.13% 86.10%

Forward price 67.80% 182.00%

Commodity correlation (76.00)% 95.00%

Commodity volatility 5.00% 148.00%

Federal funds purchased and securities loaned

or sold under agreements to repurchase $ 841 Internal model Interest rate 0.33% 4.91%

Trading account liabilities

Securities sold, not yet purchased $ 265 Internal model Price $ 0.00 $ 166.47

75 Price-based

Short-term borrowings and long-term debt $5,067 Internal model Price $ 0.00 $ 121.16

1,112 Price-based Equity volatility 12.40% 185.20%

649 Yield analysis Equity forward 75.40% 132.70%

Equity-equity correlation 1.00% 99.90%

Equity-FX correlation (80.50)% 50.40%

(1) The fair value amounts presented in this table represent the primary valuation technique or techniques for each class of assets or liabilities.

(2) Some inputs are shown as zero due to rounding.

(3) When the low and high inputs are the same, there is either a constant input applied to all positions, or the methodology involving the input applies to one large position only.

(4) Both trading and nontrading account derivatives—assets and liabilities—are presented on a gross absolute value basis.

(5) Includes hybrid products.

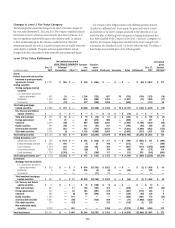

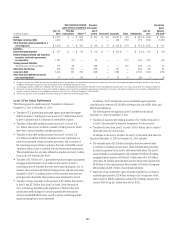

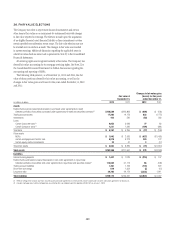

Sensitivity to Unobservable Inputs and Interrelationships

between Unobservable Inputs

The impact of key unobservable inputs on the Level 3 fair value

measurements may not be independent of one another. In addition, the

amount and direction of the impact on a fair value measurement for a given

change in an unobservable input depends on the nature of the instrument as

well as whether the Company holds the instrument as an asset or a liability.

For certain instruments, the pricing hedging and risk management are

sensitive to the correlation between various inputs rather than on the analysis

and aggregation of the individual inputs.

The following section describes the sensitivities and interrelationships of

the most significant unobservable inputs used by the Company in Level 3 fair

value measurements.

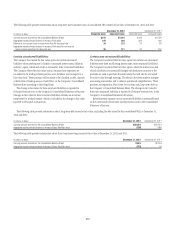

Correlation

Correlation is a measure of the co-movement between two or more variables.

A variety of correlation-related assumptions are required for a wide range of

instruments, including equity and credit baskets, foreign-exchange options,

CDOs backed by loans or bonds, mortgages, subprime mortgages and many

other instruments. For almost all of these instruments, correlations are not

observable in the market and must be estimated using historical information.

Estimating correlation can be especially difficult where it may vary over time.

Extracting correlation information from market data requires significant

assumptions regarding the informational efficiency of the market (for

example, swaption markets). Changes in correlation levels can have a major

impact, favorable or unfavorable, on the value of an instrument, depending

on its nature. A change in the default correlation of the fair value of the

underlying bonds comprising a CDO structure would affect the fair value of

the senior tranche. For example, an increase in the default correlation of the

underlying bonds would reduce the fair value of the senior tranche, because

highly correlated instruments produce larger losses in the event of default

and a part of these losses would become attributable to the senior tranche.

That same change in default correlation would have a different impact on

junior tranches of the same structure.

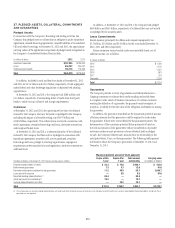

Volatility

Volatility represents the speed and severity of market price changes and is

a key factor in pricing options. Typically, instruments can become more

expensive if volatility increases. For example, as an index becomes more

volatile, the cost to Citi of maintaining a given level of exposure increases

because more frequent rebalancing of the portfolio is required. Volatility

generally depends on the tenor of the underlying instrument and the strike

price or level defined in the contract. Volatilities for certain combinations

of tenor and strike are not observable. The general relationship between

changes in the value of a portfolio to changes in volatility also depends on

changes in interest rates and the level of the underlying index. Generally,

long option positions (assets) benefit from increases in volatility, whereas

short option positions (liabilities) will suffer losses. Some instruments are

more sensitive to changes in volatility than others. For example, an at-the-

money option would experience a larger percentage change in its fair value

than a deep-in-the-money option. In addition, the fair value of an option

with more than one underlying security (for example, an option on a basket

of bonds) depends on the volatility of the individual underlying securities as

well as their correlations.

Yield

Adjusted yield is generally used to discount the projected future principal and

interest cash flows on instruments, such as asset-backed securities. Adjusted

yield is impacted by changes in the interest rate environment and relevant

credit spreads.