Citibank 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Letter to Shareholders

Dear Fellow Shareholders,

2012 was a momentous year for our company — our 200th, a

milestone few institutions ever reach. We celebrated on every

continent and in virtually every country, highlighted by our

Global Community Day on June 16, the anniversary of our

founding. On that day 200 years later, more than 110,000 of

our people, in 93 countries, celebrated our anniversary by

giving back to the communities we serve.

I’ve been with Citi or its predecessors my entire career —

nearly 30 years — and I was especially proud to be a part of

our rich legacy on that day. It was a stirring reminder of the

talent and character of our dedicated people, whom I am

proud to lead.

I welcome the chance to put 2012 into perspective and, more

important, to outline my agenda for 2013 and beyond.

Our anniversary was a terrific celebration — but last year

also provided its share of disappointments. We had some

significant charges throughout the year that hurt our bottom

line. Some we took in order to continue putting legacy issues

behind us. And we believe that the repositioning actions

announced in December will help us in the long run as we

increase the focus and efficiency of our operations. Our core

operating performance continues to improve, but it’s clear —

especially from our fourth quarter results — that we still have

work to do.

When I became CEO in October, I set myself three main

objectives to accomplish by the beginning of the year: conduct

business reviews and prepare the 2013 budget; select my

management team; and finalize and submit our capital plan

to our regulators. Throughout those months, I also spent

a good amount of time meeting with our stakeholders:

clients, investors, regulators and, of course, our people. The

conversations were almost universally encouraging about our

franchise and about the direction of this historic firm.

These important tasks now complete, we look ahead to

building on Citi’s great heritage. Let me, then, describe to you

where I think we are today, lay out where we want to go and

explain my plan for how we’ll get there.

The state of our firm is in many ways very strong. Our strategy

is well-aligned with three dominant, long-term secular trends:

globalization, urbanization and digitization.

Growth has shifted from being largely a phenomenon in the

developed world to being increasingly concentrated in the

emerging markets. In fact, between 2008 and 2012, 45% of

the world’s growth occurred in just one country: China. We’re

ahead of our peers in shifting toward these fast-growing

markets because no other bank can match our presence and

experience. And we’re in a position to seize key opportunities

as our competitors pull back. Not only do we have the most

extensive global network of any bank, we also bring to the table

decades of experience in some of the world’s key markets.

More and more people are moving into cities, and every year

the share of GDP produced in urban centers grows. Today,

fully 80% of the world’s GDP is generated in urban centers.

And cities are not reflected just in our name — they’re in

our blood. We’ve identified over 150 cities — which together

produce 32% of global GDP — that fit our business model and

represent where we think many of the coming opportunities

will emerge. We already have a presence in more than 80%

of them, with plans for the rest. As a company, we’ve often

spoken of our presence in more than 100 countries — which is

vital to our success — but in the future, you’ll hear us talking

more about the cities.

Finally, digitization is not just about websites and apps and

other customer-facing elements — though these are very

important. Digitization will continue to revolutionize our

entire industry, front office to back, and transform the way

clients — from individuals to big institutions — interact with

us and utilize our offerings. We’ve done a great deal around

Smart Banking on the consumer side — and are recognized

as industry leaders — while also building better platforms for

our institutional clients. There’s much more to do, but we feel

good about where we are today.

In addition to our network, we offer world-class products and

services and employ top talent. We’ve restructured most of

our company. In a sector that continues to deleverage, we

began that process more than four years ago and are ahead of

many of our peers.

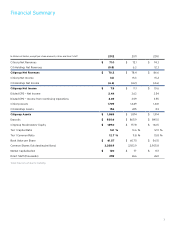

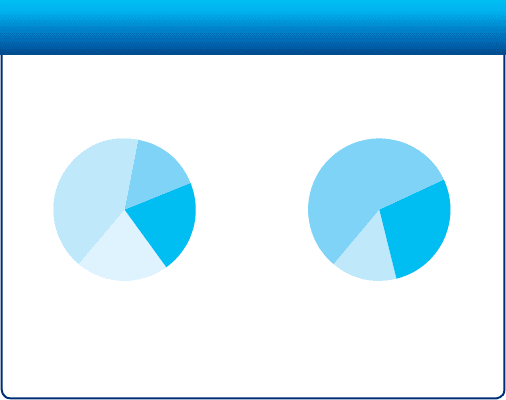

2012 Revenues: $71 billion

By Region By Business

GCB

57%

CTS

15%

S&B

28%

NA

42%

ASIA

21%

LATAM

21%

EMEA

16%

GCB — Global Consumer Banking

S&B — Securities and Banking

CTS — Citi Transaction Services

NA — North America

EMEA — Europe, Middle East and Africa

LATA M — Latin America

2012 Citicorp Revenues

Regional results exclude Corporate/Other.